Blog Post 06.17.25

Alert

Power Purchase and Interconnection Agreements for Data Centers

When structuring these agreements, it is important to consider how siting decisions, load characteristics and regulatory constraints shape risk allocation and commercial strategy.

Alert

Takeaways

07.21.25

Data centers—particularly those supporting generative artificial intelligence (AI)—are rapidly emerging as one of the most significant sources of electricity demand globally. In response, power procurement and grid access have become mission critical considerations for developers and tenants alike. As these facilities seek scalable, uninterrupted and cost-effective power, the negotiation of power purchase agreements (PPAs) and interconnection agreements plays a central role in determining both operational reliability and long-term economic viability. This article outlines key considerations for structuring these agreements, with a focus on how siting decisions, load characteristics and regulatory constraints shape risk allocation and commercial strategy.

Background

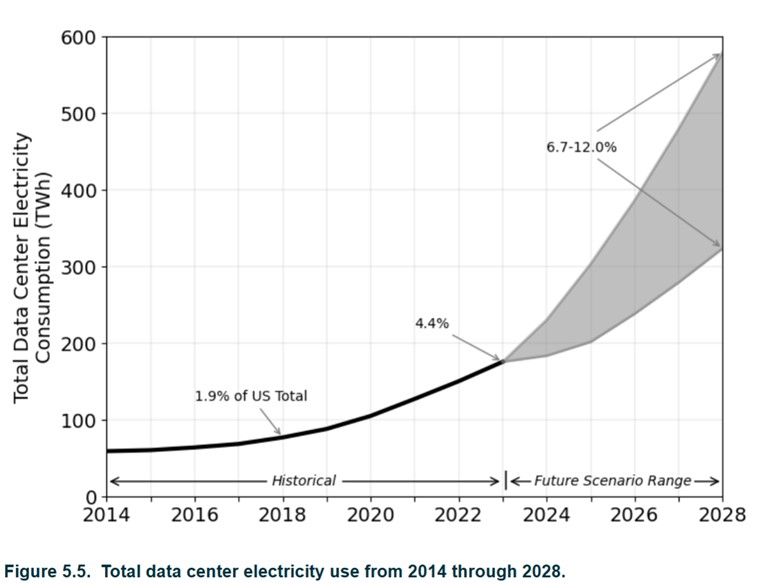

Data centers are facilities that house large numbers of computer systems for the purpose of storing and allowing access to large quantities of data. With the rapid growth of generative AI, the development of data centers and their concomitant power demand is expected to dramatically increase. In 2014, data center demand was approximately 1.5% of electricity consumed in the United States; that has since more than doubled, and today it accounts for approximately 4.4% of global demand. In the United States alone, current forecasts predict that this demand will double or even triple over the next decade.

