Alert 06.02.20

The Main Street Lending Program: Additional Guidance for Borrowers

Companies that may want to borrow under the Main Street Lending Program should take note of additional guidance recently issued by the Federal Reserve Bank of Boston.

Alert

Alert

By Joel M. Simon, Matthew Oresman, Kenneth Suh, Russell DaSilva,

06.09.20

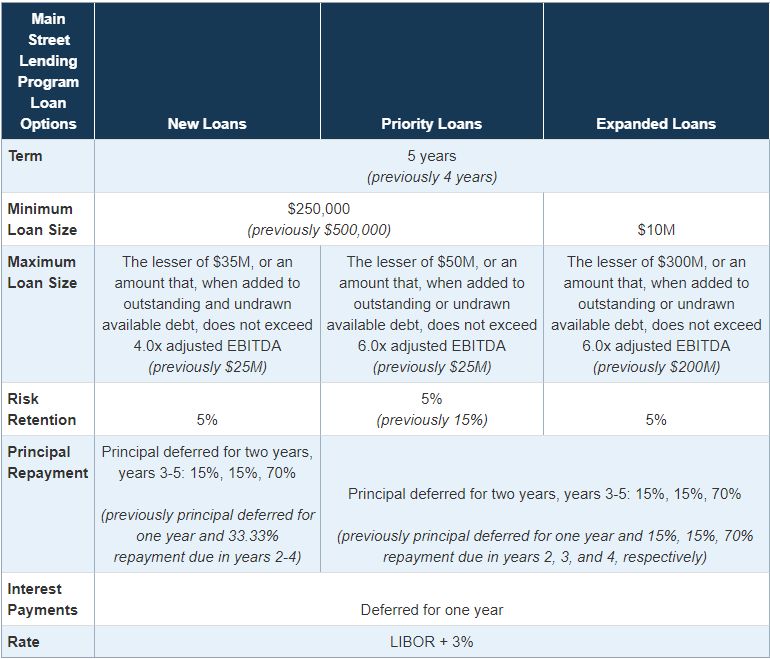

The chart below summarizes the current key terms of the Main Street Lending Program (the Program), factoring in the most recent changes.

Source: Federal Reserve Board

In addition, this chart provides additional summary details of the most current Program requirements and features.

II. Background

On June 8, 2020, the Board of Governors of the Federal Reserve System (the Board) issued a press release describing an expansion of the Program, which was authorized by the Board under Section 13(3) of the Federal Reserve Act.

To implement this expansion, the Federal Reserve Bank of Boston (the Federal Reserve) released (i) revised term sheets for each of the three loan facilities: the Main Street New Loan Facility (the New Loan Facility), the Main Street Expanded Loan Facility (the Expanded Loan Facility) and the Main Street Priority Loan Facility (the Priority Loan Facility), which replaced those previously issued on April 30, 2020 and (ii) a new version of the document called “Frequently Asked Questions of the Main Street Lending Program” (the FAQ), which was revised to conform to changes made in these term sheets, to modify certain clarifications that were contained in a draft of the FAQ that was previously issued on May 27, 2020 and to cover additional matters.

The press release, the revised term sheets for the New Loan Facility, Expanded Loan Facility and Priority Loan Facility and the FAQ are available on the Federal Reserve’s website.

The primary terms of each of the three loan facilities remain unchanged other than with respect to the minimum size of the loans and the dollar-based prong of the maximum size of the loans, the maturity date of the loans, the commencement and amount of amortization payments, and, in the case of the Priority Loan Facility, the Main Street SPV’s participation in loans made thereunder.

The Program continues to exclude a loan forgiveness feature, and the interest on all Main Street loans continues to be LIBOR plus 3%. This client alert supplements our prior ones published on June 2, 2020 and May 1, 2020, which are available here (June 2, 2020 client alert for borrowers), here (June 2, 2020 client alert for lenders) and here (May 1, 2020 client alert).

