Emerging Trends 03.04.22

Climatetech

Investment Trends, Market Analysis & Authoritative Commentary

Source: Pillsbury & PitchBook

Alert

Alert

03.25.22

On Monday, the U.S. Securities and Exchange Commission (SEC) issued proposed rule amendments requiring climate disclosures by public companies. Current disclosure practices are largely voluntary, and therefore fragmented and inconsistent. In summary, the rule would require periodic disclosure of climate-related information in its statements and reports (such as Form 10-K), including:

Background

The SEC began its efforts to provide investors with material information about environmental risks facing public companies in the 1970s, and most recently provided related guidance in 2010. Many investors are concerned about the potential impacts of climate-related risks to individual businesses. As a result, investors increasingly have been seeking additional information about the effects of climate-related risks on a company’s business. Some investors also have expressed a need for more consistent, comparable and reliable information about how a registrant has addressed climate-related risks when conducting its operations and developing its business strategy and financial plan. Many U.S. public companies have already adopted voluntary disclosure frameworks from the Task Force on Climate-related Financial Disclosures (TCFD) and the GHG Protocol, a global standardized framework for measuring and managing greenhouse gas emissions from private and public sector operations, value chains and mitigation actions.

The SEC’s proposed rules are based on the above voluntary disclosure frameworks and are intended to enhance and standardize climate-related disclosures. Many issuers currently provide this information to meet investor demand, but current disclosure practices are fragmented and inconsistent. In 2021, a group of 587 institutional investors managing over $46 trillion in assets signed a statement calling on governments to undertake five priority actions to accelerate climate investment, including implementing mandatory climate risk disclosure requirements aligned with the TCFD recommendations and ensuring comprehensive disclosures that are consistent, comparable and decision-useful. The proposed rules purportedly would help issuers more efficiently and effectively disclose these risks.

Summary of Proposed Disclosures

The proposed rules would require a registrant to disclose information about:

The proposed rules would require a registrant (including a foreign private issuer) to (i) provide the climate-related disclosure in its registration statements and Exchange Act annual reports; (ii) provide the Regulation S-K mandated climate-related disclosure in a separate, appropriately captioned section of its registration statement or annual report; (iii) provide the Regulation S-X mandated climate-related financial statement metrics and related disclosure in a note to its consolidated financial statements; (iv) electronically tag both narrative and quantitative climate-related disclosures in Inline XBRL; and (v) if an accelerated or large accelerated filer, obtain an attestation report from an independent attestation service provider covering, at a minimum, Scopes 1 and 2 emissions disclosure.

Timing for Compliance

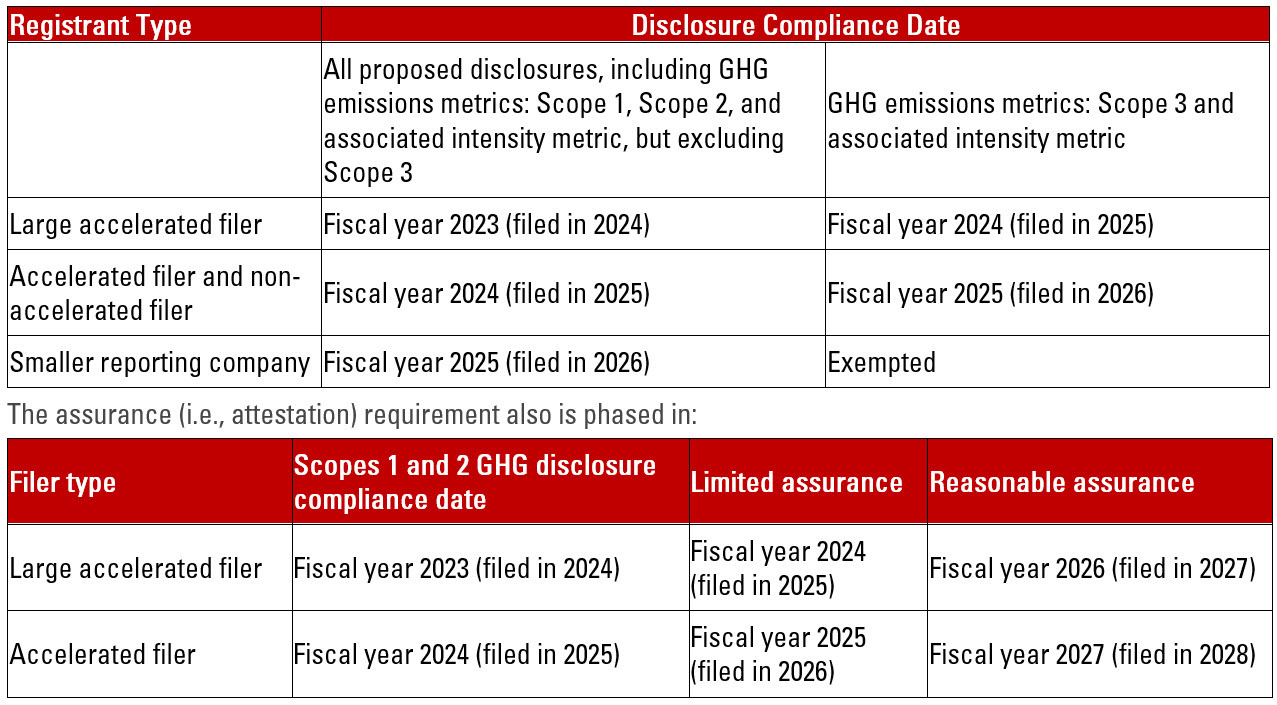

The SEC’s proposed rules include a phase-in period for all registrants, with the compliance date dependent on the registrant’s filer status, and an additional phase-in period for Scope 3 emissions disclosure. Assuming the SEC adopts the proposed rule later this year and a filer has a December 31 fiscal year-end, these climate-related disclosures would be required under the following deadlines:

Pillsbury’s Energy Transition and ESG Capabilities

Pillsbury is at the center of the energy transition. Our global cross-disciplinary Energy Industry, Sustainable Finance, ESG, and Environmental & Natural Resources teams focus on utilizing cutting-edge developments and advising our clients across all industries on how to achieve decarbonization and pioneer first-to-market transactions, while also helping navigate the business, legal and regulatory challenges in the ESG space.

Pillsbury leverages its extensive 100+ year history of trailblazing for energy clients across fuel lines (dating back to the incorporation of Chevron’s predecessor in 1900) with its market-leading Renewable Energy, Nuclear Energy and Hydrogen practices, to deliver holistic advice to clients in crafting and implementing their energy transition strategies.

That energy industry leadership is coupled with our Sustainable Finance practice, with our lawyers at the forefront of developing innovative solutions and advising on unique strategies, from sustainability-linked debt products to carbon credits and impact investing structures.

Our energy transition work also utilizes our compliance capabilities, featuring one of the first and broadest Environmental & Natural Resources practices in the U.S. and a premier team of Securities Litigation & Enforcement (SEC) attorneys, to deliver practical guidance to companies regarding regulators’ evolving priorities in regulating and enforcing ESG compliance.