Alert

SEC Amends “Smaller Reporting Company” Definition

Commission action expands number of companies eligible to provide scaled disclosure.

Alert

Takeaways

07.05.18

On June 28, 2018, the Securities and Exchange Commission adopted amendments to the definition of “Smaller Reporting Company” (SRC) that are intended to expand the number of registrants eligible to provide scaled disclosure, which will reduce compliance costs for smaller registrants that choose to provide scaled disclosure. Under the new definition, a company qualifies as a SRC if it has either (i) a public float of less than $250 million as of the last business day of its most recently completed second fiscal quarter or (ii) annual revenues of less than $100 million if it also has either no public float or a public float of less than $700 million.

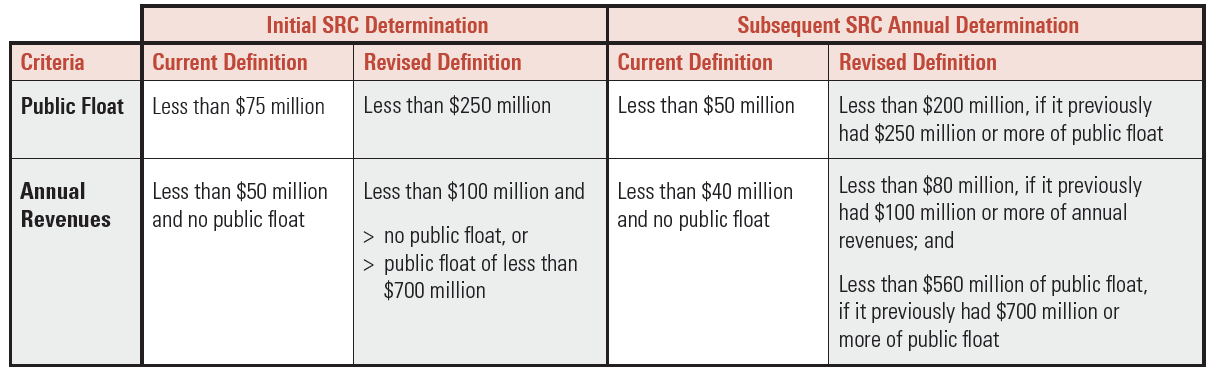

To avoid situations in which registrants frequently enter and exit SRC status due to small fluctuations in their public float or revenues, consistent with the current SRC definition, the amendment also establishes lower qualification thresholds for subsequent annual determinations made as of the end of the registrant’s most recently completed second fiscal quarter. Once a registrant determines that it does not qualify as a SRC, either upon an initial determination in the case of registrants filing an initial registration statement or as of an annual determination in the case of a reporting registrant, it will remain unqualified until it meets a lower threshold set at 80 percent of the initial qualification threshold. The initial and subsequent qualification thresholds are shown in the following table:

The amendments become effective 60 days after publication in the Federal Register. Importantly, however, for the first fiscal year ending after effectiveness of the amendments, a registrant will qualify as a SRC if it meets one of the initial qualification thresholds in the revised definition as of the date it is required to measure its public float or revenues, even if it did not previously qualify as a SRC. For example, a registrant with a December 31 fiscal year end that previously was not a SRC and that had a public float of $220 million as of June 29, 2018 (the last business day of its most recently completed second quarter) will qualify as a SRC for the fiscal year ending December 31, 2018.

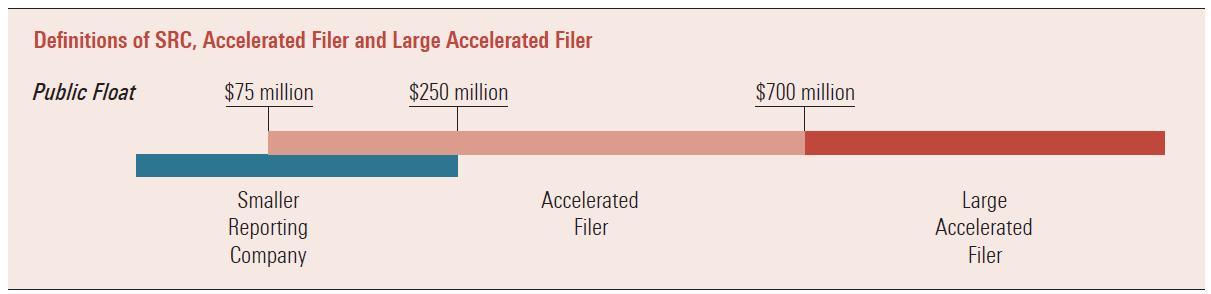

Additional amendments were also made to the definitions of “accelerated filer” and “large accelerated filer” to preserve the existing public float thresholds and eliminate the exclusion of SRCs from those definitions. As a result, some registrants will qualify as both SRCs and accelerated filers. As a consequence, newly eligible SRCs that are also accelerated filers will be required to comply with the shorter filing deadlines for their annual and quarterly reports as well as the auditor internal control attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002. Conforming changes were made to the cover pages for periodic reports (Form 10-Q and Form 10-K) and registration statements (Forms S-1, S-3, S-4, S-8, S-11 and Form 10) to delete the parenthetical regarding SRCs that followed the non-accelerated filer checkbox.