III. Size of Loans

New Loan Facility—The minimum loan size has been reduced to $250,000 (from $500,000) and the maximum loan size has been increased to the lesser of (i) $35 million (previously $25 million) and (ii) an amount which, when added to the Eligible Borrower’s outstanding and undrawn available debt, does not exceed 4.0x adjusted EBITDA.

Priority Loan Facility—The minimum loan size has been reduced to $250,000 (from $500,000) and the maximum loan size has been increased to (i) the lesser of $50 million (previously $25 million) and (ii) an amount which, when added to the Eligible Borrower’s outstanding and undrawn available debt, does not exceed 6.0x adjusted EBITDA.

Expanded Loan Facility—While the minimum loan size remains unchanged at $10 million, the maximum loan size has been increased to (i) the lesser of $300 million (previously $200 million) and (ii) an amount of the loan which, when added to the Eligible Borrower’s outstanding and undrawn available debt, does not exceed 6.0x adjusted EBITDA. Notably, a cap that would have further limited the maximum size of these loans to 35% of the Eligible Borrower’s existing outstanding and undrawn available debt that is pari passu in priority with the underlying loan subject to an “upsizing” under the Program and equivalent in secured status (i.e. secured or unsecured) was removed.

If more than one lender under an existing multi-lender facility chooses to “upsize” the existing facility to originate a Main Street loan under the Expanded Loan Facility, each of these Main Street loans should be separately submitted to the Main Street SPV by the applicable Eligible Lender for the sale of a participation interest in the Main Street loan to be made by that Eligible Lender. In all instances, the Eligible Borrower’s aggregate borrowings of those Main Street loans will remain constrained by the Expanded Loan Facility’s maximum loan size tests determined on an aggregate basis for those Main Street loans. Accordingly, the Eligible Borrower’s aggregate borrowings under the Expanded Loan Facility of all Main Street loans cannot exceed the lesser of (i) $300 million and (ii) an amount which, when added to the Eligible Borrower’s existing outstanding and undrawn available debt, exceeds six times the Eligible Borrower’s adjusted 2019 EBITDA.

IV. Extension of Maturity of Loans; Deferment of Repayments of Principal and Payments of Interests

Extension of Maturity—The term of all Main Street loans has been lengthened to five years (from four years).

Deferment of Amortization—Repayments of principal on all Main Street loans will be deferred for the first two years (previously principal was deferred only for the first year) and principal (including capitalized interest that is permitted to be deferred as described below) will be amortized (due and payable) at the end of years three, four and five at 15%, 15% and 70%, respectively. While the additional year of principal repayment relief is significant for all loan facilities under the Program, Eligible Borrowers of loans made under the New Loan Facility also stand to benefit from the new amortization schedule (from one that previously required equal repayments of principal at the end of years two, three and four).

Deferment of Interest Payments—Payments of interest on all Main Street Loans will remain deferred for the first year and capitalized to principal.

V. Participation in Loans by Main Street SPV

The Main Street SPV will purchase participations of 95% of all Main Street loans with respect to which all Program requirements have been satisfied. Consequently, risk retention by Eligible Lenders will be 5% for all Main Street loans, including ones made under the Priority Loan Facility, which previously required a 15% risk retention.

VI. Additional Clarifications

Capitalization of Interest—Unpaid interest for the first year of a Main Street loan will be capitalized in accordance with the Eligible Lender’s customary practices for capitalizing interest (e.g., at quarter-end or year-end). Thereafter, interest will be payable in accordance with the loan agreement for that Main Street loan.

Application of Prepayments of Principal Against Scheduled Amortization—Prepayments of principal of Main Street loans are permitted without penalty and are applied in the manner specified in the underlying loan documents. Although Eligible Lenders will have leeway in specifying how principal prepayments should reduce future amortization payments, they are encouraged to align their approach with the expected amortization schedule specified for each loan type. In that regard, the Federal Reserve indicated a soft preference for the application of prepayments to the next scheduled principal payment due by stating that such application would maintain the alignment of later payments with the amortization schedule and allow for the intended deferment of some portion of payments to later years. This method matches the commonly used loan agreement phrases, “forward order of maturity” and “direct order of maturity”.

