White Paper 06.23.25

Alert

Status Update: Renewable Energy Tax Credits Under the Big, Beautiful Bill

Alert

Takeaways

06.23.25

With the Senate Finance Committee (SFC) releasing the text of its version of the Big Beautiful Bill (the “Bill” or “BBB”) on June 16, 2025, we provide a comparison of the competing proposals from the House and the SFC. In short, the House version of the BBB featured three principal changes to the renewable energy tax credit provisions enacted under the Inflation Reduction Act of 2022 (IRA): (i) accelerated expiration dates and phase-outs, (ii) repeal of cash transfer elections and (iii) imposition of limitations for associations with FEOCs. The SFC version of the BBB, in turn, (i) eases some of the expiration dates and phase-outs, (ii) allows cash transfer elections to continue for the remaining periods of tax credit availability and (iii) provides important guidance on the restrictions relating to FEOCs.

SUMMARY OF HOUSE BILL

Early Expiration Dates/Phase-Outs. As expected by many within the industry, tax credits relating to clean vehicles and energy efficient homes and commercial buildings would expire at the end of 2025, with limited exceptions. More surprising, the clean hydrogen production credit (IRC § 45V) also would expire for construction of facilities that begin after 2025. With respect to the clean electricity tax credits which took effect this year (IRC §§ 48E and 45Y), projects would need to start construction within 60 days of enactment of the Bill, and would have to be placed in service by December 31, 2028, in order to qualify for the tax credits. An exception is provided for qualified advanced nuclear facilities and, for purposes of IRC § 45Y, expansions of existing nuclear facilities, which would have until the end of 2028 to commence construction. In contrast, the clean fuel production credit (IRC § 45Z) would receive an extension from December 31, 2027, to December 31, 2031, but with a new requirement that feedstocks must be sourced from the United States, Canada or Mexico.

Cash Transfer Elections. The IRA enacted IRC § 6418, which allows taxpayers to sell certain renewable energy tax credits solely for cash consideration, subject to compliance with registration and record-keeping requirements. The new provision enabled flexibility for the monetization of tax credits that potentially could not be fully utilized by the developers of renewable energy projects, generating capital to support the financing of such projects. The House Bill, however, puts an end to transferability for various renewable energy tax credits, generally after 2027.

FEOC Restrictions. Under the House Bill, prohibitions are imposed that effectively deny the ability to claim renewable energy tax credits if a taxpayer is a “specified foreign entity” (SPE) or “foreign influenced entity” (“FIE” and, together with an SPE, a “prohibited foreign entity”) or, in some cases, receives material assistance from prohibited foreign entities. Very generally, a SPE includes a FEOC or other entity or person with ties to Russia, China, Iran and North Korea. A FIE generally includes (i) an entity in which SPEs hold significant ownership interests or possess the ability to appoint directors or key executives or (ii) an entity that made certain sizable payments to SPEs during the previous taxable year. For purposes of these FEOC restrictions, “material assistance” would include the extraction, recycling, processing, manufacturing or assembly of a component, subcomponent or critical mineral in one of the designated foreign countries, or reliance on intellectual property, know-how or trade secrets originating from such countries.

