Mezzanine Loans and Collateral

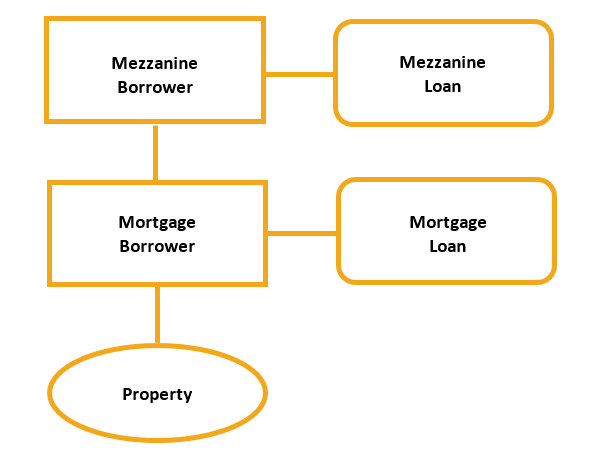

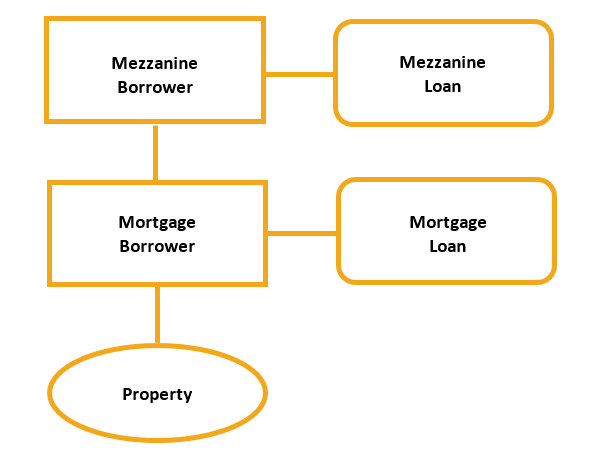

A real estate mezzanine loan is a loan made by a lender to the indirect owner(s) of real property. The mezzanine borrower does not directly own real property—it owns equity interests in the entity that owns real property (or, in the case of multiple levels of mezzanine debt, in the equity owner that is “higher” in the debt stack). Accordingly, in a mezzanine loan, the mezzanine lender takes a pledge of the equity interests owned by its borrower in order to secure its loan. The pledged equity interests usually represent 100 percent of the interests in an LLC. A mezzanine loan is almost always part of a capital structure where the real property owner is the borrower on a mortgage loan.

A simple mezzanine and mortgage loan structure would look like the diagram below:

Exercise of Remedies: Strict Foreclosure

For many mezzanine lenders, particularly those interested in a “loan to own” strategy, strict foreclosure may seem attractive. A strict foreclosure is the equivalent of a “deed in lieu” in a real estate context—the mezzanine lender accepts the collateral in full or partial satisfaction of the debt. However, the UCC provides non-waivable protections to the debtor and other parties with an interest in the transaction (e.g., a guarantor) or the collateral (e.g., a junior secured party). Those protections involve notifying the debtor and other parties with an interest in the collateral of the secured party’s proposal to accept the collateral. If the proposal is for a partial strict foreclosure (so that the secured party retains its rights to pursue a deficiency), then guarantors must also be notified. The debtor’s agreement to the strict foreclosure is required (although in the case of an unconditional proposal for full satisfaction of the debt, if the debtor fails to respond within a specific period, it is deemed to have agreed). If an objection is received from a party entitled to notice, then the secured party cannot proceed with the strict foreclosure. The UCC requirements for a strict foreclosure are largely procedural, but the lender must act in good faith.

Exercise of Remedies: Foreclosure Sales

Commercially Reasonable Disposition

A secured party has the right to cause a disposition of its collateral, and in some cases may purchase the collateral in that disposition. When collateral is being disposed of, the UCC provides protections to the debtor and to other parties with an interest in the transaction or the collateral.

The primary protection is that “[e]very aspect of a disposition of collateral, including the method, manner, time, place, and other terms, must be commercially reasonable.” Aspects of commercial reasonableness include the amount of notice given to the debtor and other parties, the efforts made to locate buyers (e.g., advertising and contacting brokers in the relevant industry), the content of published notices of the disposition and how the secured party determined the amount of its credit bid if it wants to purchase the collateral.

The UCC provides little guidance as to what is commercially reasonable, and the secured party and its advisors will need to make that determination based on the nature of the collateral. The UCC does state that “[a] disposition is made in a commercially reasonable manner if the disposition is made … in conformity with reasonable commercial practices among dealers in the type of property that was the subject of the disposition.” This leaves the secured party to look to case law and its advisors as to how to proceed.

Private Sale vs. Public Sale

A secured party generally cannot purchase the collateral at its own private sale. A lender who wants to purchase the collateral therefore will need to conduct a public sale. The UCC again provides limited guidance on the differences between a private sale and a public sale (at which the secured party can purchase the collateral). The UCC states that a public disposition “is one at which the price is determined after the public has had a meaningful opportunity for competitive bidding. ‘Meaningful opportunity’ is meant to imply that some form of advertisement or public notice must precede the sale (or other disposition) and that the public must have access to the sale (disposition).” Courts have interpreted this language not to require an outreach to the public generally, but to the types of buyers that are the likely purchasers for the particular type of asset. Again, case law and advisors will need to be consulted, taking into account whether the secured party wants to purchase the collateral and the additional time and expense that may be involved in conducting a public sale.

