Alert

Dueling Rent Taxes Come Up before San Francisco Voters in June

San Francisco electorate will vote on a new 1.7% or 3.5% tax on commercial rentals in June 2018.

Alert

Takeaways

02.12.18

There will be competing commercial rent tax measures on San Francisco’s June 2018 ballot. The “Housing for All” measure would impose a new 1.7% tax on commercial rents in San Francisco, effective January 1, 2019. The “Universal Childcare for San Francisco Families” measure would impose a new 3.5% tax on commercial rents (1% on rents from warehouses) in San Francisco (also operative January 1, 2019). Both measures specify that only one measure can be adopted, and that if both measures secure sufficient votes for passage, the measure with the most votes will prevail. If either of these measures were to be adopted it would be in addition to San Francisco’s existing 0.3% gross receipts tax on rentals.

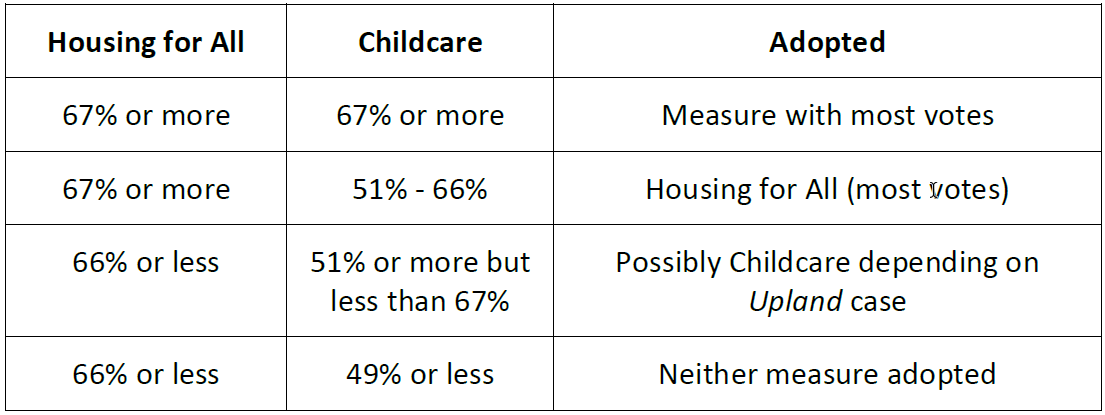

The Housing for All measure would require approval by two-thirds of the voters. It remains unclear whether the “Universal Childcare” measure also requires two-thirds approval or could be approved with only a simple majority because its proponents have gathered sufficient signatures to place it on the ballot as a voter initiative. The recent California Supreme Court decision in California Cannabis Coalition v. City of Upland (2017) 3 Cal. 5th 924 makes it unclear if special tax proposals placed on the ballot by voter initiative require only majority voter approval and avoid the two-thirds voter approval requirement for such taxes established in 1996 by Proposition 218 (Article XIIIC of the California Constitution).

Housing for All Measure

Under a procedure allowed only in San Francisco, five members of the San Francisco Board of Supervisors (less than a majority of the Board) placed the Housing for All measure on the June 2018 ballot. As a tax for a special purpose (rather than for the general fund) put on the ballot by legislative action, it requires two-thirds approval of the voters under Proposition 218 (Article XIIIC).

The measure would impose an additional 1.7% tax on the gross receipts from the lease of “commercial space” in the City to fund low- and middle-income housing and homelessness services.

The Housing for All tax would not apply to rents from:

- Residential uses;

- Production, Distribution and Repair uses;

- Retail uses;

- Entertainment, Arts and Recreational uses (e.g., theaters, nightclubs and sports arenas or stadiums).

Nonprofit organizations which are commercial landlords would be exempt from the tax and rentals paid by nonprofit organizations to a for-profit commercial landlord would be excluded from the definition of “commercial rents” and thus not subject to the tax.

Small landlords already exempt from payment of the existing gross receipts tax on commercial rents under Section 954.1 of Article 12-A-1 of the San Francisco Municipal Code (those with gross receipts of less than $1million) would also be exempt from this new tax.

It is estimated that about $65 million annually would be collected under this tax (about a six fold increase over the existing 0.3% tax).

Universal Childcare for San Francisco Families

This measure was initially placed on the June 2018 ballot by action of four San Francisco Supervisors but was subsequently also circulated by its supporters for signature of voters as an initiative measure. Only about 9,500 valid San Francisco voter signatures are required to qualify it for the ballot, and it appears to have achieved that goal. (Voter petitions with about 18,000 signatures were submitted to and are currently under review by the San Francisco Registrar of Voters.) If the Registrar determines there are sufficient valid signatures to qualify the measure as a voter initiative, the promoters of the measure argue that as a voter initiative it avoids the required two-thirds voter approval typically required for a special tax, and can therefore be approved with only majority voter approval under the Uplands case.

The measure would impose a 3.5% tax on rentals of “commercial space” in the City, with a reduced 1% tax on rentals of warehouse space in the City. The taxes raised would be dedicated to fund early care and education for children under specified ages in San Francisco families below certain thresholds of the state median income.

The Childcare tax would not apply to rents from:

- Residential uses;

- Industrial uses;

- Arts Activities (this is narrower than the exclusion of rents from entertainment, arts and recreation uses under the Housing for All measure—for example, it would not exclude rents from night clubs or sports arenas and stadia);

- Retail uses (except for rents from so called Formula Retail uses, such as Peets, Starbucks or Macy’s).

As with the Housing for All Measure, nonprofit organizations that are commercial landlords would be exempt from the tax and rents paid by a nonprofit organization to a for-profit commercial landlord would be excluded from the definition of “commercial rents” and thus not be subject to the tax.

Also, as with the Housing for All measure, small landlords exempt from the existing gross receipts tax would be exempt from this new tax.

It is estimated that about $150 million annually from the commercial real estate industry would be collected under this tax (a 12-fold increase over the existing 0.3% tax).

Possible Voting Outcomes of the June 2018 Election

All in all, San Francisco’s 2018 June election presents commercial landlords with the prospect of a massive tax increase, though the Housing for all Measure is clearly the less burdensome of the two.