Media Coverage 06.02.22

Alert

Environmental Management Systems Bridge the Gap between ESG Goals and Implementation

An EMS is a straightforward and effective strategy to implement Environmental Social and Governance principles and enhance their performance.

Alert

Takeaways

06.17.22

Environmental Social and Governance (ESG) programs are now an accepted pillar of legal, corporate and financial risk assessment. In the last two years, ESG-based investments have proliferated globally, with many accounting firms emphasizing the importance of ESG programs to their clients and investment banks treating ESG as an essential financial risk factor for purposes of directing strategic decisions.

Regulatory developments in the last few months constitute a further step toward the institutionalization of ESG. Most notably, the U.S. Securities and Exchange Commission (SEC) proposed a new rule in March 2022 that would require registrants to provide climate-related disclosure in registration statements and periodic reports. The SEC also included ESG investing in its 2022 Examination Priorities report, indicating that the Commission believes that climate-related statements constitute material disclosures necessary for investors to make informed investment decisions. In addition, the SEC announced a proposed rule on May 25 that would amend the disclosure requirements for investment advisers and business development companies to prevent “greenwashing” and increase marketplace transparency.

Given these developments, it comes as no surprise that businesses are increasingly allocating resources to the development of effective ESG strategies to meet the expectations of regulators, stakeholders, customers, investors, employees and communities. ESG ratings remain an essential quantitative metric for evaluating corporate performance in this regard, and one avenue by which companies can bolster their ESG ratings on the environmental side is by establishing or improving corporate compliance policies that deal with environmental matters. These would include policies related to regulatory compliance, auditing, environmental emissions and product stewardship. Perhaps the most significant type of such policy—and one that the United States Environmental Protection Agency long has deemed a useful tool for purposes of enhancing compliance performance—is an Environmental Management System (EMS).

How an EMS May Improve an ESG Score

At the highest level, an EMS is a set of voluntary, self-initiated processes and practices that enable an organization to reduce its environmental impacts and increase its operating efficiency. It serves to identify specific roles and responsibilities within an organization for environmental matters, establish goals and provide standard protocols and procedures for ensuring compliance and meeting these objectives. Furthermore, as a framework document, an EMS may incorporate other, more specifically tailored environmental plans. For example, an EMS may include individual plans dedicated to air emissions, hazardous waste management or any other matters of environmental interest and concern to an organization.

As set forth on EPA’s website, an EMS includes seven basic elements:

- Establishing the organization’s environmental goals;

- Analyzing its environmental impacts and compliance obligations;

- Setting goals for environmental compliance and the reduction of environmental impacts;

- Ensuring employees’ environmental awareness and competence;

- Establishing programs to meet these objectives;

- Monitoring and measuring progress in achieving goals; and

- Reviewing progress of the EMS and achieving improvements.

These elements readily align with ESG principles. (For information on ESG principles, see Five Keys to Building a Successful ESG Program, Transparency and Impact: The Essential Principles of ESG, and What ESG Principles Should You Care About?) For example, a core principle of ESG is a companywide commitment to reducing environmental impacts, which begins with setting a clear mission that orients a company’s institutional practices. To document this commitment to ESG principles, a number of companies have taken to preparing policy statements and written objectives and posting them to their websites. With minor adaptions, such statements can be carried over to an EMS, a standard element of which is the business’ signed declaration of a dedication to environmental stewardship and compliance (elements 1 and 3).

Furthermore, a hallmark of ESG is compliance with regulatory obligations. An EMS can assist businesses in ensuring compliance with these requirements (recognized in element 2). Successful ESG programs also require establishing comprehensive sustainability programming and then insuring integration throughout the corporate structure. This aligns with the requirement for an EMS to establish programs to meet objectives and targets and to ensure employees’ environmental awareness and competence (elements 4 and 5). Finally, ESG programs require comprehensive oversight from the top of the company, which works with internal review and audit process to ensure continual improvement and success. An effective ESG disclosure will demonstrate the impact a company’s program is having. An EMS can help with these objectives as well, as it requires ongoing monitoring and reviewing of progress (elements 6 and 7). Generally, a properly crafted and thorough EMS may also serve as a practical and useful compliance guide for personnel involved in the day-to-day operations of a business. In this sense, an EMS can help bridge any potential disconnect between the strategic ESG aspirations of company management and the activities of EHS personnel “with boots on the ground.”