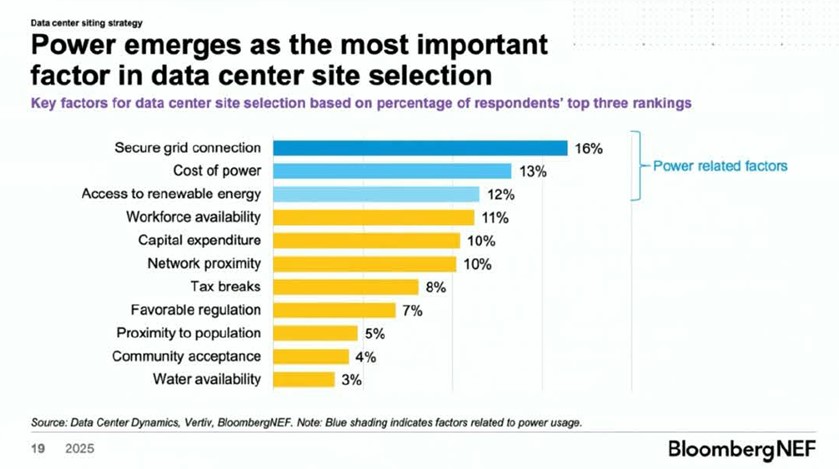

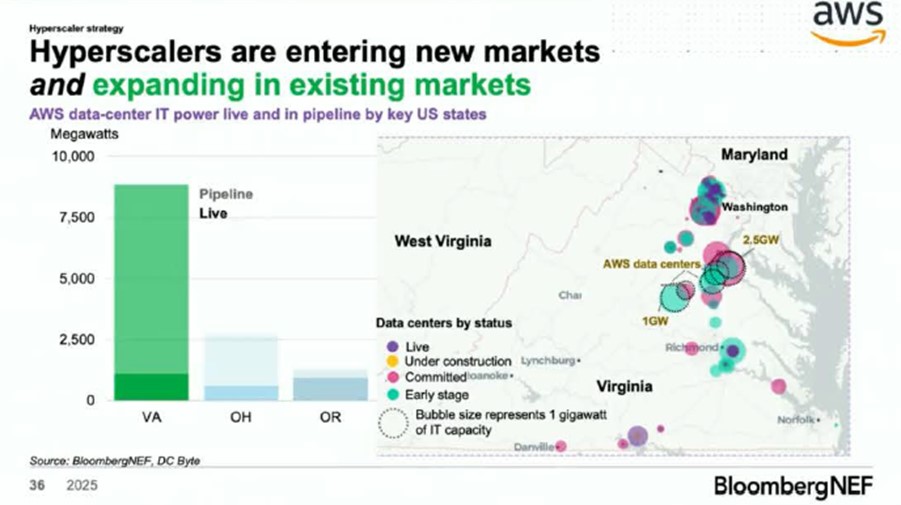

These data centers require a significant and reliable power supply in order to function efficiently to ensure uninterrupted service to customers. That power can either come from the grid via utility service or through negotiated PPAs with electric generating resources. Companies are looking at siting these facilities in markets where the power is relatively cheap and interconnection queues are relatively short. Other siting considerations include mitigating environmental risks in particular locations (e.g., avoiding areas that are prone to natural disasters such as earthquakes, hurricanes or wildfires), choosing a temperate climate (given that cooling accounts for a significant portion of data center energy use), and managing land costs. Siting will likely impact the considerations applicable to the PPA and Interconnection Agreement.

In addition to siting, the purpose of the center may also impact the parties’ strategic drivers with respect to the PPA and Interconnection Agreement. Generative AI data centers must rely more on having continuous power with no room for interruption, while crypto miners may not be subject to such rigid demands. Because of this, generative AI data centers are more likely to require strong interconnection and be located in areas that can provide this, whereas crypto miners may have more flexibility on where they can locate. Crypto miners can be more flexible when it comes to negotiating PPAs, while generative AI data centers will have more specific needs and must ensure that they can receive long-term PPAs that can provide them with a reliable and sustainable power supply.