Financial Records and Calculation of Adjusted EBITDA—Certain certifications are to be made with respect to the Eligible Borrower’s financial records and the calculation of adjusted EBITDA, and guidance is also provided as to what financial statements are to be provided to the Eligible Lender in connection with such certifications.

Payments of Principal and Interest that are Considered “Mandatory and Due”—In determining whether payments of principal of or interest on any debt of the Eligible Borrower are “mandatory and due” for purposes of the debt repayment covenants of the Main Street loan, the payments on the pre-existing debt must have been scheduled as of the date of the origination of that Main Street loan (and not April 24, 2020 as was previously indicated in an earlier version of the FAQ) or must arise upon the occurrence of an event that automatically triggers prepayment under a contract for indebtedness of the Eligible Borrower that was executed prior to the date of the origination of that Main Street loan (and not April 24, 2020 as was previously indicated in an earlier version of the FAQ).

Mortgage Debt—The term “Mortgage Debt” previously meant debt secured by real property at the time a Main Street loan is made under either the Priority Loan Facility or the Expanded Loan Facility. The defined term now also includes limited recourse equipment financings (including equipment capital or finance leasing and purchase money equipment loans) secured by only the acquired equipment. Further clarifications were also provided in the context of Main Street loans to be made under the Expanded Loan Facility. Any collateral that secures Mortgage Debt that constitutes a tranche of debt in an underlying credit facility in respect of which a Main Street loan is made under the Expanded Loan Facility must also secure that Main Street loan on a pari passu basis. Furthermore, a Main Street loan made under the Expanded Loan Facility may be unsecured only if the Eligible Borrower does not have, as of the date of origination, any secured Loans or Debt Instruments (other than Mortgage Debt that does not secure any other tranche of the underlying credit facility under which the Main Street loan is made).

Additional Fees—Other than a one-time origination or upsizing fee as set out in the applicable Main Street term sheet, additional fees are generally prohibited, except de minimis fees for services that are customary and necessary in the Eligible Lender’s underwriting of commercial and industrial loans to similar borrowers, such as appraisal and legal fees. However, the new version of the FAQ clarifies that Eligible Lenders may also charge customary consent fees if those fees are necessary to amend loan documentation in the context of making a Main Street loan under the Expanded Loan Facility.

Treatment of Paycheck Protection Program loans as “Outstanding Debt” for purposes of the Program—The portion of any outstanding principal of any Paycheck Protection Program loan that has not yet been forgiven must be counted as outstanding debt for the purposes of the maximum loan size test.

Debt and EBITDA of an Affiliated Group—If an Eligible Borrower is the only Business in its affiliated group that has sought funding through the Program, its affiliated group’s debt and EBITDA are not relevant to determining whether that Business can qualify, except to the extent that the Borrower’s subsidiaries are consolidated into its financial statements. If the Eligible Borrower has one or more affiliates that have previously borrowed or have an application pending to borrow from a loan facility under the Program, then the entire affiliated group’s debt and EBITDA are relevant to the determining the Eligible Borrower’s maximum loan size.

Qualification of Interests in Underlying Loans Purchased after December 31, 2019 for Purposes of Main Street Loans Made under the Expanded Loan Facility—An interest in the underlying loan purchased by an Eligible Lender who makes a Main Street loan under the Expanded Loan Facility no longer has to have been purchased by that Eligible Lender as of December 31, 2019 as indicated in an earlier version of the FAQ. Rather, that interest must have been purchased by the Eligible Lender before April 24, 2020. If the Eligible Lender purchased the interest in the underlying loan as of December 31, 2019, the Eligible Lender must have assigned an internal risk rating to the underlying loan equivalent to a “pass” in the FFIEC’s supervisory rating system as of that date. If the Eligible Lender purchased that interest after December 31, 2019, the Eligible Lender should use the internal risk rating given to that underlying loan at the time of purchase to determine whether the underlying loan is eligible for upsizing under the Expanded Loan Facility.