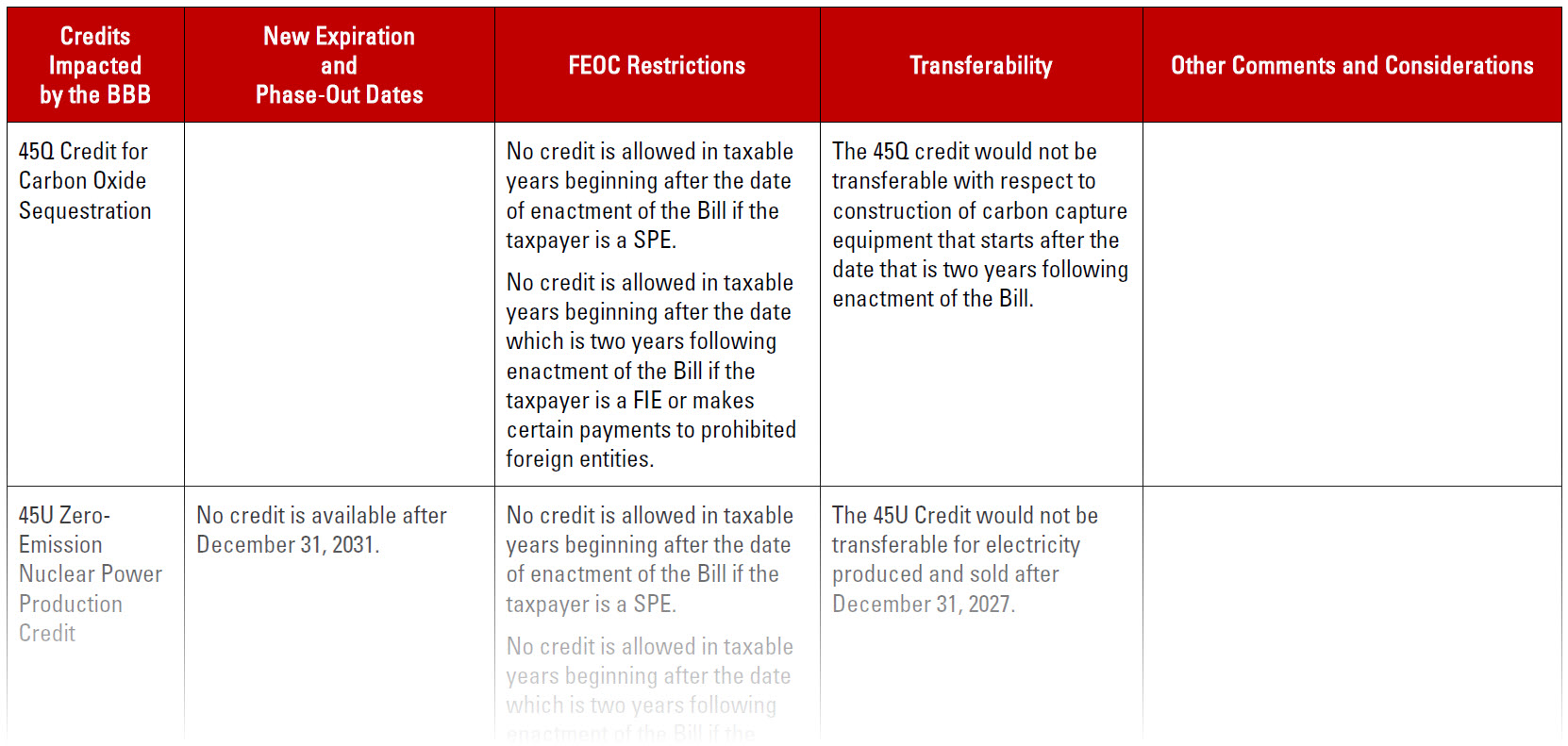

A table summarizing these changes as relates to the key renewable energy tax credits is set forth below (click here to view the full table).

SUMMARY OF SFC BILL

The SFC version of the BBB departs from the House Bill with respect to the expiration dates and phase-outs for certain tax credits, restores the ability to transfer tax credits for cash consideration and provides additional guidance with respect to the FEOC restriction on material assistance from prohibited foreign entities.

Early Expiration Dates/Phase-Outs. The SFC Bill similarly puts an early end to tax credits relating to clean vehicles and energy efficient homes and commercial buildings, but with expiration occurring a number of days or months following enactment of the Bill. The SFC Bill also retains the early expiration of the clean hydrogen production credit (IRC § 45V). The clean electricity tax credits (IRC §§ 48E and 45Y), however, would receive a reprieve under the SFC Bill, except that wind and solar projects would be subject to significant phase-outs for construction that starts in 2026 and later years. The advanced manufacturing production credit under IRC section 45X for applicable critical minerals, which currently does not expire, would begin to phase out after 2030.

Cash Transfer Elections. The SFC Bill generally follows current law with respect to the ability to sell renewable energy tax credits for cash consideration. A limitation is imposed, however, under which credits cannot be transferred to SPEs.

FEOC Restrictions. The SFC Bill retains FEOC restrictions that largely are consistent with the House Bill, but with additional guidance with respect to the material assistance limitation and other matters. In particular, whether or not a taxpayer has received material assistance from a prohibited foreign entity would be determined by calculating the “material assistance cost ratio” for the credit eligible property, with the tax credit being denied if the ratio falls below a threshold percentage that increases over time. In this regard, the material assistance cost ratio generally would be calculated as (i) the total costs for the credit eligible property reduced by costs attributable to the mining, production or manufacturing by a prohibited foreign entity, (ii) divided by the total costs for the credit eligible property. Treasury, in consultation with the Department of Energy (DOE), is directed to issue safe harbor tables for purposes of the material assistance determination not later than December 31, 2026. Additionally, an extended six-year statute of limitations is provided for deficiencies related to the material assistance determination.