Power Purchase Agreements

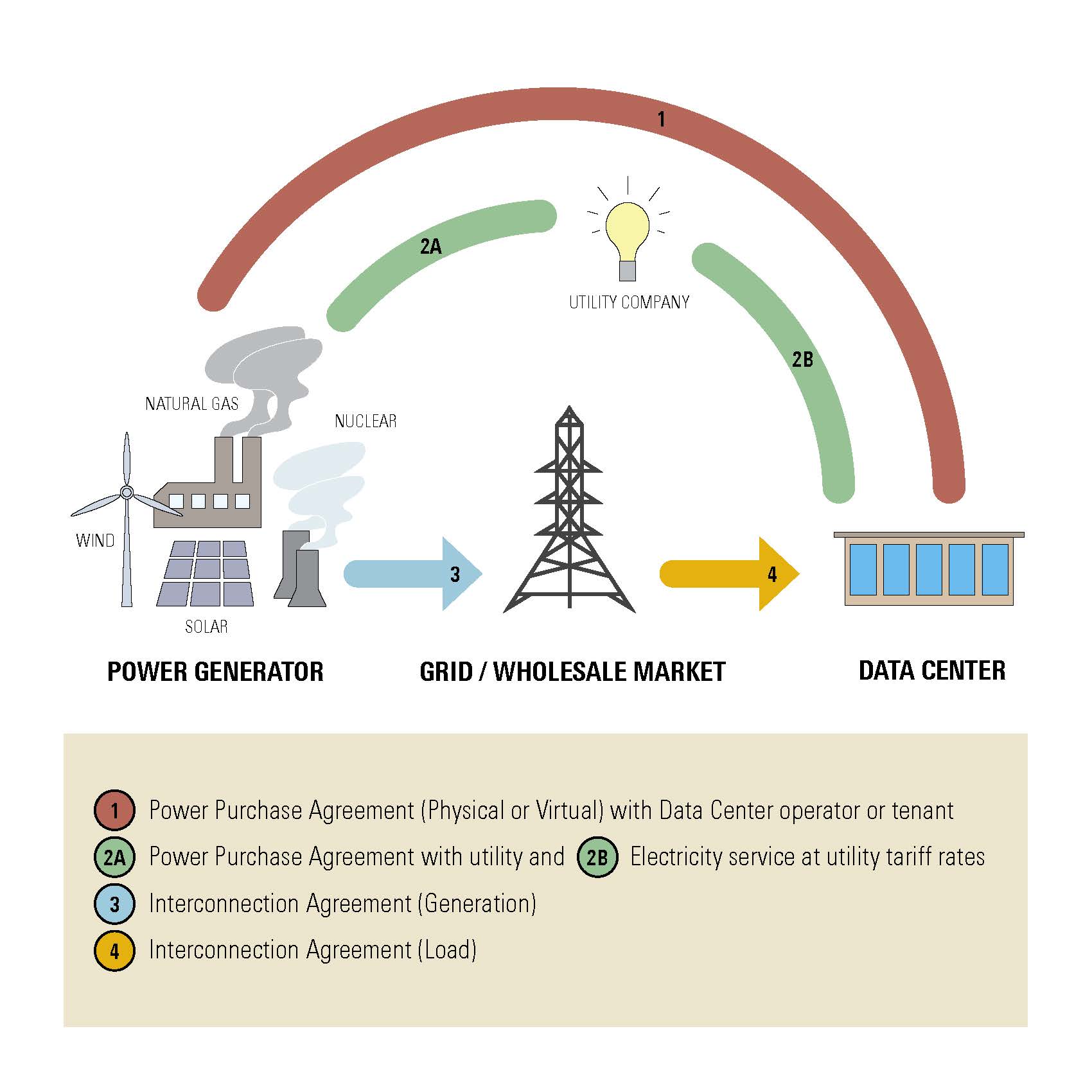

PPAs are long-term contracts establishing the terms and conditions under which electricity generated by a power plant will be sold. In the data center space, the PPA can be either (i) between the power generator and the data center developer, who then provides the energy as a service to the tenant as part of the data center lease, or (ii) directly between the generator and the data center tenant. The former is more common for a multitenant or co-location data center, and the latter is more common where there is a single or substantial anchor tenant in a data center, such as a hyperscaler (i.e., a company that builds and operates massive-scale computing infrastructure). In fact, many of the large-scale hyperscalers prefer to procure the energy for their data centers directly. For example, in May 2024, Microsoft entered into an agreement with Brookfield to deliver over 10.5 gigawatts of new renewable energy capacity between 2026 and 2030 to Microsoft in the United States and Europe. Similarly, Meta recently signed a deal with developer Invenergy to support four new projects which will secure 791 megawatts of renewable energy.

