Alert

SEC Postpones Effective Date of Share Repurchase Disclosure Modernization Rule

Alert

Takeaways

12.11.23

Share Repurchase Rule Postponed

On November 22, 2023, the Securities and Exchange Commission (SEC) issued an order postponing the effective date of the Share Repurchase Disclosure Modernization Rule (“Share Repurchase Rule”), which became effective on July 31, 2023. The postponement order was issued in light of the October 31, 2023, decision by the U.S. Court of Appeals for the Fifth Circuit. The decision by the Fifth Circuit granted a petition for review and remanded the rule to the SEC to “correct the defects” identified in the rule by November 30, 2023. As a result of the SEC’s postponement order, the Share Repurchase Rule is stayed pending further action by the SEC.

Share Repurchase Rule Summary

On May 3, 2023, the SEC adopted the Share Repurchase Rule, which amended the then-existing share repurchase plan disclosure requirements. The amendments would require issuers to:

- provide quarterly tabular disclosure of certain daily share repurchase data as an exhibit (XBRL tagging required) to periodic reports on Form 10-Q and Form 10-K;

- indicate via check box whether any officers or directors traded in the issuer’s securities within four business days before or after the public announcement of the share repurchase plan or the announcement of an increase in the size of an existing share repurchase plan;

- provide narrative disclosure regarding the objectives and rationale of issuer share repurchase plans, the process or criteria used to determine the repurchase amount, the number of shares repurchased outside of a publicly announced share repurchase program and the nature of these transactions, and any policies or procedures relating to purchases and sales of the issuer’s securities during a share repurchase program; and

- provide quarterly disclosure regarding the adoption or termination of any issuer Rule 10b5-1 trading plans.

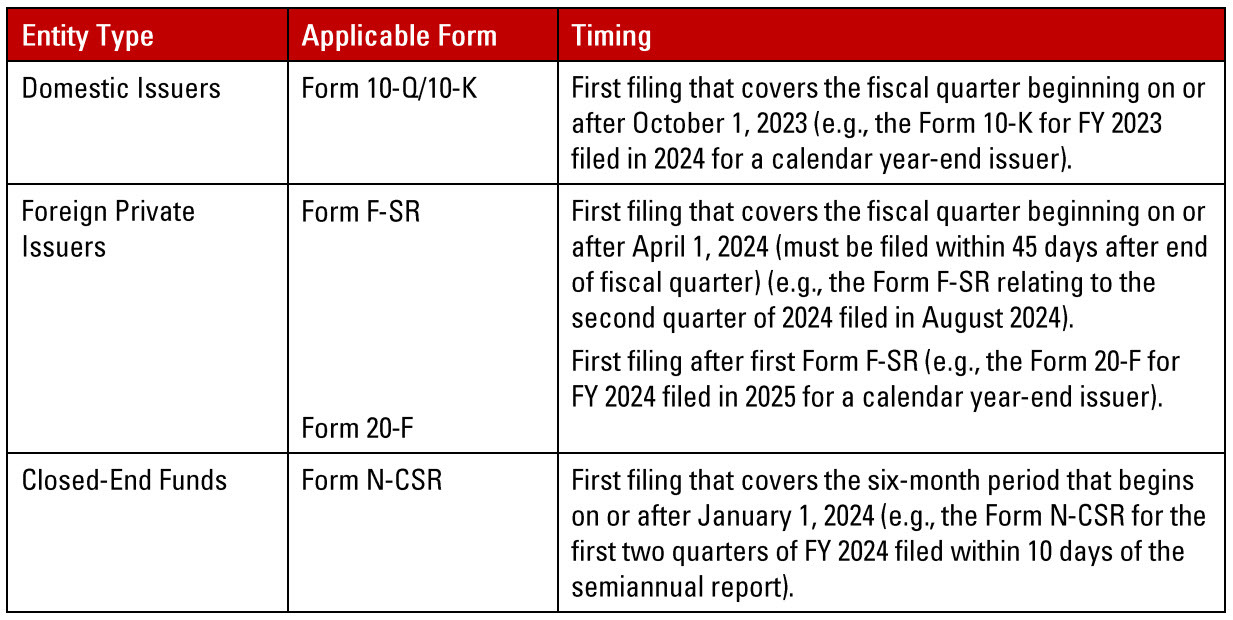

Issuers other than foreign private issuers and closed-end funds would be required to comply with the disclosure and tagging requirements under the Share Repurchase Rule in periodic reports on Form 10-Q and Form 10-K beginning with the first filing covering the first full fiscal quarter beginning on or after October 1, 2023. (See Timing section for further information on timing, as well as other requirements applicable to foreign private issuers and closed-end funds.)

