Article

A Resurgence of Synthetic Securitizations

After a major market contraction in the wake of the financial crisis, risk-pooling transactions show signs of gaining favor once more.

Article

Takeaways

06.20.17

Within the past few months, there have been a number of reports of the resurgence, particularly in Europe, of synthetic securitizations of risky assets. These transactions allow banks to transfer credit and other default risks with respect to illiquid assets held on their balance sheets, improve their capital ratios and thereby free up regulatory capital to be used for additional lending.

What is a balance sheet synthetic securitization?

A balance sheet synthetic securitization is generally regarded as being a transfer by a bank of tranched risk exposure to a portfolio or pool of loans, bonds or other financial assets (“underlying assets”) achieved by the use of credit default swaps, credit guarantees or other derivatives contracts. Typically, in exchange for a risk premium paid by the bank, the investor will agree to make a payment to the bank, in the event of defaults or other loss events with respect to the underlying assets of a specified magnitude and type, up to a maximum. This minimum magnitude and maximum amount define the size and position of the “tranche” covered by the synthetic securitization. The more senior the tranche, the less protection acquired by the bank and the lower the premium earned by the investor. Conversely, the more junior the tranche, the greater the protection acquired by the bank and the higher the premium earned by the investor.

Terms to be negotiated in a synthetic securitization include, among others, the definition of the underlying assets, the trigger events, the notional amount of the tranche, the tenor of the transaction, the risk premium, collateralization requirements, events of default and termination events. The underlying assets may be either a static pool of identified financial assets or a blind pool of assets described by specified criteria, such as asset type, size, credit risk, etc. Because the risk transfer is “synthetic” (i.e., there is no sale of the underlying assets which remain the obligations of the bank), at closing, there is no exchange of assets other than any initial risk premium (paid by the bank to the investor) and collateral (provided by the investor to the bank).

Differences from true-sale securitizations

A “true-sale” securitization allows an originator of financial assets to raise capital to finance their operations or provide credit to borrowers by transferring the ownership of those financial assets to the capital markets. In a typical true-sale securitization, the originator transfers the assets in a “true sale” directly or indirectly to a bankruptcy-remote special purpose vehicle that finances the acquisition by issuance of bonds to investors, often in multiple classes each representing a different tranche of seniority and risk and yield. The investors’ return on investment is produced primarily by the cash flows on the assets held by the special purpose vehicle. The proceeds of the bond issuance are used to acquire the assets from the originator. Thus, a true-sale securitization is a “funded structure” in that it provides funding to the originator with an implied cost of capital. However, this cost of capital is less than the credit spread of the originator because, by selling the assets to a bankruptcy-remote entity, the investors are protected from the credit risk of the originator.

In contrast, a synthetic securitization is not necessarily a funded structure. The financial assets remain on the balance sheet of the originator and the originator does not realize any upfront funding. Therefore, cost savings in a synthetic securitization in theory do not come from a reduced cost of funding through isolation of the assets from the credit risk of the originator. Instead, they come from a reduced regulatory capital charge to the bank. Having said that, because the bank is exposed to the credit of the investor (who is obligated to make a payment upon the occurrence of a defined event), synthetic securitizations may require the investor to post collateral consisting of cash, cash equivalents or other property, which is tantamount to funding. However, the amount of collateralization may be driven by mark-to-market calculations of the transaction and therefore constitute only partial funding.

In addition, true-sale securitizations tend to be highly document-intensive, involving complex arrangements to custody and service the assets and manage the distribution of cash flows. Synthetic securitizations can be handled with more streamlined documentation, given that the underlying assets are not transferred. The process can reduce transactional costs and accelerate execution.

Investor base for synthetic securitizations

Synthetic securitizations are generally bilaterally negotiated between banks and institutional investors in the capital markets, including hedge funds, pension funds, asset managers, insurance companies and other credit institutions. According to a recent article in Institutional Investor, there is a growing trend for pension funds, endowments and other financial institutions to negotiate these regulatory capital relief synthetic securitizations directly with banks, rather than by investing indirectly through specialized hedge funds or private equity funds. By doing this, they reduce transaction costs, including management and incentive fees payable to the asset manager. For example, it has been reported that PGGM, a pension service provider in the Netherlands that manages $203 billion of assets for Dutch pension funds, has invested close to €6 billion in synthetic securitizations and manages 22 transactions.

