The Final Rules primarily address disclosure of: (1) material impacts of climate-related risks (both actual and likely); (2) governance and related processes regarding identified climate-related risks; (3) GHG emission reporting; (4) targets or goals, transition plans, and scenario analysis concerning climate-related risks; and (5) certain financial reporting requirements regarding climate-related risks and certain severe weather events.

FINAL RULES

Overview

The Final Rules, which create new subparts to Regulation S-K and Regulation S-X, will require a registrant to identify and disclose information in their annual reports and registration statements, including those for IPOs.

Registrants will need to provide narrative quantitative and qualitative disclosures, including the following:

- Material Impacts, specifically requiring consideration of whether climate-related risks have had or are reasonably likely to have a material impact on the registrant, including any actual and possible material effects of any determined climate-related risk on the registrant’s strategy, business model, and outlook;

- Mitigation or Adaption Activities if contemplated as part of the registrant’s strategy related to material climate-related risks;

- Transition Plans if utilized to manage a material transition risk;

- Scenario Analysis if used to determine whether a climate-related risk is reasonably likely to have a material impact on the registrant’s business;

- Internal Carbon Price if material to how a registrant evaluates and manages a material climate-related risk;

- Board of Directors Oversight and any role by management in assessing and managing material climate-related risks;

- Internal Processes for identifying, assessing, and managing material climate-related risks and, if the registrant is managing those risks, whether and how any such processes are integrated into the registrant’s overall risk management system or processes;

- Climate-Related Targets and Goals that have materially affected or are reasonably likely to materially affect the registrant’s business, results of operations, or financial condition;

- Scope 1 and/or 2 GHG Emission Reporting, if material, for large-accelerated filers and accelerated filers; and

- Third-Party Attestation Reports for registrants reporting Scope 1 and/or 2 emissions, as applicable.

Footnotes to the registrant’s audited financial statements will require disclosures regarding:

- Severe Weather Events and Other Natural Conditions, including capitalized costs, expenditures incurred, charges, and losses recognized, subject to applicable 1% and de minimis disclosure thresholds;

- Carbon Offsets and Renewable Energy Credits, including capitalized costs, expenditures incurred, charges, and losses recognized if used as a material component in plans to achieve climate-related targets or goals; and

- Estimates and Assumptions Underlying Financial Statement Disclosure if severe weather events and other natural conditions materially affected such estimates and assumptions.

The following summary is qualified in its entirety by the Final Rules, which can be found here.

Identifying and Describing Material Climate-Related Risks and Impacts

- Climate-Related Risks: Climate-related risks are defined as “the actual or potential negative impacts of climate-related conditions and events on a registrant’s business, results of operations, or financial condition.” This definition encompasses both physical and transition risks, and any identified climate-related risk must be categorized as such in the registrant’s disclosures. For actual and likely material risks identified by the registrant, the registrant must discuss whether such risks are anticipated to materialize in the next 12 months) and in the long-term (beyond the next 12 months). The disclosures regarding identified risks must be clear and robust to provide investors with a greater understanding of the actual or potential impact on the registrant’s strategy, operations and financial health, and how the registrant addresses such risks, including a discussion of the extent and materiality of the risk and the exposure to the registrant.

- Materiality: Management teams should engage in an objective qualitative and quantitative assessment of the materiality and consequences of climate-related risks. The Final Rules provide a non-exclusive list of material impacts to be disclosed, including: (i) business operations, (ii) product offerings or services, and (iii) research and development costs. Each registrant must determine, based on its specific situation, which disclosures are necessary to provide the information investors need in order to understand how management has considered these climate-related material impacts. A registrant must describe quantitatively and qualitatively the actual material costs and impacts on financial estimates and assumptions that management determines are a direct result of mitigation or adaption activities in response to identified climate-related risks.

Transition Plans, Scenario Analysis, and Internal Carbon Pricing—What’s Required?

- Transition Plans: Although a registrant is not required to adopt a transition plan, if a plan is adopted, a registrant is required to detail such plan. The registrant will need to update its transition plan disclosure with any actions taken under the plan, as well as the impact of such actions, in its annual reports each fiscal year.

- Scenario Analysis: Similarly, a scenario analysis disclosure is only required where a registrant uses scenario analysis to determine whether a climate-related risk is reasonably likely to have a material impact on its business. The extent of disclosure depends on how the scenario analysis is used by the registrant. For example, a registrant who has recently adopted scenario analysis as an analytical tool may only have qualitative disclosures to discuss until their use of the tool becomes more sophisticated.

- Internal Carbon Pricing: Internal carbon pricing disclosures are also only required if used by the registrant. Where a registrant uses internal carbon pricing and such use is material to its assessment and management of identified climate-related risks, a registrant must disclose specified information about the pricing, such as the price per metric ton and total price of CO2e (carbon dioxide equivalent), in units of the registrant’s reporting currency.

