Alert 03.17.20

ESG: Implementing and Disclosing for the New Normal

Moving toward responsible environmental, social, and governance (ESG) practices to benefit all stakeholders—not just investors.

Alert

Alert

By Sheila McCafferty Harvey, Reza Zarghamee, Ashleigh K. Myers,

06.24.20

Environmental stewardship, including efforts to mitigate climate change and other impacts on the natural environment, is an important and controversial topic in today’s world. Politicians, companies, investors, consumers and the public all have a stake in how businesses approach environmental stewardship. The 2020 Davos Manifesto of the World Economic Forum (WEF) reflects the current trend of scrutinizing businesses based on their environmental performance. Addressing companies and the world’s top 120 CEOs, the Manifesto states, in part:

“A company is more than an economic unit generating wealth. It fulfills human and societal aspirations as part of a broader social system. Performance must be measured not only on the return to shareholders, but also on how it achieves its environmental, social and good governance objectives.”

This brief statement highlights both the interrelation between business operations and environmental impacts, and the importance of environmental stewardship as a reflection of good corporate governance.

Board Responsibilities

Traditionally, a company’s board will manage corporate governance risks and executive compensation. The practical need to expand these responsibilities to account for environmental stewardship and risk management is a relatively new phenomenon, and many boards are not yet up to speed.

The first step toward properly addressing environmental matters is for the board to collaborate with management to identify the different ways in which the company’s businesses and operations interface with environmental issues. The aim here is to think expansively. For purposes of ESG, environmental matters extend beyond regulatory compliance and impacts on natural resources to include concepts such as environmental justice, carbon footprints, supply chains and product stewardship.

Consistent with this approach, an equally broad realm of potential environmental risks also should be considered. These may include the potential to cause environmental contamination and natural resource damages, which may trigger not just cleanup liabilities but also disclosure requirements in financial statements. Also relevant is the potential for business operations to be disrupted by environmental factors such as climate change.

Once potential environmental risks are identified, assessments should be made regarding their materiality and the existence of standing corporate policies and procedures to address them. Where such policies are lacking, they should be developed and implemented. Moreover, determinations should be made about how the company will present itself to investors, regulators and society to adequately inform them of potential environmental risks, avoid reputational harm and increase long-term value.

There is no one-size-fits-all solution, and companies have different environmental profiles. Each will have to find its own way, but the board should make sure that management devotes the appropriate resources to addressing environmental matters, understands environmental disclosure requirements and standards and ranking systems, and takes a proactive approach to protecting the company’s reputation from an environmental standpoint.

This is a multifaceted paradigm that requires open lines of communication between management and the board at all times. Moreover, because not every board member can be an ESG expert, we recommend that the appropriate committee be tasked in its charter with spearheading the environmental risk area for the board.

Disclosure Standards and Rankings

Various environmental disclosure standards exist. At present, there is a lack of harmonization between them in terms of the scope of issues evaluated to generate a score, and the different standards that are used. The World Economic Forum and Big Four accounting firms currently are working on a framework to ensure consistency across all industries and countries. Also relevant is the CDP (formerly known as the “Carbon Disclosure Project”), which, since 2002, has provided a functional and highly regarded framework for collecting self-reported data on environmental impacts and converting them to quantifiable metrics. As the name suggests, the CDP is primarily interested in environmental impacts related to greenhouse gas emissions, a concept broad enough to allow for ancillary programs dedicated to deforestation, supply chains, and urban development.

Despite this lack of harmonization between scoring standards, various stakeholders, including institutional investors, asset managers and financial institutions, are increasingly relying on environmental ratings to inform decisions and shareholder proposal-related investor engagements. Thus, company management and boards are recommended to stay abreast of these ratings and, to the extent possible, work to boost the company’s score. In this connection, many ratings providers encourage input and engagement with subject companies to improve or sometimes correct data.

A number of prominent scoring agencies base their ratings on the disclosure standards of the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB) standards and the Task Force on Climate Related Financial Disclosures (TCFD) recommendations. Below are two examples of how environmental ratings are generated.

1. ISS Environmental & Social Disclosure Quality Score

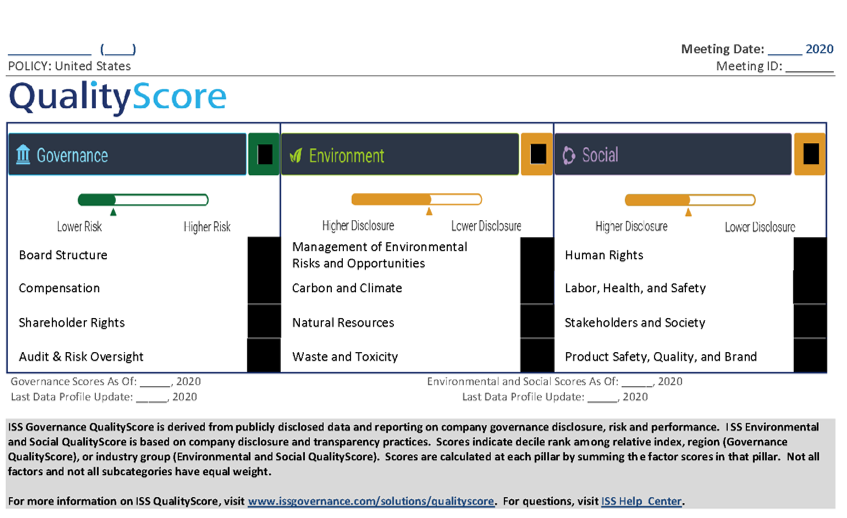

The ISS Environmental Disclosure & Social Disclosure Quality Score, like the better-known Governance Quality Score used for board governance matters and executive compensation, is a data-driven approach to ranking the quality of environmental disclosures and identify deficiencies. Consistent with Governance Quality Score, the decile scores, 1-10, represent a relative measure based on rankings of the company’s peers. A lower score represents relatively higher quality disclosures and fewer omissions. In assessing a company’s disclosures and participation in industry initiatives, ISS incorporates into its scoring methodology the disclosure standards of the GRI, SASB and TCFD. ISS reviews approximately 4,700 companies in various industries with respect to the categories of Carbon and Climate, Waste and Toxicity and Natural Resources with approximately 240 factors in 12 subcategories including:

- targets for reducing GHG emissions,

Set forth below is a sample Environmental Quality Score Profile that appears in a hypothetical company’s ISS report on the proxy. Red flags identify areas raising the risk profile, green flags show stronger disclosure practices:

2. State Street R-Factor

R-Factor is a proprietary ESG scoring system developed by State Street Global Advisors (SSGA). SSGA has announced that it will start penalizing big companies that consistently underperform under its R-Factor scoring system. (“R” stands for Responsibility.) The system sources data from Sustainalytics, ISS-ESG and Virgo-EIRIS. The SASB Materiality Map is used to identify which of the following six environmental issues are relevant:

SSGA says that by sharing R-Factor scores with portfolio companies, we build more sustainable capital markets for the future.

Other Services

Other prominent services include the Bloomberg ESG Data Service, Corporate Knights Global 100, MSCI ESG Research, RepRisk, Sustainalytics Company ESG Reports, and Thomson Reuters ESG Research Data. In addition, various institutional investors have their own metrics.

Conclusion

As investors increasingly focus on environmental disclosures with respect to their investment decisions, our corporate governance and environmental attorneys can help you and your management team improve your environmental compliance, impacts on natural resources, disclosures and rankings to optimize investor