Blog Post 06.08.20

Alert

SBA Discloses Identities of PPP Borrowers

On Monday, July 6, the U.S. Small Business Administration (SBA) publicly disclosed the names and addresses of Paycheck Protection Program (PPP) borrowers that received loans of at least $150,000 each.

Alert

Takeaways

07.07.20

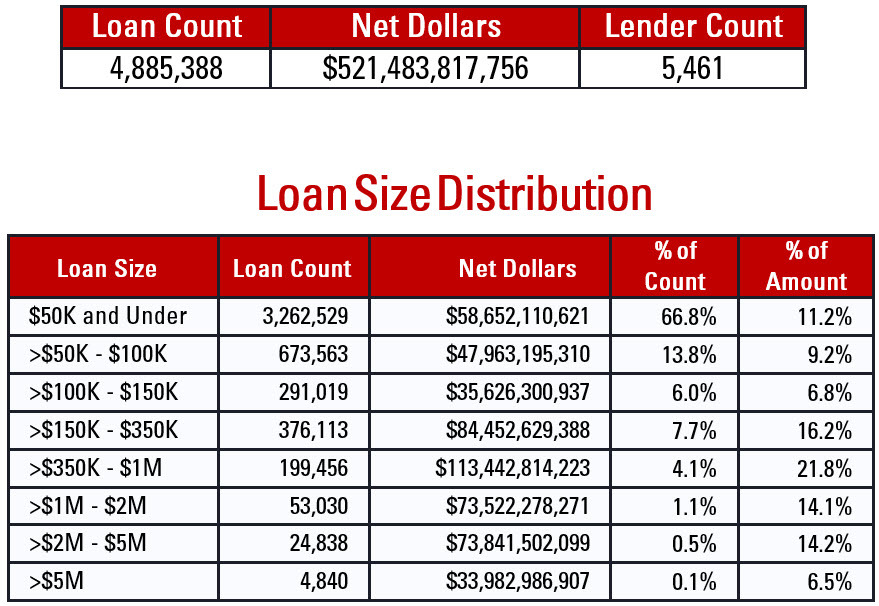

SBA, in conjunction with the Department of the Treasury, announced in a June 6, 2020 press release that it would disclose “detailed loan-level data” regarding all of the 4.9 million PPP loans made to date. Recent legislation, which we summarized here, extended the deadline to apply for new PPP loans to August 8, 2020.

SBA made this detailed data immediately available in a spreadsheet downloadable from SBA’s website. The spreadsheet is organized by state and the approximate value of loans received, within the following ranges: (1) $150-350,000; (2) $350,000-$1 million; (3) $1-2 million; (4) $2-5 million; and (5) $5-10 million. For each PPP borrower that received a loan of at least $150,000, the spreadsheet lists, in addition to its loan range and certain other information, the borrower’s name, address, lender and number of “jobs supported”—which appears to be the number of employees specified in the borrower’s PPP application.

While SBA previously had announced that it would release the identities of PPP borrowers, it had not specified when or how much information it planned to release in this regard. Many borrowers will find the scope of this week’s disclosure to be surprising. It appears, however, that certain news agencies and other third parties already were able to obtain similar information through Freedom of Information Act requests.1

In addition to this information about individual loans and borrowers, SBA recently released the following summary of program statistics, to date:

Pillsbury’s experienced, multidisciplinary COVID-19 Task Force is closely monitoring the global threat of COVID-19 and providing real-time advice across industry sectors, drawing on the firm’s capabilities in crisis management, employment law, insurance recovery, real estate, supply chain management, cybersecurity, corporate and contracts law and other areas to provide critical guidance to clients in an urgent and quickly evolving situation. For more thought leadership on this rapidly developing topic, please visit our COVID-19 (Coronavirus) Resource Center.

1. As PPP borrowers face increased scrutiny, particularly in advance of the impending wave of PPP forgiveness applications, borrowers should make doubly sure to comply with all of the program’s administrative requirements, which we summarized here. For example, the forgiveness application requires significant documentation, including bank statements, tax forms, payment receipts, cancelled checks or account statements, and documents reflecting FTE levels. PPP borrowers must retain this documentation, as well as all other documents demonstrating compliance with the PPP requirements, for six years after the date the loan is forgiven or repaid in full, and borrowers must provide access to these records upon the request of SBA or the Office of Inspector General.