Background

An issuer may repurchase its shares through numerous methods, including through open market purchases, tender offers, privately negotiated transactions and accelerated share repurchases. In 2020, an SEC study concluded that issuer share repurchases are often employed in a manner that may be aligned with stockholder value maximization, and that many investors view repurchases as an indication that the issuer’s management believes its shares are undervalued. However, the SEC study also noted that there are many reasons an issuer might implement a share repurchase plan that are not motivated by the long-term value of the issuer. For example, repurchases can be driven by a lack of better investment opportunities or a desire to increase the issuer’s leverage ratio or achieve certain financial metrics, including the issuer’s earnings per share or stock compensation figures, which may or may not be indicative of the issuer’s underlying financial health. Additionally, certain issuer executive compensation structures may enable executives to benefit from repurchases in addition to any benefits realized by investors as a whole, even when such repurchases may not increase the actual value of the issuer. Considering the various rationales which may underly an issuer’s decision to implement a repurchase program and the potential for information asymmetries, the amendments aim to provide investors with better insight into the efficiency, purpose and impact of share repurchases, and thus enable investors to evaluate when the purpose of repurchases may be motivated by goals unconnected to increasing stockholder value or signaling the issuer’s view that its stock is undervalued.

Current Rules

Under current SEC rules, issuers are required to notify the public of their entrance into, or modification of existing, share repurchase plans. Issuers’ announcements relating to such plans, often on Form 8-K and/or by press release, typically included, among other things, the maximum dollar amount or number of shares subject to the share repurchase plan, the term of the share repurchase plan and the manner in which the shares would be repurchased. Pursuant to Item 703 of Regulation S-K, issuers are currently required to report quantitative aggregated monthly share repurchase data in tabular form in their periodic reports on Form 10-Q and Form 10-K and include in a footnote to such table the date the plan was announced, the dollar amount of the plan or the number of shares to be repurchased thereunder, and the plan’s expiration date. (Issuers listed on Nasdaq must submit a Shares Outstanding Change Form if the repurchase causes a decrease of 5% or more in the number of issuer shares outstanding.)

New Requirements under Share Repurchase Rule

Tabular Quantitative Disclosure

The Share Repurchase Rule would require tabular quantitative disclosure of an issuer’s daily repurchase activity for the following periods:

- Quarterly on Form 10-Q or Form 10-K for domestic issuers;

- Semi-annually on Form N-CSR for listed closed-end funds; or

- Within 45 days after the end of the fiscal quarter for foreign private issuers (FPIs).

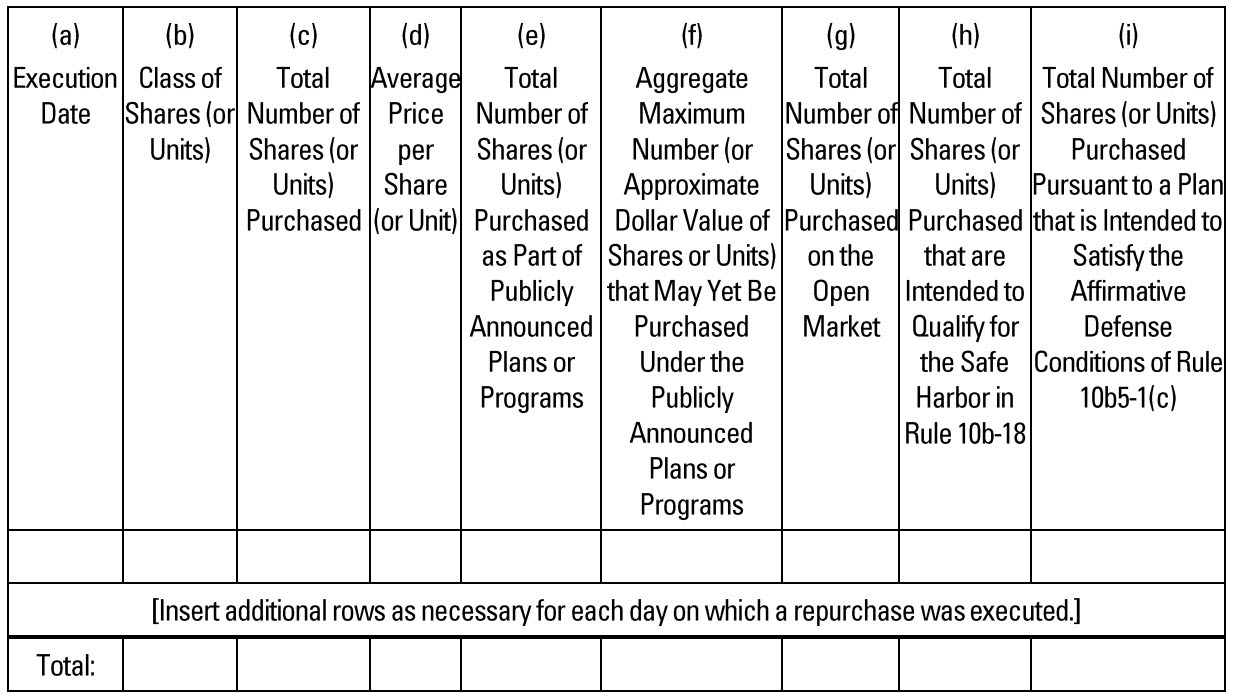

The SEC has noted that the disclosure of such daily repurchase data “may indicate that management may have timed share repurchases in order to meet certain earnings goals or targets, to support insiders’ trading positions or to otherwise increase insider compensation.” For each date on which a repurchase was executed, the issuer must disclose the following information for such repurchases in tabular form:

- Class of shares;

- Average price paid per share;

- Total number of shares repurchased (including number purchased as part of a publicly announced share repurchase plan);

- Aggregate remaining maximum number of shares or dollar value that can be repurchased under a publicly announced share repurchase plan;

- Total number of shares purchased on the open market; and

- Total number of shares purchased which are intended to qualify for the Rule 10b-18 safe harbor and, separately, the total number of shares purchased under an issuer Rule 10b5-1 trading plan.

