Emerging Trends

Financing a More Sustainable Future

How policymakers and the financial services industry can help the sustainable finance market to scale

Source: Pillsbury & The Economist Intelligence Unit

Emerging Trends

06.28.21

This comprehensive report illuminates the much-buzzed-about but often misunderstood topic of sustainable finance, which has proven an attractive avenue of investment for environment- and climate-conscious corporations and financial institutions. Prepared by a team of researchers, writers and editors from The Economist Intelligence Unit, the publication provides an extensive examination of the ongoing transition to a low-carbon future and sustainable finance’s role in it, with first-hand input from well-known subject matter experts.

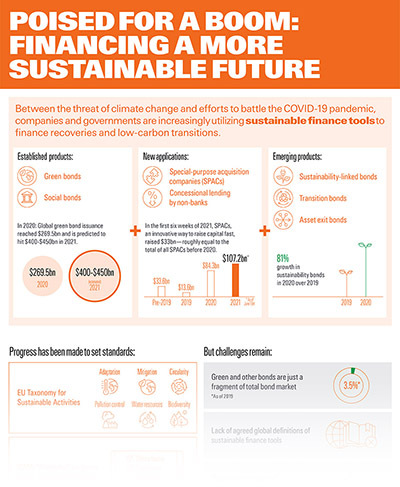

The report also includes direct insights from Pillsbury on topics such as sustainability-linked debt products and environmental, social & governance (ESG) best practices in the boardroom, and is it accompanied by a one-page infographic summarizing key themes:

Read the full report here: Financing a More Sustainable Future

Pillsbury’s Sustainable Finance and ESG practices are devoted to helping clients around the world find sustainable, cost-effective solutions as they contemplate lending, business and investment decisions. A multidisciplinary team of firm attorneys works seamlessly across practices and time zones to leverage their extensive knowledge of renewable energy, private equity, trade, regulatory, litigation, environmental, tax, investment funds, capital markets and intellectual property law and provide clients with comprehensive guidance on the full spectrum of sustainable finance matters.