Article

Avoiding Pitfalls in the Appraisal Valuation of Health Care Facilities

Source: LinkedIn

Article

01.27.16

Accurately valuing the owned real estate and operations of an insolvent health care business is critical to analyzing and resolving a variety of business and litigation issues. Outside of formal bankruptcy proceedings, secured lenders rely upon appraisals to support regulatory-reporting obligations and to assist in developing exit strategies (e.g., to price a discounted loan sale). Inside of bankruptcy proceedings, appraisals are used by both lender and borrower parties to take positions on disputes over (i) adequate protection, both for use of cash collateral and obtaining debtor-in-possession financing, (ii) relief from the automatic stay, and (iii) plan treatment.

For example, if a lender’s collateral value exceeds its loan balance (i.e., oversecured), the lender is entitled to recover interest and costs (including legal fees), but is unlikely to obtain relief from the automatic stay of collection efforts in the bankruptcy of its borrower. Conversely, an undersecured lender, while not entitled to recover interest and costs, is entitled to maintenance of its collateral value (i.e., adequate protection), and may be more likely to obtain lift-stay relief.

In the insolvency and bankruptcy contexts, a seemingly insignificant assumption can have a dramatic impact on an appraiser’s conclusions; with the potential for an equally-dramatic swing in negotiated or litigated results. The potential for vast valuation swings is greater in the health care industry because of the unique nature of the business. Unlike commercial office buildings, apartment complexes, and retail malls, health care facilities are limited and specific use facilities that can lose substantial value if the particular use is frustrated (e.g., by loss or reduction of licensure or payment certification).

In addition to the things necessary to run non-health care properties (e.g., janitors, window washers, and general property management), health care facilities require substantial staffing (often 24-7) by highly-trained medical professionals and specialized and constantly-evolving equipment. Furthermore, health care properties are subject to federal and state regulatory regimes, and reimbursement arrangements (e.g., private insurance, Medicare, Medicaid), not present in other real estate operations, which significantly affect valuation.

Given the high stakes at risk in health care cases, parties must ensure their appraisals are based upon sound assumptions and must be prepared to challenge the assumptions contained in an adversary’s report. Particular attention should also be paid to the following areas:

- Facility Type. The appraiser must describe and analyze the subject’s facility-type accurately and recognize the licensing and payment certification in place. Not all bed types can be treated the same. This is because the expenses and staffing requirements associated with (and the revenues derived from) each, are very different.

- Payer Mix. The appraiser must consider the subject’s payer mix and not deviate from that mix without adequate support, because the valuation could be significantly different with any shift in the payer source. Furthermore, a shift in the resident mix should only be considered with a corresponding examination of the cost of patient care.

- Geographic Location. Appraisals that compare facilities (even same-type facilities) from different geographic regions should be scrutinized. Operating expenses are likely substantially higher for an east-coast urban facility than a sun-belt facility located in a less urban environment. The payer mix and reimbursement structure is likely very different as well. Appraisals based upon comparables located in the same general geographic region will likely be viewed as more credible.

- Facility Age. Advances in both health care and non-health care technology must be accurately considered in any appraisal. A facility built in the 1950s will likely have more obsolescence than one built in the last twenty years. The differences will include inefficient floor plans, deferred maintenance, capital expenditures, and the like, as well as the fact that a modern facility will have built-in technological advancements that simply did not exist at the time an older facility was erected and are necessary today. These differences will be substantial and necessary to compete in today’s market and must be appropriately accounted for.