Recognizing the regulatory complexity created by the new overlap in the SRC and accelerated filer definitions, the Commission directed the SEC staff to formulate a recommendation on future changes to reduce the number of registrants that fall within the accelerated filer definition.

Lastly, the amendment also increases the revenue threshold under which certain registrants are eligible to provide two rather than three years of historical audited financial statements of certain acquired businesses. The current rule allows registrants to omit financial statements for the earliest of the three fiscal years required if the net revenues of the business to be acquired are less than $50 million. Because the $50 million threshold was based on the revenue threshold in the prior SRC definition, the amendment also increases the net revenue threshold from $50 million to $100 million to require the third year of historical financial statements.

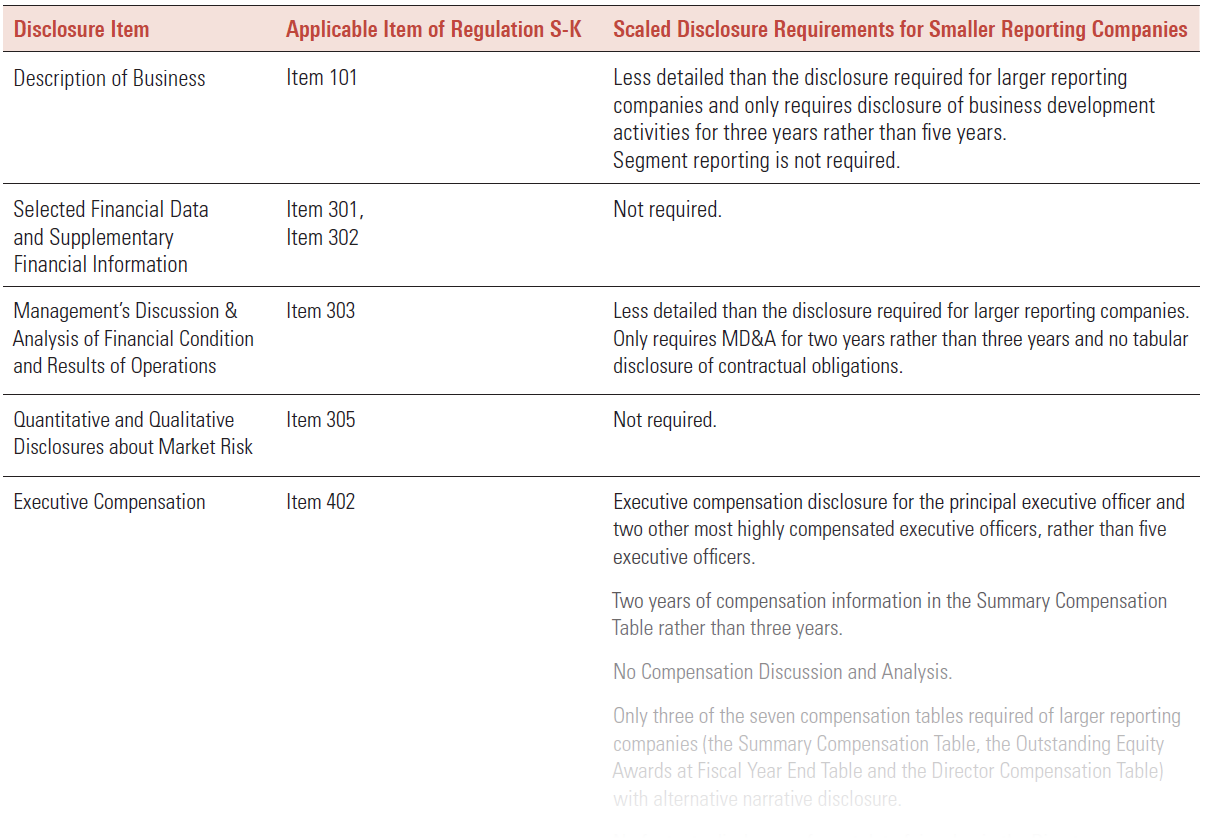

The scaled disclosure accommodations available to SRCs on an item-by-item basis are unchanged and are summarized in the following tables:

Click here to view the full tables (pdf).