Alert 01.25.21

Alert

New York Budget Raises Tax Rates, Provides Relief to Address Pandemic

New York’s Fiscal Year 2022 budget increases taxes on corporations and high earners and provides relief to pandemic-hit industries.

Alert

Takeaways

04.15.21

The New York Legislature passed New York State’s Fiscal Year 2022 budget (Budget Bill) on April 6 and 7, 2021. The Budget Bill now awaits Governor Cuomo’s signature, which is expected this week. Under the New York Constitution’s Executive Budget process, the appropriations provisions included in the Governor’s original proposed budget became law immediately upon being passed by the Legislature. If Governor Cuomo takes no action, the entirety of the bills will become law ten days after being passed by the Legislature.

The Budget Bill is estimated to raise $2.5 billion in additional tax revenue in Fiscal Year 2022 and $4.3 billion in additional tax revenue in Fiscal Year 2023, while providing targeted relief to certain taxpayers. Specifically, the Budget Bill includes: (1) tax rate increases on both corporations and individuals; (2) an elective pass-through tax to permit owners to deduct state and local taxes for federal income tax purposes; (3) sales and use tax provisions; and (4) relief provisions for taxpayers harmed by the pandemic. The Budget Bill’s key provisions are summarized below.

Tax Increases for Corporations and Individuals

Modifications to Article 9-A Corporate Franchise Tax:

- The Budget Bill temporarily increases the tax rate on business income from 6.5 percent to 7.25 percent for taxpayers with “taxable income” over $5 million. Because “taxable income” is not defined in the legislation, the Legislature or New York Department of Taxation and Finance may need to clarify the term’s meaning in future legislation or guidance. The rate increase applies only for tax years beginning in 2021, 2022, and 2023. Qualified New York manufacturers and qualified emerging technology companies are specifically exempt from the business income tax rate increase.

- The Budget Bill temporarily halts the phase-out of the alternative capital base tax and increases the rate for the next three years. New York’s 2015 tax reform legislation implemented a gradual capital base tax rate reduction and eliminated the capital base tax for tax years beginning in 2022 and later. The Budget Bill keeps the alternative capital base tax in place at the rate of 0.1875 percent for tax years beginning in 2021, 2022, and 2023, up from 0.038 percent in 2019 and 2020. Tax liability under this method is capped at $5 million. Qualified New York manufacturers, qualified emerging technology companies, and cooperating housing corporations are exempt from Article 9-A’s alternative capital base tax rate increase.

Modifications to Article 22 Personal Income Tax:

- Single filers: The Budget Bill imposes a temporary increase to the current highest marginal personal income tax rate from 8.82 percent to 9.65 percent with taxable income over $1.1 million and heads of households with taxable income over $1.6 million.

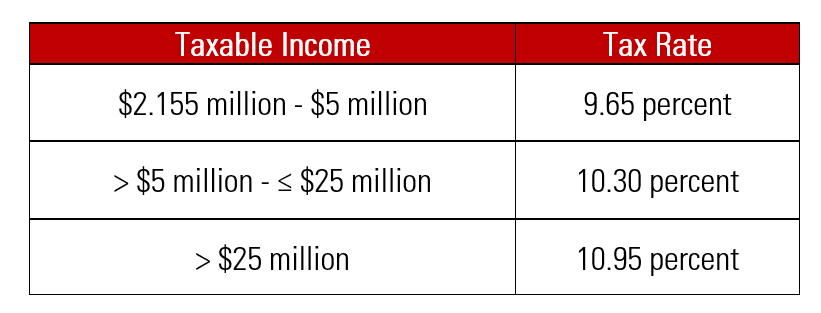

- Married or joint filers: The Budget Bill temporarily adopts three additional tax brackets for tax years ending in 2021, 2022, and 2023:

Elective Entity-Level Tax for Pass-Throughs

- The Budget Bill provides for an elective entity-level tax on the New York-sourced income of partnerships and S corporations treated as pass-throughs for New York Personal Income and Corporate Franchise Tax purposes.

- The Budget Bill provides for an offsetting Personal Income Tax credit for direct partners or members in electing partnerships and direct shareholders of S corporations.

- The pass-through entity tax operates as a workaround to the federal cap on state and local tax deductions imposed by the Tax Cuts and Jobs Act. The Internal Revenue Service has blessed this structure to permit the deduction of all state and local taxes paid (uncapped) at the business entity level.

Sales Tax Provisions

- The Budget Bill corrects the remote vendor registration requirements for New York State sales and use tax purposes. Specifically, the Budget Bill provides that remote vendors (e., vendors with no in-state physical presence) with $500,000 or more in gross receipts from New York customers, based on the previous four sales tax quarters, must register to collect and remit New York sales and use tax.

- Previously, the same registration threshold for remote vendors was set lower at $300,000 even though New York’s economic nexus threshold did not apply until a remote vendor’s gross receipts met or exceeded $500,000. The Budget Bill corrects this inconsistency.

- The Budget Bill extends sales tax exemptions related to the Dodd-Frank Wall Street Reform and Consumer Protection Act until June 20, 2024 for certain sales or services between financial institutions and their subsidiaries. Specifically, the bill extends exemptions that apply to sales and services between parents and subsidiaries required under the provisions of the Act applicable to such financial institutions.

- The Budget Bill extends tax exemptions for sales of certain alternative fuels from sales and use taxes, motor fuel taxes, petroleum business taxes, and fuel use taxes. The Budget Bill extends the exemption through September 1, 2026.

Provisions Addressing Pandemic-Impacted Industries

- The Budget Bill adopts a Restaurant Return-To-Work tax credit, which provides $35 million in tax credits to restaurants that were hardest-hit by COVID-19 related restrictions.

- In addition, the Budget Bill implements a Restaurant Resiliency Grant Program, which provides $25 million in funding to restaurants that serve meals to distressed or under-represented communities.

- The Budget Bill extends: (1) the Empire State Film Production and Post-Production tax credits to taxable years beginning before January 1, 2027; and (2) the Musical and Theatrical Production tax credit to taxable years beginning before January 1, 2026.

Miscellaneous

- The Budget Bill did not enact a digital advertising services tax or a data collection tax. Both proposals are currently being considered by the New York State Legislature.

- The Budget Bill did not grant the New York State Department of Taxation and Finance the right to appeal Tax Appeals Tribunal decisions to the Appellate Division, Third Department. The Governor’s original budget proposal included a provision that would have allowed such appeals.

- The Budget Bill legalized mobile sports betting in New York. The state will issue a Request for Applications for licenses to operate at least two gambling vendor platforms and four betting app operators. The businesses that receive a license will partner with state-licensed casinos. Platform providers will pay tax on mobile sports betting receipts at a rate of at least 12 percent based on the results of a competitive bidding process.