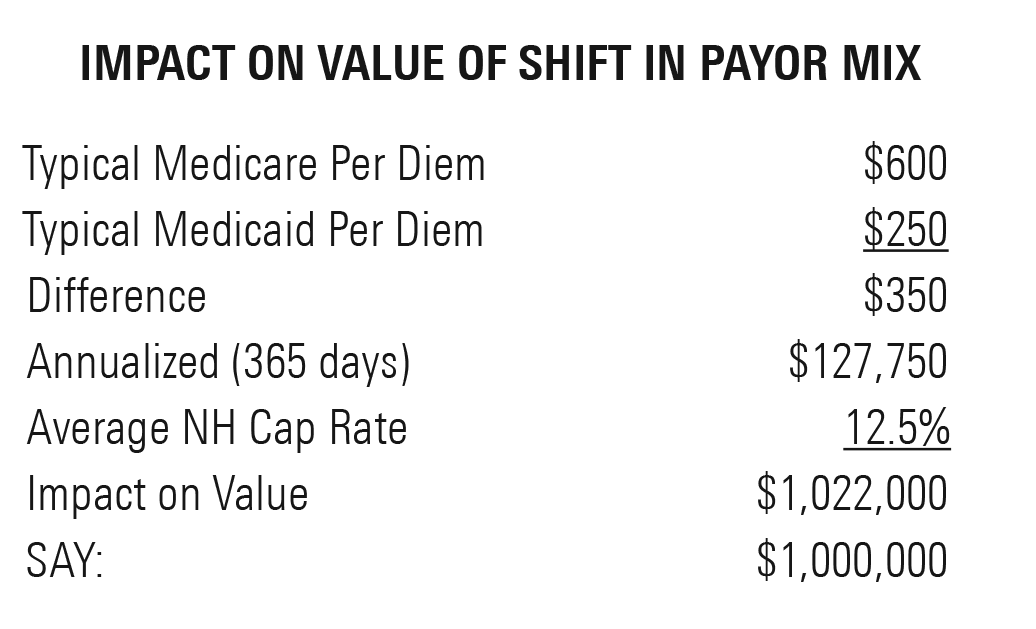

With this in mind, the value of a health care facility is affected more by the assumptions made for the income and expenses and less for the cap rate, unlike other property types. This is particularly true when valuing nursing homes and other higher acute care facilities where the operating expenses as a percentage of income are significant. For example, if an appraiser assumes that just one resident shifts from being Medicaid to Medicare without any corresponding adjustment to expenses, that could easily have an impact of $1.0 million on value as noted in the following table:

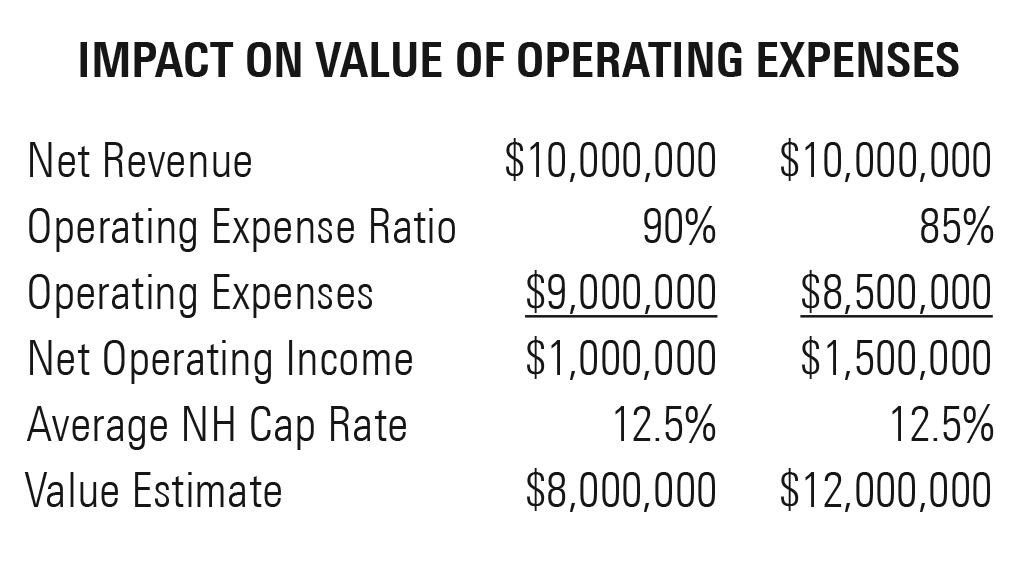

Additionally, assuming that a facility could operate more efficiently by reducing expenses by what appears to be a modest amount can result in a significant value swing as noted in the following example.

Additionally, assuming that a facility could operate more efficiently by reducing expenses by what appears to be a modest amount can result in a significant value swing as noted in the following example.

Because valuing an insolvent health care facility is critical to determining many issues, both in and out of court, it must be done right. To accomplish this effectively, the parties and their professionals, including appraisers, must take time and exercise discipline to carefully evaluate the traits of the subject, and to strive to compare the subject to facilities that are actually comparable. They must also be willing to recognize material differences in comparables and to make substantial adjustments when necessary.

Because valuing an insolvent health care facility is critical to determining many issues, both in and out of court, it must be done right. To accomplish this effectively, the parties and their professionals, including appraisers, must take time and exercise discipline to carefully evaluate the traits of the subject, and to strive to compare the subject to facilities that are actually comparable. They must also be willing to recognize material differences in comparables and to make substantial adjustments when necessary.

Pillsbury’s Health Law—Insolvency & Restructuring LinkedIn group highlights the legal and practical issues confronting health-related businesses as they deal with operational and financial challenges both in and out of court. We invite you to visit the group page and become a member so you can follow more content like this post.