Other. Notably, the SFC Bill also includes a provision that would deny five-year Modified Accelerated Cost Recovery System (MACRS) depreciation for facilities and energy storage technologies claiming the clean electricity tax credits under IRC §§ 48E or 45Y. MACRS has previously allowed taxpayers to condense depreciation of capital expenditures for certain projects from 15 years down to just five years. This elimination will impact any large-scale-capital-intensive project. For example, the DOE had previously calculated that MACRS for a new AP1000 resulted in a 6 percent reduction to the levelized cost of electricity for the project.

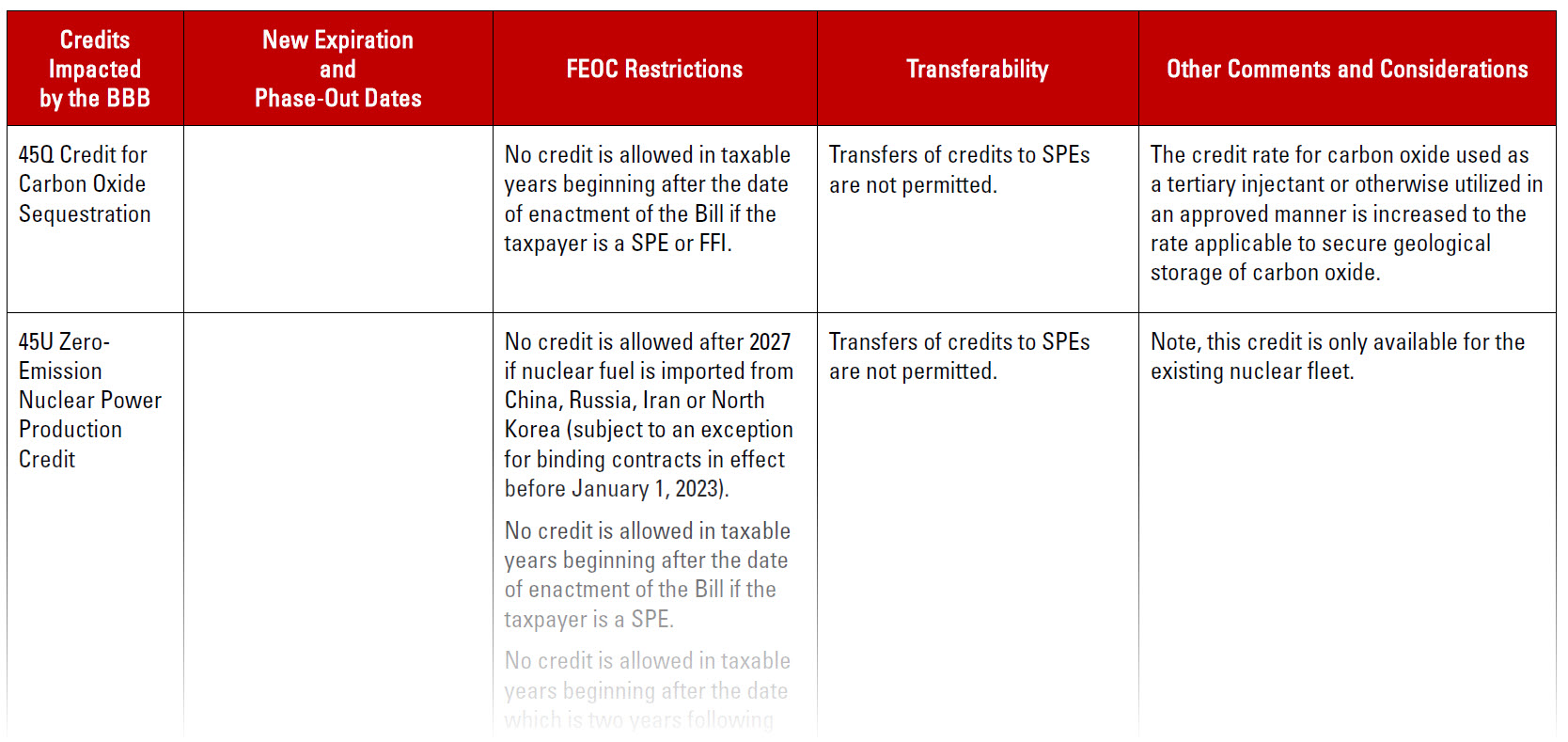

A table summarizing these changes as relates to the key renewable energy tax credits is set forth below (click here to view the full table).