Alert 04.08.20

SEC Amends Disclosure Requirements for Offerings of Guaranteed Securities

The amendments will become effective on January 4, 2021, with earlier compliance permitted.

Alert

Alert

04.28.20

Introduction

The Securities and Exchange Commission (SEC) recently adopted amendments to the “accelerated filer” and “large accelerated filer” definitions pursuant to Rule 12b-2 under the Securities Exchange Act of 1934 in order to resolve an overlap that existed between the definitions related to accelerated filers and “smaller reporting companies,” with the focus to reduce disclosure and reporting obligations for low-revenue smaller reporting companies. The most notable impact of these amendments is that a smaller reporting company with less than $100 million in revenue that previously met the definition of an accelerated filer or large accelerated filer will not be required to obtain an attestation of their internal control over financial reporting as required under Section 404(b) of the Sarbanes-Oxley Act and will not be required to comply with the shorter SEC filing deadlines that apply to accelerated filers. Smaller reporting companies that have more than $100 million in annual revenues will continue to be both a smaller reporting company and an accelerated filer, and therefore remain subject to the disclosure and reporting requirements of accelerated filers.

The final amendments will become effective on, and shall apply to an annual report filing due on or after, April 27, 2020.

Background

On June 28, 2018, the SEC amended the definition of smaller reporting company to (i) increase the public float threshold from $75 million to $250 million and the revenue threshold from $50 million to $100 million, and (ii) expand the availability of the revenue test to companies with a public float of less than $700 million, all with the intent to increase the number of reporting companies that can take advantage of the more scaled disclosure requirements afforded to smaller reporting companies. However, these amendments had the unintended consequence of some smaller reporting companies continuing to qualify as accelerated filers. As a result, some smaller reporting companies continued to be required to obtain an attestation of their internal control over financial reporting as required under Section 404(b) of the Sarbanes-Oxley Act and remained subject to the earlier reporting deadlines for quarterly and annual reports that are applicable to accelerated filers (40 and 75 days for accelerated filers, respectively, compared to 45 days and 90 days for non-accelerated filers).

The new amendments are intended to rectify the overlap that existed between the definitions of a smaller reporting company and an accelerated filer and large accelerated filer in order to reduce disclosure burdens and compliance costs for certain low-revenue smaller reporting companies.

Amendments to Exclude Low-Revenue Smaller Reporting Companies from the Definitions of Accelerated Filers

The amendments are intended to conform the accelerated and large accelerated filer definitions to the revised smaller reporting company definition as a result of the 2018 amendments by expressly excluding low-revenue smaller reporting companies from the definitions of accelerated and large accelerated filer. Accordingly, the amendments exclude from the accelerated and large accelerated filer definitions an issuer that qualifies as a smaller reporting company and had annual revenues of less than $100 million in the most recent fiscal year for which audited financial statements are available. As a result, smaller reporting companies with less than $100 million in revenues will be exempt from the auditor attestation requirements under Section 404(b) of the Sarbanes-Oxley Act and accelerated reporting deadlines. An issuer that qualifies as a smaller reporting company due to a public float between $75 million and $250 million, yet has annual revenues in excess of $100 million, will continue to be both a smaller reporting company and an accelerated filer, and therefore remains subject to the auditor attestation requirements under Section 404(b) of the Sarbanes-Oxley Act and accelerated reporting deadlines.

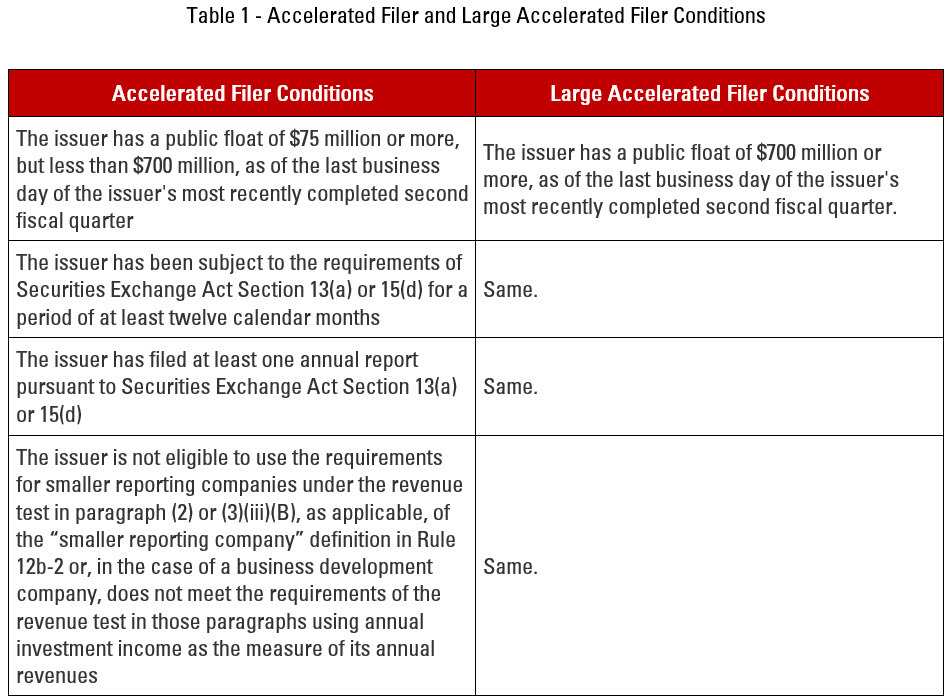

See Table 1 below, “Accelerated Filer and Larger Accelerated Filer Conditions,” which summarizes the conditions required to be considered an accelerated and large accelerated filer under the final amendments to Rule 12b-2.