There are several different flavors of PPAs. First, there is the distinction between physical PPAs and virtual PPAs (or VPPAs). Physical PPAs allow buyers to take title to the actual electricity produced by the generating facility through physical delivery via the grid and, for renewable projects, acquire the renewable-energy certificates produced by the generating facility. In contrast, VPPAs do not result in the buyer taking physical delivery of electricity, but rather (i) the buyer procures their energy from their local utility company, (ii) the buyer pays a fixed price to a power generator for power that is produced by the generating facility and delivered into the wholesale market, and if the market price for the delivery of power at the specified grid delivery location is higher than the fixed PPA price, then the generator pays the difference, and vice versa, and (iii) in the case of renewable-energy projects, the buyer acquires the renewable-energy certificates produced by the generating facility (and to further complicate things, some VPPAs allow the buyer to elect a physical delivery option). A more detailed discussion of VPPAs can be found here.

Because there is no actual physical delivery of energy for VPPAs, there is more geographic flexibility for buyers, which can be beneficial to companies with multiple locations. A physical PPA may not be a viable option for a distributed load or load in a regulated market. Additionally, VPPAs provide a partial hedge against wholesale price volatility. However, because of this, VPPAs also pose a market price risk for buyers since they involve the exchange of a fixed price for the unpredictable wholesale market price, which may result in buyers owing significant amounts of money to the generator even if their own electricity costs remain stable.

On the other hand, physical PPAs allow buyers to receive power directly from the generating facility, which can reduce the risk involved as a specific price or price formula is agreed upon upfront. However, location is more important with physical PPAs as the buyer must be located in the same grid region as the generating facility. Physical PPAs also require coordination with grid operators for delivery and can entail significant interconnection costs. Finally, physical PPAs may not be available in regulated electricity markets or may need to be in the form of a sleeved PPA where the utility acts as an intermediary between the generator and the data center or hyperscaler.

In each of these different types of PPAs, there are some consistent considerations and risks that must be allocated.

- Term of the PPA. PPAs can span 10 to 20 years to provide long-term price stability and support the financing for the construction of the power generating facility. This duration may also drive more competitive PPA pricing for the buyer. However, some data center operators or hyperscalers may prefer a shorter five-to-ten-year term to allow them to adapt to evolving technologies or market conditions. There is an inherent tension as hyperscalers may need to deploy rapidly in order to take advantage of technological innovations, while power generators face development, construction, ownership and operation processes that frequently span decades.

- Counterparty Credit Risk and Credit Support. The power generator will likely be financing the construction of the generating asset on the long-term revenue streams under the PPA, and the project finance providers will be acutely attuned to the credit worthiness of the buyer. For that reason, many power generators may prefer a PPA directly with the data center tenant, if that tenant is one of the major hyperscalers. In contrast, if the data center tenants are smaller companies or startups and the data center developer has a stronger credit profile, then the power generator may prefer a PPA with the data center developer. In contrast, the buyer will be concerned with ensuring that the power generator (which is typically a special purpose entity) provides sufficient credit support in the form of a parent company guaranty or letter of credit to secure its long-term obligations under the PPA.

- Development Milestones. If both the data center and the power generating asset are greenfield developments, it will be critical to ensure that the key development milestones and guaranteed commercial operation date for both the data center and the power generating asset are aligned, and there are liquidated damages for any delay in either the data center of the power generating asset that are adequate to cover anticipated losses if they become misaligned. Those liquidated damages should dovetail with the remedies available to either party under its engineering, procurement and construction contracts.

- Scheduled and Unscheduled Outages; Curtailment. The PPA will need to address scheduled and unscheduled outages of the power generating facility, including curtailment directed by a grid operator or by the buyer. The data center may want the ability to procure (or cause the power generator to procure) replacement or backup power during any scheduled or unscheduled outages or grid-directed curtailment. Conversely, the power generator may want the ability to operate the power-generating facility and to sell that power either into a wholesale market or to other buyers if the data center is not capable of taking that power.

