Alert

Deadline Looming for BE-10 Filing

Alert

05.15.15

- Mandatory reporting required by the Bureau of Economic Analysis on Form BE-10 – 2014 Benchmark Survey of U.S. Direct Investment Abroad

- Investment managers, general partners, hedge funds and private equity funds are among those that may have to file

What is BE-10

BE-10 is a benchmark survey of U.S. direct investment abroad, conducted once every five years by the Bureau of Economic Analysis (“BEA”) of the U.S. Department of Commerce. The purpose of the survey is to obtain economic data on the operations of U.S. parent companies and their foreign affiliates. The BE-10 survey is conducted pursuant to the International Investment and Trade in Services Survey Act, and the filing of reports is mandatory pursuant to Section 5(b)(2) of that Act. BE-10 reports are kept confidential and used for statistical analysis.

What is the filing deadline

May 29, 2015

if you are a U.S. Reporter (defined below) filing to report fewer than 50 Foreign Affiliates (defined below).

June 30, 2015

if you are a U.S. Reporter filing to report 50 or more Foreign Affiliates.

Extensions

The BEA will consider reasonable requests for extensions if received before the applicable due date of the report. Extension requests should “enumerate the substantive reasons necessitating the extension” on the form provided by the BEA.

Who must file

All U.S. persons that had direct or indirect ownership or control (each, a “U.S. Reporter ”) of at least 10 percent1 of the voting stock of a foreign business enterprise (a “Foreign Affiliate ”) at any time during the entity’s 2014 fiscal year must file.

Any U.S. general partner or investment manager of a private fund could be a U.S. Reporter, and any hedge fund, private equity fund, or other private fund could be either a U.S. Reporter or a Foreign Affiliate, if they meet the above criteria.

Examples of U.S. Reporters and/or Foreign Affiliates

- A U.S. private fund with at least 10 percent ownership of voting securities in a foreign portfolio company/investment

- A U.S. investment manager holding management shares in an offshore fund

- A U.S. entity serving as the general partner2 (directly) of a non-U.S. limited partnership, such as an offshore master fund

- A U.S. manager that is the sole shareholder of the non-U.S. general partner entity of an offshore limited partnership

- Wholly-owned offshore subsidiaries of a U.S. investment manager/general partner

- A U.S. holding company (including investment manager/general partner) or SPV holding 10 percent or more of the voting securities of a foreign subsidiary or other company

What forms must be completed

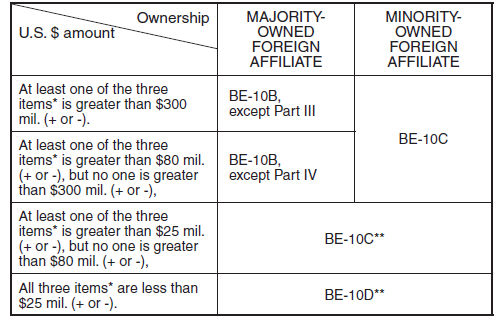

Each U.S. Reporter is required to file a Form BE-10A for itself, and a BE-10B, BE-10C or BE-10D, based on the thresholds listed below, for each of its Foreign Affiliates.

Form BE-10A – Report for U.S. Reporter. A U.S. Reporter3 that exceeds the “$300 Million Threshold ”4 must file a complete Form BE-10A; a U.S. Reporter that does not exceed the $300 Million Threshold must fill out a partial Form BE-10A: items 1 - 42 and 97 - 114.

Form BE-10B – Report for majority-owned foreign affiliates of U.S. parents with assets, sales, or net income greater than $80 million (positive or negative);

Form BE-10C – Report for majority-owned foreign affiliates of U.S. parents with assets, sales, or net income greater than $25 million (positive or negative), but no one of these items was greater than $80 million (positive or negative); for minority-owned foreign affiliates of U.S. parents with assets, sales, or net income greater than $25 million (positive or negative); and for foreign affiliates for which none of assets, sales, or net income was greater than $25 million (positive or negative), and is a foreign affiliate parent of another foreign affiliate being filed on Form BE-10B or BE-10C;

Form BE-10D – Report for foreign affiliates for which none of assets, sales, or net income was greater than $25 million (positive or negative), and is not a foreign affiliate parent of another foreign affiliate being filed on Form BE-10B or BE-10C.

BE-10 forms may be filed electronically on the BEA website or submitted by mail or fax to the BEA.

BEA guidance chart

What information is included in the forms

BE-10 collects information regarding the U.S. Reporter’s and its Foreign Affiliates’ legal identity, activities/products/services, sales and employment data, financial and operating data, export and import business, and investment and transactions between the Reporter and its Foreign Affiliates.

Are there penalties for not filing

A non-filer is subject to civil penalties up to $25,000 and injunctive relief, and willful violations may result in criminal penalties of up to $10,000 and imprisonment for up to one year. Even though the BEA has stated informally that it does not intend to penalize for failure to file, persistent failure to file may ultimately result in civil and criminal penalties.

Helpful information on the BEA’s website:

BE-10 Forms, Instructions, FAQs and Tutorials

Download: Deadline Looming for BE-10 Filing

1. A U.S. Reporter’s ownership interest in a Foreign Affiliate may be held indirectly through a directly held Foreign Affiliate that owned the given foreign enterprise. You must “look through” all intervening foreign enterprises in the chain to determine whether you hold a foreign business enterprise to the extent of 10 percent or more. To calculate your ultimate ownership percentage, multiply the direct ownership percentage in the first Foreign Affiliate by that first Foreign Affiliate’s direct ownership percentage in the second enterprise in the chain, multiplied by the direct ownership percentage for all other intervening enterprises in the ownership chain, until you reach the ownership percentage in the final foreign business enterprise. To illustrate, if a U.S. Reporter owned 50 percent of Foreign Affiliate A directly, and A owned 75 percent of foreign business enterprise B which, in turn, owned 80 percent of foreign business enterprise C, the U.S. Reporter’s percentage of indirect ownership of B would be 37.5 percent (the product of the first two percentages), its indirect ownership of C would be 30 percent (the product of all three percentages), and B and C (as well as A) would be considered Foreign Affiliates of the U.S. Reporter.

2. The BEA considers ownership of voting interest in limited partnerships to be divided equally among the general partners (if more than one), with the limited partners owning no voting interest, unless otherwise specified in the ownership agreement. The U.S. general partner of a non-U.S. limited partnership is deemed to hold 100 percent of the non-U.S. limited partnership’s voting interests.

3. A US Reporter includes the reporting entity’s “fully consolidated U.S. domestic enterprise,” i.e., (i) the U.S. business enterprise whose voting securities are not owned more than 50 percent by another U.S. business enterprise, and (ii) proceeding down each ownership chain from that U.S. business enterprise, any U.S. business enterprise whose voting securities are more than 50 percent owned by the U.S. business enterprise above it, excluding foreign branches and affiliates.

4. The $300 Million Threshold is exceeded if any of the (i) total assets, (ii) sales or gross operating revenues excluding sales taxes or (iii) net income after U.S. income taxes is greater than $300 million (positive or negative) at any time during the U.S. Reporter’s 2014 fiscal year.