Trust, But Verify

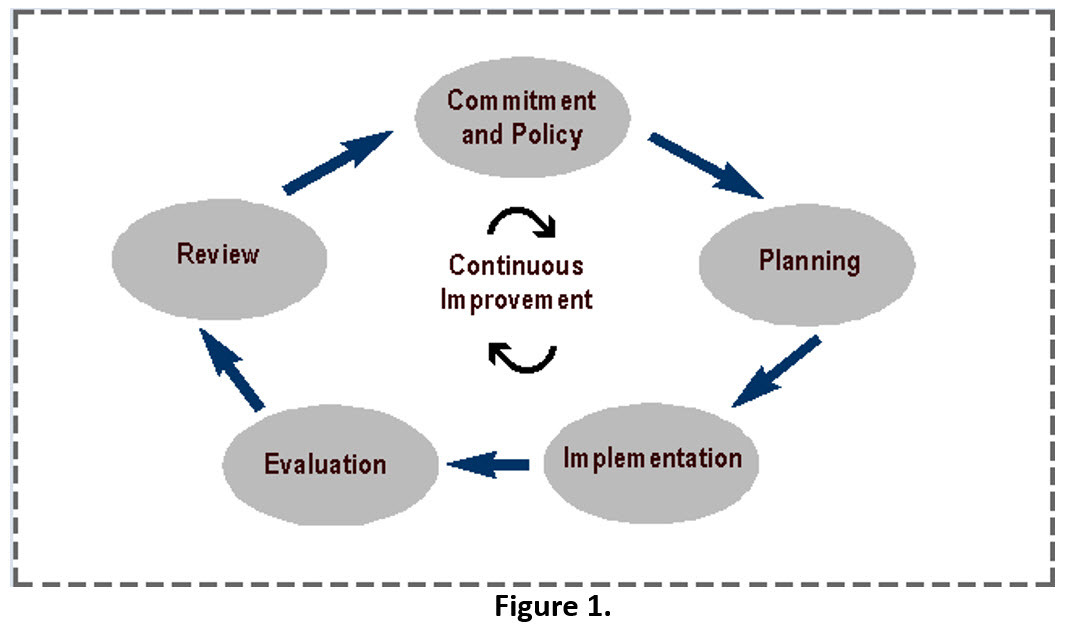

Each EMS may vary in quality, so it should not be assumed that all such documents will have a beneficial impact on ESG ratings, despite the general alignment between the core tenets of ESG and EMS. For an EMS to have a positive effect, it should squarely address as many ESG environmental criteria as is practical given the business’ operations and meet baseline criteria regarding document preparation, distribution (within the business) and implementation. (The specific criteria evaluated vary across ratings agencies and industries, but often considered are such categories as carbon emissions, pollution, environmental strategy and environmental management systems.) Regarding the latter, the International Standards Organization (ISO) has established a standard for the EMS (ISO 14001), and by passing an audit performed by an ISO-approved auditor, companies can obtain certification for an EMS that meets or exceeds this standard. In issuing such certifications, ISO-approved auditors consider the fulfillment of the five main stages of an EMS that result in a “continuous loop of improvement.” (See Figure 1.) Certification of compliance with the ISO 14001 standard provides a degree of comfort that an EMS meets a minimum level of sufficiency.

Accordingly, ESG ratings agencies, accounting firms and businesses are increasingly viewing ISO-certification as an indicator of ESG performance. For example, ECPI, which operates an esteemed ESG rating index, has explicitly recognized an ISO certified EMS as a component of a complete ESG strategy. Similarly, Deloitte has highlighted EMS ISO certification as a way for companies to satisfy the “Audit and Assurance” component of ESG. In the same vein, Norsif, an independent association of asset managers, service providers and industry groups dedicated to sustainable investments, recently issued a report titled “Guide to ESG Integration in Fundamental Equity Valuation.” In the report, Norsif recommends that investors interested in the metals and mining industry ask what percentage of the target’s operations are conducted under a certified environmental management system, on the premise that a certified EMS ensures “regular review of mine sites and objective assessments” and “process consistency across sites.”

As to the actual ratings impact, methodologies vary between ratings agencies, and an EMS may be one of approximately 70 to 80 indicators subject to consideration in assigning an ESG score. In such a case, no single indicator would be worth more than a few percentage points of the overall rating. However, a thoughtfully crafted and implemented EMS can have a beneficial, trickle-down effect on other environmental scoring indicators. Thus, in addition to a discrete individual impact on ESG scoring, an EMS may have a broader, albeit less tangible, cumulative effect that might boost a rating.

Legal Involvement

Companies interested in obtaining ISO certification or in submitting an EMS to a ratings agency should consider the legal implications of sharing potentially sensitive corporate compliance documents with a third party. At minimum, such companies should be prepared to speak to the details of their EMS and its implementation. Given that such EMS reviews may uncover or focus attention on potential compliance deficiencies, interested businesses may wish to consider the benefits of involving legal counsel during this process for purposes of maximizing privilege if problems or deficiencies are identified.

Conclusion

Companies have long used the EMS to improve compliance performance both up and down the chain of management and across facilities, operations and business platforms. Now, due to the push toward ESG, the EMS—if carefully prepared and properly implemented—stands to take on a new significance. Pillsbury lawyers have extensive experience crafting EMS for various industries, as well as in assisting companies with environmental auditing.