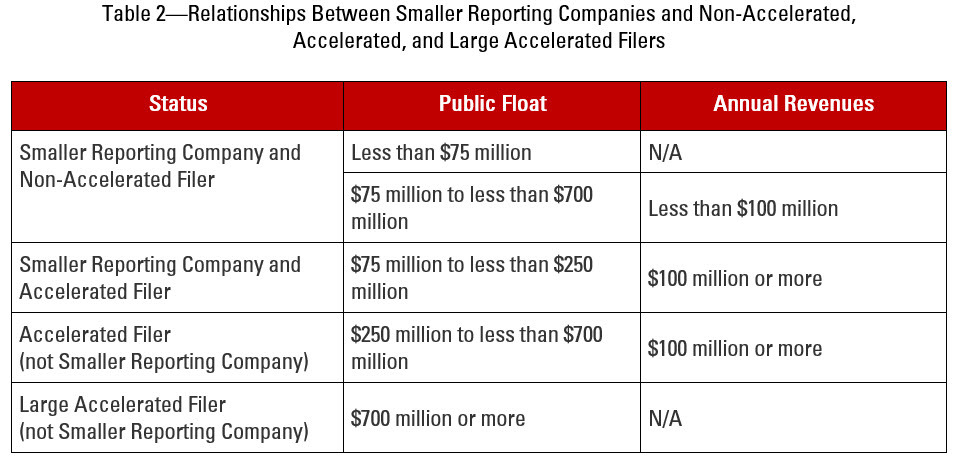

See also Table 2 below, “Relationships Between Smaller Reporting Companies and Non-Accelerated, Accelerated, and Large Accelerated Filers,” which summarizes the relationships between smaller reporting companies and non-accelerated and accelerated filers under the final amendments to Rule 12b-2.

Amendments to Public Float Transition Thresholds

The purpose of public float transition thresholds between accelerated filer status and non-accelerated filer status is to avoid situations in which an issuer frequently enters and exits accelerated filer status due to relatively small fluctuations in its public float. Prior to the amendments described above, the public float transition threshold for an accelerated filer to become a non-accelerated filer was $50 million, and the public float transition threshold for a large accelerated filer to become an accelerated filer was $500 million. The SEC believed these threshold amounts were too low, resulting in more issuers than intended being classified as an accelerated or large accelerated filer and therefore subject to increased disclosure requirements and higher compliance costs.

The final amendments increase the public float transition threshold for an accelerated filer to become a non-accelerated filer from $50 million to $60 million, and increase the public float transition threshold for a large accelerated filer to become an accelerated filer from $500 million to $560 million. In addition, the amendments add an additional threshold under which a large accelerated filer or accelerated filer can transition to being a smaller reporting company when the issuer (i) has annual revenues of less than $100 million and (ii) has a public float of less than $700 million.

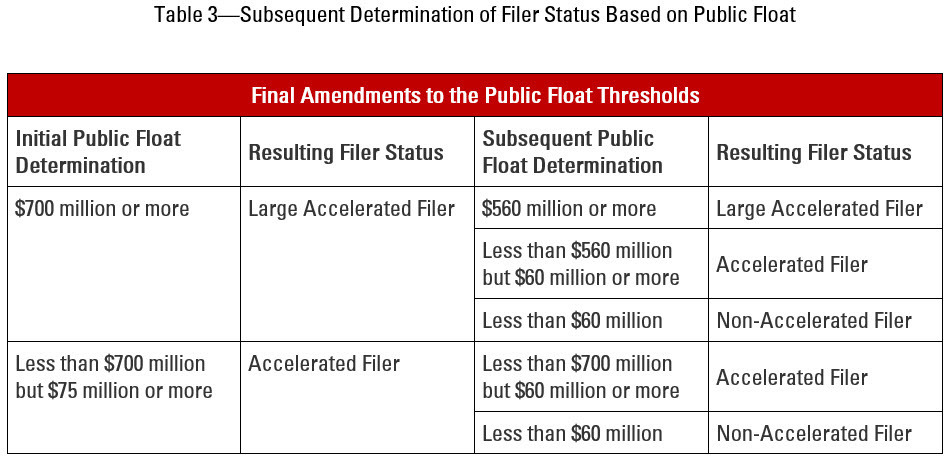

See Table 3 below, “Subsequent Determination of Filer Status Based on Public Float,” which summarizes how an issuer's filer status will change based on its subsequent public float determination.

Check Box on Annual Report Cover Pages

In addition, these amendments also provide for an additional check box on the cover pages of annual reports on Forms 10-K, 20-F, and 40-F to indicate whether an auditor attestation over internal control of financial reporting is included in the filing.

To access the SEC’s final rule regarding the amendments described above, please use this link.

Please contact any member of Pillsbury’s Capital Markets team should you have any questions or would like additional information regarding this client alert.