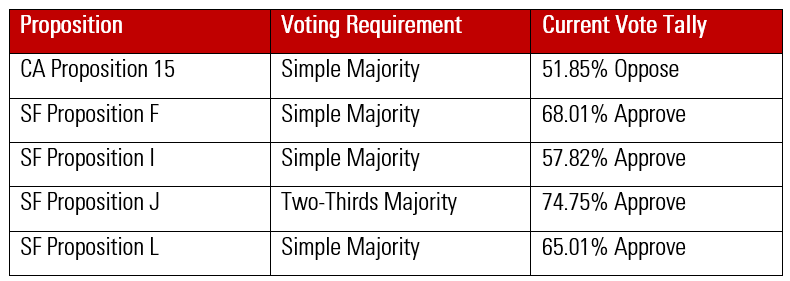

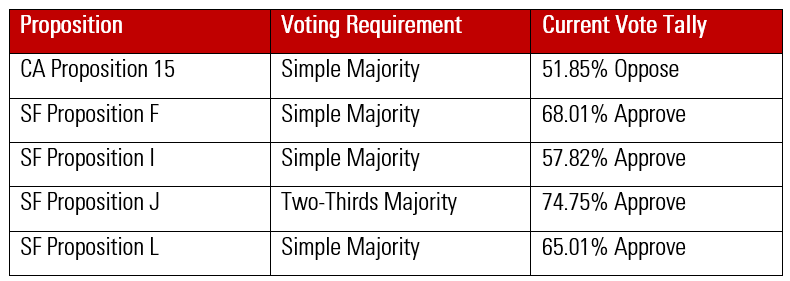

California Proposition 15 (Split Roll Property Tax Initiative)

While it is still too close to call, Proposition 15 is currently failing by a margin of roughly 440,000 votes. At the time of publication, California had counted 12.45 million ballots with 51.85% of voters opposing Proposition 15. There are roughly four to five million vote-by-mail ballots still to be counted, which are expected to further favor the opposition. Election officials have until November 20 to count all ballots that were postmarked by November 3 and must certify their election results by December 11.

Proposition 15 would change California property tax assessments by creating a “split roll” system where commercial and industrial real property are assessed differently than residential property. Currently, these properties all enjoy the protections of the historic Proposition 13 passed by voters in 1978 to create a system wherein properties are assessed based on their acquisition value increased annually by an inflation factor not to exceed 2%. Proposition 15 would instead require that commercial and industrial properties be reassessed at current market values at least every three years.

San Francisco Proposition F (Business Tax Overhaul)

San Francisco voters passed Proposition F, a business tax overhaul package that phases out the city’s payroll tax and increases the city’s gross receipts tax. For context, in 2012, San Francisco voters approved Proposition E, a measure that would phase out San Francisco’s payroll tax and phase in an apportioned gross receipts tax beginning in 2014. The 1.5% payroll expense tax rate was to be reduced by 10%, 25%, 50%, and 75% in 2014 through 2017, respectively, and was supposed to be fully phased out by 2018. These phase-outs were subject to modification depending on the amount of revenue generated by the newly enacted gross receipts tax. Due to lower-than-anticipated amounts of revenue generated by the gross receipts tax, the payroll expense tax remained in place until now. Proposition F finalizes this transition away from the payroll tax and to the gross receipts tax by eliminating the city’s payroll expense tax as of January 1, 20211 and increasing the city’s gross receipts tax rates.

Proposition F generally increases the gross receipts tax rates by approximately 40% across all industries beginning January 1, 2021.2 A full list of the gross receipts tax rate increases can be found here. The gross receipts tax is reduced temporarily for certain industries that are heavily impacted by the COVID-19 pandemic (i.e., retail trade, maintenance and laundry services, manufacturing, arts, entertainment and recreation, accommodations, and food services).3 The measure also enacts additional phased increases in gross receipts tax rates for several industries (e.g., biotechnology, financial services and real estate) beginning in 2022, if certain gross receipts thresholds are met.4 Proposition F continues to impose the administrative office tax, rather than the gross receipts tax, on specified large businesses with San Francisco operations that are predominantly administrative,5 increasing that tax to 1.47% of payroll in 2022, 1.54% in 2023, and 1.61% in 2024. Proposition F also contains provisions to delay the rate increases for a number of industries if they continue to experience heavy economic strain.

In addition to the modifications discussed above, Proposition F expanded the small business exemption for the gross receipts tax and commercial rent tax to all small businesses with less than $2 million of annual gross receipts (up from $1.17 million).6 The business registration fee for businesses with less than $1 million in gross receipts is reduced by half while the fee is increased for businesses with more than $1 million in gross receipts.7 The credit for businesses that pay a similar gross receipts tax elsewhere is eliminated.8

San Francisco Proposition I (Transfer Tax Increase)

San Francisco voters passed Proposition I, which doubles the real estate transfer tax on transactions of $10 million or more. Effective January 1, 2021, the tax rate increases from 2.75% to 5.5% on transactions of at least $10 million and under $25 million and the tax rate increases from 3% to 6% on transactions of $25 million or more.9 The events that trigger transfer tax remain unchanged: a direct sale of real property, a Proposition 13 change in ownership, and a technical termination of a partnership under IRC section 708.