Diligence and Planning Before Action are Critical

Before deciding how to proceed in exercising (or forbearing from exercising) its remedies, a mezzanine lender needs to do a careful review of the transaction documents and related information.

- Perform Lien Searches, The mezzanine lender will need to know whether there are any other creditors who have claims on the collateral, and these creditors, in addition to the borrower and (in most cases) guarantors, will also need to be given notice. Accordingly, UCC lien searches and other searches will need to be obtained (in some cases within specified time frames established by the UCC to protect the secured party in meeting its notice obligations). Mezzanine lenders should conduct title and other searches at the property level—as well as diligence regarding potential tax, employment and other liabilities. Also, obtaining updated title coverage or endorsements early on in the process can help smooth the sale process and comfort potential purchasers.

- Confirm the Security Interest is Perfected. The lien search will also confirm whether the mezzanine lender’s security interest remains perfected by UCC filings. If a filing has become ineffective (whether because of a debtor name change or change in location, lapse due to failure to file a continuation statement or an erroneous termination) the lender may face legal and practical limitations on its remedies, Where the pledged equity interests were certificated (and perfection and priority may rely in whole or in part on possession of the certificates) the mezzanine lender should confirm that it (or its agent) has possession of the applicable certificates.

- Review Mezzanine Loan Documents. A security interest generally can only be enforced after a “default” (which will be determined by the terms of the loan documents). In addition, the mezzanine loan documents may contain agreements of the parties relevant to how to satisfy the standard that a disposition of collateral be conducted in a commercially reasonable manner, including minimum notice periods and processes to be followed in conducting the sale. While the agreement cannot waive or vary the secured party duties and protections provided to the debtor and other parties established by the UCC, the agreement can set standards for compliance with those duties and protections (as long as the agreement is not “manifestly unreasonable”) and can expose the secured party to a challenge if it fails to follow its own agreement. Counsel should review all of the loan documents for applicable requirements.

- Review Underlying Real Property Documents. Underlying real property documents (g., ground leases or hotel management or franchise agreements) may restrict upper-tier ownership transfers. Counsel should review these documents to confirm whether these restrictions were addressed when the loan was originated and that the transfer that occurs upon the exercise of a UCC remedy is permitted—and to identify any related requirements.

- Review the Intercreditor Agreement. Mezzanine lenders will need to carefully review (and abide by) their intercreditor agreements, as these agreements typically impose requirements to be complied with during (and after consummation of) a UCC foreclosure. Intercreditor agreements typically impose notice requirements, limit and define (by imposing financial and other parameters) the universe of acceptable purchasers at a foreclosure sale (unless senior lender approval or a rating agency confirmation is obtained), require that a foreclosing lender or purchaser at a foreclosure sale provide replacement guaranties from acceptable guarantors (which may delay the process), require that a foreclosing lender or purchaser effect certain payment and other cures and so forth. None of these requirements can be ignored. (More on intercreditor agreements in another alert to be published shortly.)

- Prepare to be an Owner. Consider and anticipate management and employment-related issues, for example.

- Develop a Playbook. Working with counsel, prepare a preliminary plan for enforcement of remedies, including whether action needs to be taken to declare a default and to accelerate the secured obligations, a timeline and costs estimates for pursuing remedies, identification of parties (g., the mortgage lender) who have consent rights or rights to notices, the type of remedy (and the UCC provisions that affect how it may be pursued), any steps needed to prevent a release of guarantors, whether to retain a broker or other advisor to assist with the sale process and whether (and how much) the lender intends to credit bid at a foreclosure sale. A combined legal and economic analysis at this stage (with frequent references back to the documents and UCC requirements) will help the mezzanine lender plan a successful enforcement strategy that complies with UCC requirements and reduces risks.

- Consider State and Federal Securities Law Issues. In most mezzanine loans, the interest being foreclosed upon will not be a security for purposes of federal and state securities laws because the foreclosing lender (or its purchaser) will be acquiring the entire economic interest in the pledged entity and all related control and management rights. Where this is not the case (g., there are control rights that are not acquired in the foreclosure), then securities counsel should be consulted. Even if the interest is a security for federal or state securities law purposes, it is still possible to conduct a foreclosure sale (and for that sale to be a public sale for purposes of the UCC so that the secured party can buy at its own sale) without having to register the sale of the securities with the SEC or otherwise comply with securities law requirements that will add costs or delays. In the case of the federal securities laws, there is a well-established body of guidance in the form of SEC no-action letters that set out the requirements for holding a sale that is “public” for purposes of the UCC but does not require the costs and delays of SEC filings to conduct the sale.

Caroline Harcourt is a partner in Pillsbury’s Real Estate practice. Lynn Soukup is a partner in Pillsbury’s Finance practice, and Jacob Axelrod is a senior law clerk.

Pillsbury’s experienced, multidisciplinary COVID-19 Task Force is closely monitoring the global threat of COVID-19 and providing real-time advice across industry sectors, drawing on the firm’s capabilities in crisis management, employment law, insurance recovery, real estate, supply chain management, cybersecurity, corporate and contracts law and other areas to provide critical guidance to clients in an urgent and quickly evolving situation. For more thought leadership on this rapidly developing topic, please visit our COVID-19 (Coronavirus) Resource Center.