- Shape and Volume Risks. These risks relate to a potential mismatch between the energy generation profile of the power generating asset and the data center consumption pattern, which are most acute in VPPAs for intermittent clean energy generation projects. Shape refers to the differences between the hourly generation profile of a renewable project and the hourly consumption profile of the data center—for example, a wind project typically has the strongest generation at night, but a data center may have its load peaking during the day. Volume risk refers to the risk that the overall production of the generating project over a specified period (frequently an annual basis) will be either greater or less than overall electricity usage by the data center during that period. In recent years, two different types of hedge instruments have been developed to help mitigate the financial consequences of these risks. First, a volume firming agreement can address shape risk, resulting in the combined volume of power on which the buyer settles under the VPPA and under the volume firming agreement being roughly the same amount of power used by the data center. Second, a settlement guarantee agreement to lock in a long-term-fixed cost with respect to the VPPA (either as a fixed $ per MWh or fixed $ per settlement period). For a data center, mitigating the financial risks are only half of the practical solution; the data center will want to have backup generation or the ability to acquire power from the grid to ensure continuity of the operation of the data center, and then these financial instruments can offset the costs of that backup generation.

- Assignment and Change of Control. The conditions for transferring the PPA to a third party or upstream change of control of either the power generator or the customer will be specified, as well as any obligations to replace credit support and any qualifications of the applicable transferee.

Power Supply and Interconnection Agreements for Data Centers

Interconnection Agreement

Interconnection refers to the system structures that allow electricity generators to feed power into the grid and for electric loads to draw power from the grid in a synchronized and reliable fashion. When considering issues of interconnection, it is imperative to consider both the interconnection of the power generating asset and the interconnection of the data center. These involve different approval processes and most independent system operators have separate interconnection queues, with associated timelines. Typically, both types of interconnection requests will be initiated by the submission of an interconnection application or request to the relevant grid operator. Upon submission of the initial interconnection application or request, together with the payment of any associated fees, the applicant will be placed in the queue. The grid operator will then conduct an early-stage feasibility or screening study to determine if the proposed generating asset or data center load can interconnect at the proposed location. If the feasibility or screening study is positive, generally the next step is to conduct one (or more) fulsome study (or studies) to determine the costs associated with the relevant interconnection—including both the interconnection facilities themselves, as well as any system impacts and related network or deliverability upgrades.

Most grid operators require either a deposit or posting of some type of financial security in a relatively modest amount to commence the full interconnection studies. The final step is to enter into an interconnection agreement with the independent-system operator, participating transmission owner or local distribution company. The timeline for the interconnection process varies based on the applicable grid, but it often ranges from 18 to 48 months.

Frequently, the independent system operator specifies the form of interconnection agreement. However, there are several items that can be negotiable:

- Interconnection Cost Allocation. The interconnection agreement will outline the responsibility for each party to construct the necessary interconnection and system upgrade infrastructure and allocate the associated costs among the parties. Frequently, direct interconnection costs are paid by the generating asset or load, whereas system costs or network upgrades may be shared. Frequently, the sharing mechanism is defined by the rules of the independent system operator or tariff of the local utility company.

- Modification to Facilities. The rights of the power generating asset or data center to add additional capacity or load will often be specified, as well as the utilities obligation to reserve transmission or distribution capacity. For data center interconnection, minimum demand thresholds, ramp-up periods and penalties for under-utilization will need to be negotiated.

- Milestones and Scheduling. The timelines for achieving permitting, equipment procurement, construction testing and commercial operation should be clearly set forth, as well as any associated flexibility and grace periods to address regulatory or construction delays. Force majeure provisions and other events excusing delay or non-performance, as well as associated duration limits and required notices, will also be included. Consideration should be given to delay-damages and termination rights.

- Ownership of Interconnection Facilities. Who owns, operates and maintains the interconnection facilities will be set forth in the interconnection agreement, including the timing for the transfer of ownership of the applicable facilities. Ownership typically depends on location and function, and maintenance responsibilities and costs are frequently negotiated.

- Credit Support. The credit support requirements, including the amount, form (letter of credit, cash, parent company guaranty) and duration will be set forth in the interconnection agreement. Consideration should be given to reductions in credit support over time, release mechanisms and triggers for drawdown.