Economic Injury Disaster Loan (EIDL)—Businesses that have received a loan through the Small Business Administration (SBA)’s EIDL program can be Eligible Borrowers under the Program if they meet the Eligible Borrower criteria. This clarification expanded upon similar guidance that had previously addressed only the SBA’s Paycheck Protection Program loans.

Treatment of Participation Interests in Main Street Loans—The FAQ further clarifies that:

the Main Street SPV does not have a right to “put” the participation interest back to the Eligible Lender from whom it purchased that participation interest;

interest that accrues on the Main Street SPV’s purchased amount of a Main Street loan that is participated from the time such Main Street loan is made by the Eligible Lender until the time of payment by the Main Street SPV to the Eligible Lender for the participation interest will be for the account of the Main Street SPV regardless of when the interest accrued; and

the Federal Reserve has structured the transfer of interests in financial assets under the Participation Agreement from the Eligible Lender to the Main Street SPV with the intent that it would qualify:

VII. Revised Documentation to be Provided by the Federal Reserve

The Federal Reserve has previously published the forms and documents that are to be required at the time a participation interest is sold by an Eligible Lender to the Main Street SPV; however, several of these forms and documents are being revised by the Federal Reserve to reflect the changes to the Program announced since the original release of those forms. Consequently, the forms and documents that were previously made available by the Federal Reserve on May 27, 2020 should be used for the sale by Eligible Lenders to the Main Street SPV of participation interests only in loans that are to be, or were, funded before June 10, 2020 in conformance with the April 30, 2020 term sheets. The following documents are being updated by the Federal Reserve to bring them in line with the revised term sheets:

- New Loan Facility

- Expanded Loan Facility

- Priority Loan Facility

- New Loan Facility

- Expanded Loan Facility

- Priority Loan Facility

- Standard Terms and Conditions

- Transaction-Specific Terms

- Standard Terms and Conditions

- Transaction-Specific Terms

The only documents not being updated by the Federal Reserve are:

VIII. Implications

By lengthening the term, extending the commencement of amortization, reducing the minimum size and increasing the maximum size of, and increasing (with respect to the Priority Loan Facility) the size of the Main Street SPV’s participation in, Main Street loans, the Board seeks to improve access to the Program by small and medium-sized businesses thereby improving the ability of the Program to support employment during this difficult period.

The Board is encouraging Eligible Lenders to begin making Main Street loans immediately following their registration in the Program. To this end, the Program will also accept Main Street loans that were originated under the previously announced terms, if funded before June 10, 2020 in conformity with the April 30, 2020 term sheets. The Main Street SPV intends to purchase 95% of each eligible loan that is submitted to the Program, subject to the satisfaction of the relevant Main Street facility’s requirements. However, the Federal Reserve is in the process of updating a number of the forms and documents required to be submitted in connection with the Program.

The Board also stated that it is working to establish a program soon for nonprofit organizations, as they play a critical role throughout the economy.

For more information or questions on the Program, please reach out to a member of the Pillsbury team or contact us at MSLquestions@pillsburylaw.com.

Pillsbury’s experienced, multidisciplinary COVID-19 Task Force is closely monitoring the global threat of COVID-19 and providing real-time advice across industry sectors, drawing on the firm’s capabilities in crisis management, employment law, insurance recovery, real estate, supply chain management, cybersecurity, corporate and contracts law and other areas to provide critical guidance to clients in an urgent and quickly evolving situation. For more thought leadership on this rapidly developing topic, please visit our COVID-19 (Coronavirus) Resource Center.