Additionally, the issuer must also disclose via a footnote to the tabular disclosure the date of adoption or termination of any issuer Rule 10b5-1 trading plans. The newly required tabular disclosure must be tagged using Inline XBRL.

Example of Tabular Disclosure

Use the checkbox to indicate if any officer or director reporting pursuant to Section 16(a) of the Exchange Act (15 U.S.C. 78p(a)), or for foreign private issuers as defined by Rule 3b-4(c) (17 CFR 240.3b-4(c)), any director or member of senior management who would be identified pursuant to Item 1 of Form 20-F (17 CFR 249.220f), purchased or sold shares or other units of the class of the issuer’s equity securities that are registered pursuant to Section 12 of the Exchange Act and subject of a publicly announced plan or program within four (4) business days before or after the issuer’s announcement of such repurchase plan or program or the announcement of an increase of an existing share repurchase plan or program.

Checkbox Requirement

The Share Repurchase Rule would require issuers to include a checkbox preceding its tabular disclosure indicating whether certain officers or directors traded in the relevant securities within four business days before or after the announcement of the share repurchase plan (or announcement of an increase to an existing share repurchase plan). This requirement may help investors evaluate whether corporate insiders are potentially benefiting unfairly from information imbalances by purchasing shares ahead of an issuer’s share repurchase plan announcement. For domestic issuers, this applies to any directors or Section 16(a) officers. For FPIs, this applies to any director or member of senior management who would be identified pursuant to Item 1 of Form 20-F, regardless of whether the FPI is reporting on the forms exclusively available to FPIs or on their domestic forms.

Narrative Disclosure

The Share Repurchase Rule would require issuers to enhance their qualitative disclosure regarding their share repurchase plans and practices in their periodic reports. Such narrative disclosure must outline the objectives or rationales for the share repurchases, the process and criteria used to determine the aggregate repurchase amount and include a description of its policies and procedures relating to the purchase and sale of the issuer’s securities during a share repurchase plan period by its officers and directors, including any restrictions that may exist on such transactions. As is currently the case, an issuer’s publicly announced share repurchase plan disclosure also must include:

- the date that each plan was announced;

- the dollar (or share or unit amount) approved;

- the expiration date (if any) of each plan;

- each plan that has expired during the period covered by the disclosure; and

- each plan the issuer determined to terminate prior to expiration, or under which the issuer does not intend to make further repurchases.

The Share Repurchase Rule would eliminate the current requirements in Regulation S-K, Form 20-F and Form N-CSR to disclose an issuer’s monthly repurchase data in periodic reports.

Issuer Rule 10b5-1 Trading Plan Disclosures

New Item 408(d) of Regulation S-K would require issuers to provide quarterly disclosure in periodic reports on Form 10-Q and Form 10-K regarding the adoption and termination of issuer Rule 10b5-1 trading plans and the material terms of such plans, including the:

- date of plan adoption or termination;

- duration of the trading plan; and

- aggregate number of shares to be purchased or sold under the plan.

With this requirement, the SEC seeks to address prior gaps in the disclosure requirements that could permit corporate insiders to unfairly exploit informational imbalances. This information must first be provided along with the tabular and narrative disclosures and must be tagged using Inline XBRL format.[1]

Timing

Issuer Considerations and Next Steps

To prepare to comply with the amendments, issuers should review and update their existing trading policies and share repurchase tracking procedures to ensure that the issuer and Section 16 reporting person trades are tracked daily, and that the information required by the new tabular disclosures is recorded timely and accurately. Issuers should also be mindful of the narrative disclosure requirements when documenting and implementing share repurchase plans, including during discussions preceding the adoption of a share repurchase plan, and should carefully consider the objectives and rationales for the share repurchases, the process and criteria used to execute repurchases, including with respect to the amount of repurchases approved and the imposition of trading blackouts that include restrictions on trading within four business days of a share repurchase plan announcement. Issuers should consult with legal counsel to navigate the newly adopted disclosure requirements.

[1] The new Item 408(d) disclosure would be triggered if a Rule 10b5-1(c) plan was adopted or terminated during the prior quarter regardless of whether any share repurchase activity under the plan occurred during the quarter, while the Item 703 disclosure regarding Rule 10b5–1(c) trading arrangements is triggered only if the issuer conducted share repurchase activity during the prior quarter. Item 408(d)(1) would provide that, if the disclosure provided pursuant to Item 703 contains disclosure that would satisfy the requirements of Item 408(d)(1), a cross-reference to that disclosure would satisfy the Item 408(d)(1) requirements.