Regulatory drivers of synthetic securitizations in Europe

In general, the banks’ need to reduce risk weighted assets has been driven by an increase in capital requirements since the financial crisis. In addition, the securitization market in Europe has been slow to recover and on 30 September 2015, as part of the Capital Markets Union (CMU) action plan to increase investment in the EU, the European Commission proposed a regulatory framework designed to relaunch sound securitization practices and free up capital for economic growth through simple, transparent and standardized securitizations. The proposal had two components: (i) a regulation on securitization that would require due diligence, risk retention and transparency with a set of criteria to identify simple, transparent and standardized (STS) securitizations, and (ii) an amendment to the rules relating to the capital treatment of securitizations for banks and investment firms. Under the proposal, a securitization receiving an STS designation would be eligible for certain lower capital requirements. As initially proposed, however, the STS designation would apply only to traditional (i.e., true-sale) securitizations, and not to synthetic securitizations, although institutions retaining senior positions in certain synthetic securitizations backed by an underlying pool of loans to small and medium-size enterprises that meet certain strict criteria would be permitted to apply the lower capital requirements.

On May 30, 2017, the European Parliament, the European Commission and the Council of the EU agreed in principle on an EU regulatory framework for STS securitization and risk retention. It has been reported that the agreement reflects a number of compromises and differences from the 2015 proposal but is “broadly sensible.” It is unclear whether and to what degree synthetic securitizations are included in the STS framework, as the final text is not currently available. One positive development that has been reported, though, is that the risk retention requirement will remain at 5 percent, rather than higher amounts which had been under discussion. (It is notable, however, that a new macro-prudential review function has been given to the European Systemic Risk Board which may result in this level being reviewed in the future.)

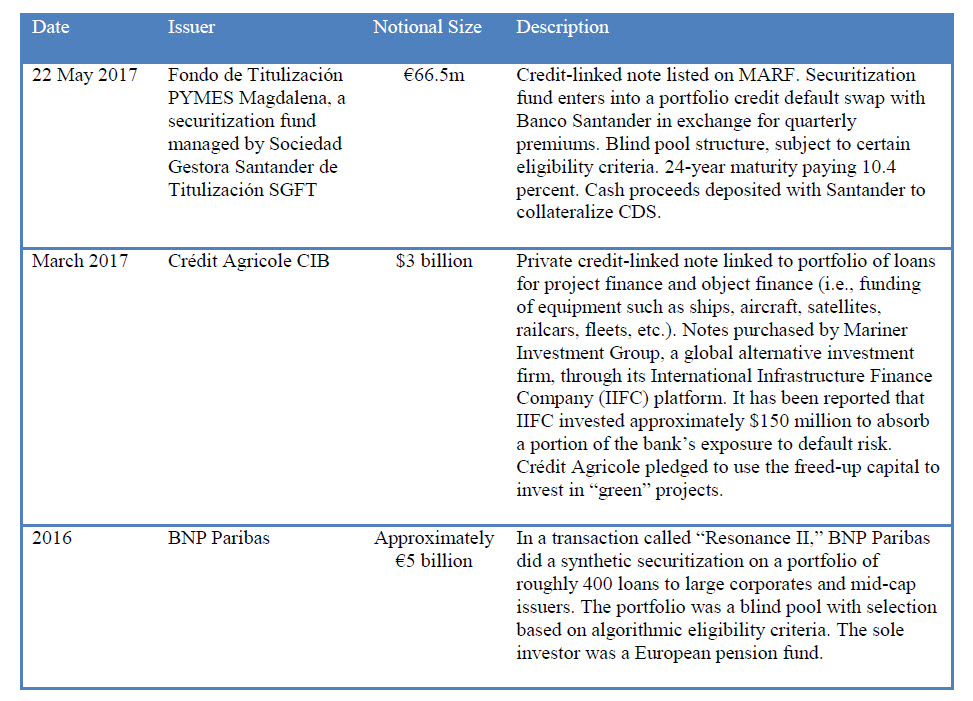

Notable recent transactions

As most synthetic securitizations are private transactions, only a limited amount of deal information is publicly available. Below are details regarding a few transactions that have been reported in the press.