- Curtailment Rights. Any dispatch, must-run requirements or curtailment rights of the independent system operator will be set forth in the interconnection agreement. Data centers may seek guarantees of firm or non-interruptible service. For both types of interconnection, consideration should be given to whether compensation is owed for non-emergency (i.e., economic) curtailment, duration and settlement methods.

- Metering and Data Access. Location, specifications and access rights for metering equipment and operational data will be set forth. Both generators and customers will often want real-time and historical access to meter data to ensure accuracy. Consideration should be given to meter calibration and testing, data ownership and cybersecurity provisions.

- Assignment and Change of Control. Similar to a PPA, the conditions for transferring the interconnection agreement to a third party or upstream change of control will be specified, as well as any obligations to replace credit support and any qualifications of the applicable transferee.

Co-Location with Power Generation Facilities

Co-location of a data center with a power generating facility can offer benefits like reduced transmission costs and losses and improved reliability. Many companies are currently exploring behind-the-meter co-location, meaning that the power generating asset can deliver power directly to the data center without being interconnected with the grid; however, even when there is behind-the-meter, co-located power generation and data center load, it is likely that both the power generator and the data center will want independent interconnections to the grid to mitigate the risk of stranded assets. This has raised significant regulatory concerns, including potential impacts on grid reliability and cost-shifting to other consumers. For example, the Federal Energy Regulatory Commission (FERC) has initiated a show-cause proceeding in PJM after it rejected an agreement between Amazon Web Services and Talen Energy to expand a data center co-located with a nuclear plant in Pennsylvania. The key issues in that proceeding involve (i) whether FERC has jurisdiction over loads that are fully isolated from the grid; (ii)whether co-located loans should be required to pay for transmission services and other ancillary benefits they receive from the grid; (iii) reliability and resource adequacy concerns related to ensuring grid stability; and (iv) clarity on the rates, terms and conditions applicable under the PJM tariff.

While co-location may still be attractive, both power generators and data center operators and tenants should be fully aware of the complications and engage regulatory counsel early in the process to reduce risk that their behind-the-meter arrangements inadvertently expose them to regulatory scrutiny, additional fees, charges or other penalties from grid operators.

Conclusion

As data centers—particularly those supporting generative AI—emerge as dominant energy consumers, the importance of structuring PPAs and interconnection arrangements cannot be overstated. These contracts directly impact cost, reliability and regulatory risk. Power developers, data center developers and hyperscalers alike must align project timelines, credit structures and flexibility mechanisms to balance infrastructure buildout with market volatility and technological change. Interconnection processes must be navigated early and strategically, particularly where both load and generation assets are greenfield developments. Finally, while co-location offers potential efficiencies, it also presents complex regulatory questions that demand early legal engagement. Tailored, forward-looking agreements are not just a contractual necessity—they are critical for ensuring the long-term viability of the data center itself.

(The authors thank summer law clerk Amal Abdelhalim for her research assistance on this article.)

[1] Ashish Sethia, Helen Kou and Nathalie Limandibhratha, How AI Influences US Data Center Power Demand BloombergNEF Webinar (June 12, 2025) (recording available at https://www.bloomberg.com/professional/insights/webinar/bnef-data-centers-webinar/).

[2] Arman Shehabi, Sarah J. Smith, Alex Hubbard, Alex Newkirk, Nuoa Lei, Md Abu Bakar Siddik, Billie Holecek, Jonathan Koomey, Eric Masanet, Dale Sartor, 2024. 2024 United States Data Center Energy Usage Report.

Lawrence Berkeley National Laboratory, Berkeley, California. LBNL-2001637.

[3] Ashish Sethia, Helen Kou and Nathalie Limandibhratha, How AI Influences US Data Center Power Demand BloombergNEF Webinar (June 12, 2025) (recording available at https://www.bloomberg.com/professional/insights/webinar/bnef-data-centers-webinar/).