San Francisco Proposition L (Overpaid Executives Gross Receipts Tax)

San Francisco voters also passed Proposition L, which institutes a complex add-on to the gross receipts tax called the “Overpaid Executive Gross Receipts Tax,” which is commonly referred to as the “CEO Tax.” Effective January 1, 2022, the measure focuses on a business’ “executive pay ratio,” which is the ratio of the compensation of the highest-paid managerial employee relative to the median employee compensation for San Francisco-based employees, and imposes a progressively higher gross receipts tax where that ratio exceeds 100:1.10 For taxpayers that pay the gross receipts tax, the increased tax is 0.1% of gross receipts if the ratio is more than 100:1, 0.2% if the ratio is more than 200:1, 0.3% if the ratio is more than 300:1, 0.4% if the ratio is more than 400:1, 0.5% if the ratio is more than 500:1, and 0.6% if the ratio is more than 600:1.11 Additionally, for taxpayers that are subject to the San Francisco administrative office tax, and pay the payroll tax in lieu of the gross receipts tax, the tax increase is based on total payroll attributed to business conducted in San Francisco. In such a case, the increase to the payroll tax rate is 0.4% if the ratio is more than 100:1; 0.8% if the ratio is more than 200:1; 1.2% if the ratio is more than 300:1; 1.6% if the ratio is more than 400:1; 2.0% if the ratio is more than 500:1; and 2.4% if the ratio is more than 600:1.12

In determining the “executive pay ratio” the annual compensation (including wages, commissions, bonuses, and equity compensation) paid to a taxpayer’s highest-paid managerial employee is compared to the median compensation paid to the taxpayer’s employees in San Francisco.13 The term “taxpayer” means the San Francisco taxpayer responsible for paying the tax and any other entity in the same combined group with the taxpayer for California income tax purposes.14 Interestingly, the definition of “highest-paid managerial employee” includes any employee of the taxpayer, regardless of where the employee works, while the median employee is limited to only those employees of the taxpayer working in San Francisco, where working in San Francisco means that total working hours in the City exceed total working hours outside the City.15 Employee salaries are calculated on an annualized basis for mid-year hires, and part-time employee salaries are adjusted to their full-time equivalency.16 Finally, the computations for determining whether a taxpayer is subject to the tax rate increase are done on a year-by-year basis.

Given that annual equity compensation could vary substantially, the annual compensation of the highest-paid managerial employee could vary significantly from year to year, subjecting the annual “executive pay ratio” to extreme changes, exposing a taxpayer to the possibility of a substantial tax in one year, with no tax at all in a subsequent year. Computing the “executive pay ratio” could be particularly problematic for San Francisco’s retail taxpayers who hire part-time employees to accommodate holiday sales at year end, which would likely increase their exposure to the tax by pushing down the median San Francisco employee salary. It is also troubling that the rate structure is not calibrated for the type of business, with low-margin businesses (e.g., retail) exposed to the same slate of increased rates on gross receipts (up to 0.6%) as high-margin businesses. Finally, it will be difficult for businesses to plan for the tax as the year-by-year executive pay ratio cannot be determined until the end of the year when the company has finalized its employee hiring and compensation.

San Francisco Proposition J (Fair Wages for Educators Parcel Tax)

Finally, San Francisco voters passed Proposition J, which imposes an annual parcel tax called the “Fair Wages for Educators Parcel Tax.” The tax is estimated to raise some $48 million per year to fund salary increases for San Francisco schoolteachers. Effective July 1, 2021, the measure imposes an annual parcel tax of $288 on real property located within San Francisco.17 The tax is adjusted for inflation, beginning with fiscal year 2022-2023, and expires after 17 years, on June 30, 2038.18 The tax applies to each “parcel” of real property with a separate parcel number,19 with exemptions for (1) possessory interests, (2) a principal residence owned by an individual over 65 and (3) parcels which are fully exempt from ad valorem property tax.20 Proposition J replaces San Francisco’s 2018 Proposition G, which had imposed a $320 parcel tax. Proposition J also removes an exemption for parcels that are classified as parking spaces, which are contiguous with exempt residential parcels.

1 Art. 12-A (repealed Jan. 1, 2021).

2 See generally, Art. 12-A-1, Sec. 953.

3 See generally, Art. 12-A-1, Sec. 953.

4 See generally, Art. 12-A-1, Sec. 953.

5 Section 953.8(b) of Article 12-A-1 specifies that the administrative office tax only applies to a taxpayer with over 1,000 U.S. employees and over $1 billion of annual revenue (on a combined return basis), where more than 50% of the San Francisco payroll expense is attributable to employees providing administrative or management services.

6 Art. 12-A-1, Sec. 954.1.

7 Art. 12-A-1, Sec. 855.

8 Art. 12-A-1, Sec. 954.

9 Art. 12-C, Sec. 1102.

10 Art. 33, Secs. 3302, 3303(a).

11 Art. 33, Sec. 3303(b).

12 Art. 33, Sec. 3303(d).

13 Art. 33, Sec. 3302.

14 Art. 33, Sec. 3302.

15 Art. 33, Sec. 3302(a).

16 Art. 33, Secs. 3302(b), (c).

17 Art. 37, Secs. 3704(a), (b).

18 Art. 37, Secs. 3704(b), (c).

19 Art. 37, Sec. 3704(a).

20 Art. 37, Sec. 3705(a).