While board diversity has been a priority for companies for many years, Nasdaq found that more than 75 percent of its listed companies did not meet its proposed diversity requirements, highlighting the need for such a proposal. According to the 2018 Board Diversity Census from the Alliance for Board Diversity and Deloitte, of Fortune 500 companies, 83.9 percent of board seats were filled by white directors and 59.6 percent of seats were filled by white men.

Fortunately, companies that would not currently meet Nasdaq’s proposal have sufficient time to prepare. After the proposed rule is published in the Federal Register, it will be open for public comments for a minimum of 21 days. The SEC has 30 to 240 days from publication to approve the rule proposal. Most Nasdaq-listed companies would be required to comply with the diversity disclosure requirements within one calendar year of the SEC's approval of the listing rule.

Nasdaq’s proposal is based on over two dozen studies that have linked diverse boards to better financial performance and corporate governance. In its proposal, Nasdaq cited a number of reasons for this diverse board member requirement, including the observed positive impact of board diversity upon the quality of a company’s financial reporting, management oversight, average earnings growth, and decision making, by reducing the tendency toward “groupthink.”

Nasdaq’s listing proposal is not the first codification of a diversity requirement for board composition. With the passing of AB 979 in September 2020, California became the first state to require that every publicly held corporation with its principal executive office in California have a minimum of one director from an underrepresented community on its board of directors by the end of 2021. In 2018, California passed SB826 and became the first state to mandate that every publicly held corporation with its principal executive office in California have at least one woman on the board by the end of 2019. Since 2019, Maryland, Illinois and New York have all enacted board diversity-related measures, and a number of other state legislatures are considering similar board diversity requirements.

Discussion

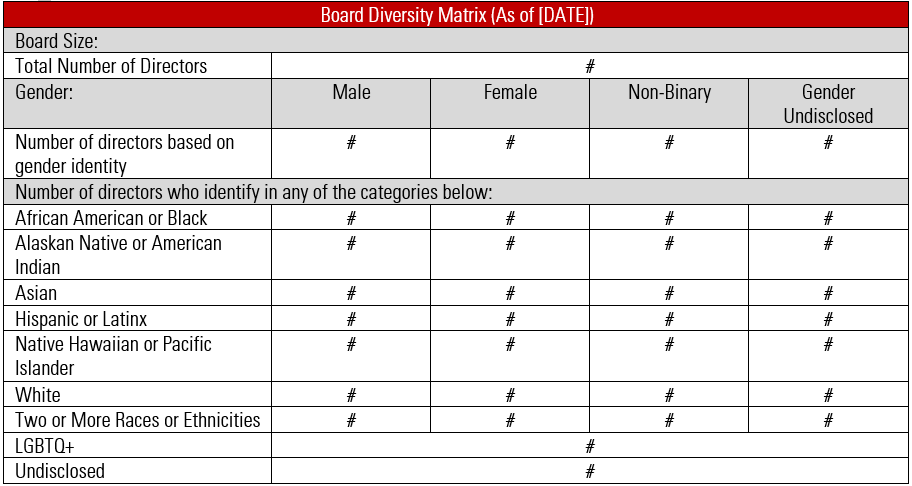

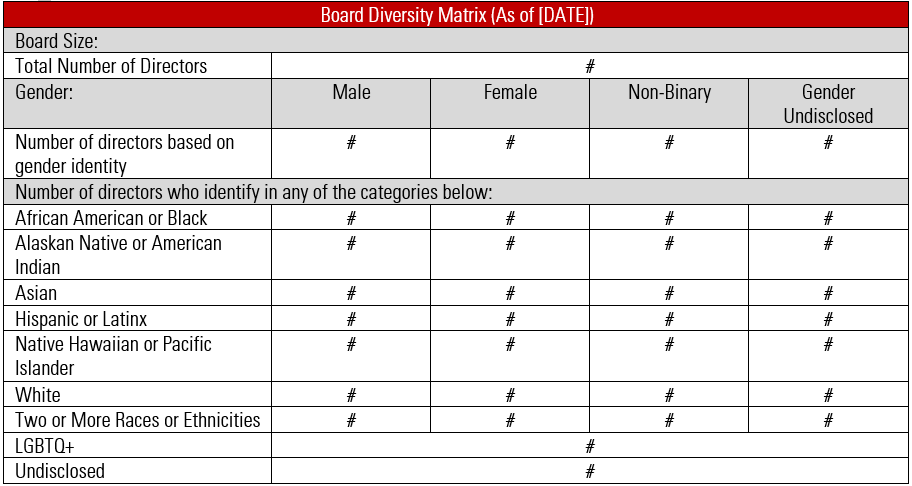

This Nasdaq listing proposal reflects a recent increase in public and institutional support for diversity initiatives and transparency regarding diverse identities on corporate boards. The proposal includes an example “Board Diversity Matrix” (example shown below) that companies may use to structure disclosures in their annual proxy under the new rule. In doing so, companies will be able to provide disclosures that are consistent with those of their peers and the market generally, giving investors and institutional groups a clearer basis for comparative analysis.

Public companies, particularly smaller companies looking to distinguish themselves among their peers on this issue, should consider the value that a Board Diversity Matrix could add to their annual proxy disclosures for this upcoming proxy season to communicate to investors their commitment to transparency in diversity. When combined with narrative disclosures that detail the diverse qualifications and experiences of the company’s board, the Board Diversity Matrix can effectively highlight the efforts that a company has made to assemble a multifaceted advisory team.

While the use of Board Diversity Matrixes has not yet become commonplace, diversity-related disclosures have been trending upward. According to the EY Center for Board Matters, in the 2019 proxy season 45 percent of the Fortune 100 disclosed the racial and ethnic diversity of the board of directors and 36 percent disclosed the level of overall diversity on the board, an increase from 23 percent and 13 percent, respectively, since 2016. EY also reports that 75 percent of the Fortune 100 now use a skills matrix to highlight the diversity of relevant director qualifications (although generally not inclusive of racial and ethnic diversity), an increase from 30 percent in 2016.

Nasdaq’s rule proposal comes at a time when several institutional investors have stated that they are prepared to recommend against the nominating committee chair of a board that has failed to make strides in the diversity of their board. Taken as a whole, board composition, and transparency regarding diversity, is likely to be a priority for investors this coming proxy season.

When preparing the director questionnaires that would be used to collect the data to be displayed in a Board Diversity Matrix, companies should separately identify and describe their intentions in this regard, so that directors can provide informed consent regarding the information that will be shown in the Board Diversity Matrix.

Moreover, while the Board Diversity Matrix takes a quantitative approach to describing the diversity of a company’s board, companies should be thinking about boardroom diversity more broadly than as a matter of filling quotas. The events of the past year underscore that, in a world experiencing increasingly novel challenges, it is prudent to have diverse leadership that is prepared.

Conclusion

Nasdaq’s proposal is consistent with the view that the best decisions are made when groups are able to draw from the broadest array of experiences and informed viewpoints. Embracing diversity as an organizational value is not simply a matter of hiring a handful of directors or achieving certain demographic metrics, but of cultivating an environment in which a multitude of perspectives can collaborate on equal terms and drive innovation.

Companies can take this time to reflect upon how their board is positioned to meet the needs of their stakeholders, and whether their director questionnaires and public filings could be updated to illustrate their commitment to maintaining a board that reflects the diverse interests of all of their stakeholders. Companies that do not currently meet the proposal’s requirements for board diversity should also begin to prepare an explanation of the business reasons that they do not meet such requirements.