The existing Private Securities Litigation Reform Act (PSLRA) safe harbor for forward-looking statements is available for disclosures regarding a registrant’s transition plan, scenario analysis and internal carbon pricing.

Governance Disclosures

- Board Oversight: Registrants must report on aspects of the board’s oversight and processes related to climate-related risks, including identifying any board committee/subcommittee responsible for climate-related risk oversight, the procedures by which such committee is informed of such risks, and how targets, goals, or transition plans disclosed under the Final Rules, if any, are supervised. Disclosure is also required regarding management’s position in evaluating and handling material climate-related risks. This includes, but is not limited to, the relevant expertise of such management personnel, the procedures to evaluate such risks, and whether the board receives reports on information regarding such climate-related risks.

- Risk Management: A registrant must disclose any existing practices they have for determining, evaluating, and handling material climate-related risks. This includes how the registrant determines if it has experienced, or is reasonably likely to experience, a material physical or transition risk, how it determines whether to mitigate, accept, or adapt to such risks, and how it prioritizes whether to address the risk. If a registrant is handling a material climate-related risk, it must discuss how such climate-related risk management processes are integrated into the registrant’s overall risk management system.

- Targets and Goals: Disclosures are required where climate-related targets and goals have materially affected, or are reasonably likely to materially affect, a registrant’s business, results of operations, or financial condition. Where such targets and goals exist, a registrant must provide additional information, including the scope of activities in the target, target timeline, any baselines against which progress is tracked, how targets and goals are planned to be achieved, and information about carbon offsets or Renewable Energy Certificates (RECs) if they are a material component of the climate-related plans. With respect to the financial discussion, registrants should consider the overall expenditures and materiality in the aggregate. A registrant must annually update this disclosure.

GHG Emission Reporting and Attestation Requirements

Large-accelerated filers and accelerated filers must disclose material Scope 1 and/or Scope 2 emissions. “Scope 1 emissions are direct GHG emissions from operations owned or controlled by the registrant, and Scope 2 emissions are indirect GHG emissions from the generation of purchased or acquired electricity, steam, heat or cooling that is consumed by operations owned or controlled by the registrant.” Additionally, the registrant must detail the organizational boundaries, methodology and significant inputs and assumptions relied upon with respect to Scope 1 and 2 emissions. A registrant may use reasonable estimates in its reporting, so long as it also describes the reasons for using such estimates.

Certain exemptions and exceptions apply to the GHG emission reporting requirements, including:

- GHG emissions from a manure management system are not required in Scope 1 and 2 emission disclosures;

- Smaller reporting companies (SRCs) and emerging growth companies (EGCs) are exempt from any disclosure requirements regarding Scope 1 and/or 2 GHG emission reporting; and

- Scope 3 emissions are not required.

Registrants who are required to provide Scope 1 and/or 2 emissions must also provide an attestation report. The attestation report requirement dictates that an independent third-party must provide an inspection on the correctness and comprehensiveness of a registrant’s reported GHG emissions. The provider of the attestation report must meet certain independence and expertise criteria.

Required Financial Information and the Impact on Financial Statements

Although the Final Rules did not adopt many of the financial metric requirements under the prior proposals, registrants must continue to satisfy any current and pre-existing disclosure obligations. For example, registrants are currently required under generally accepted accounting principles (GAAP) to consider material impacts on the financial statements whether driven by climate-related matters or not. The adopted amendments to Regulation S-X, in comparison to the prior proposals, have been scaled back to focus on severe weather events and other natural conditions, and carbon offsets and RECs. However, the registrant is not required to make any conclusions regarding whether a severe weather event or other natural condition was caused by climate change.

Registrants are required to include disclosures in the footnotes to audited financial statements regarding the effects of severe weather events and other natural conditions (including flooding, droughts, wildfires, and sea level rise, among others), and the purchase and use of carbon offsets and RECs. This includes details on the effects for severe weather events and other natural conditions for each fiscal year as to (i) capitalized costs, if the amount equals or exceeds 1% of the absolute value of stockholders’ equity or deficit (unless it is less than $500,000), and (ii) expenditures and losses, if the amount equals or exceeds 1% of the absolute value of pre-tax income or loss (unless it is less than $100,000). For carbon offsets and RECs deemed material to achieving climate-related targets, registrants must disclose the aggregate amounts capitalized, expensed and lost (as well as their location in the financial statements).

Finally, registrants must identify any estimates and assumptions regarding disclosed transition plans and whether or how they were materially (i) effected by risks and uncertainties associated with, or known impacts from, any disclosed climate-related targets; and (ii) exposed to risks and uncertainties associated with, or known impacts from, severe weather events and other natural conditions.

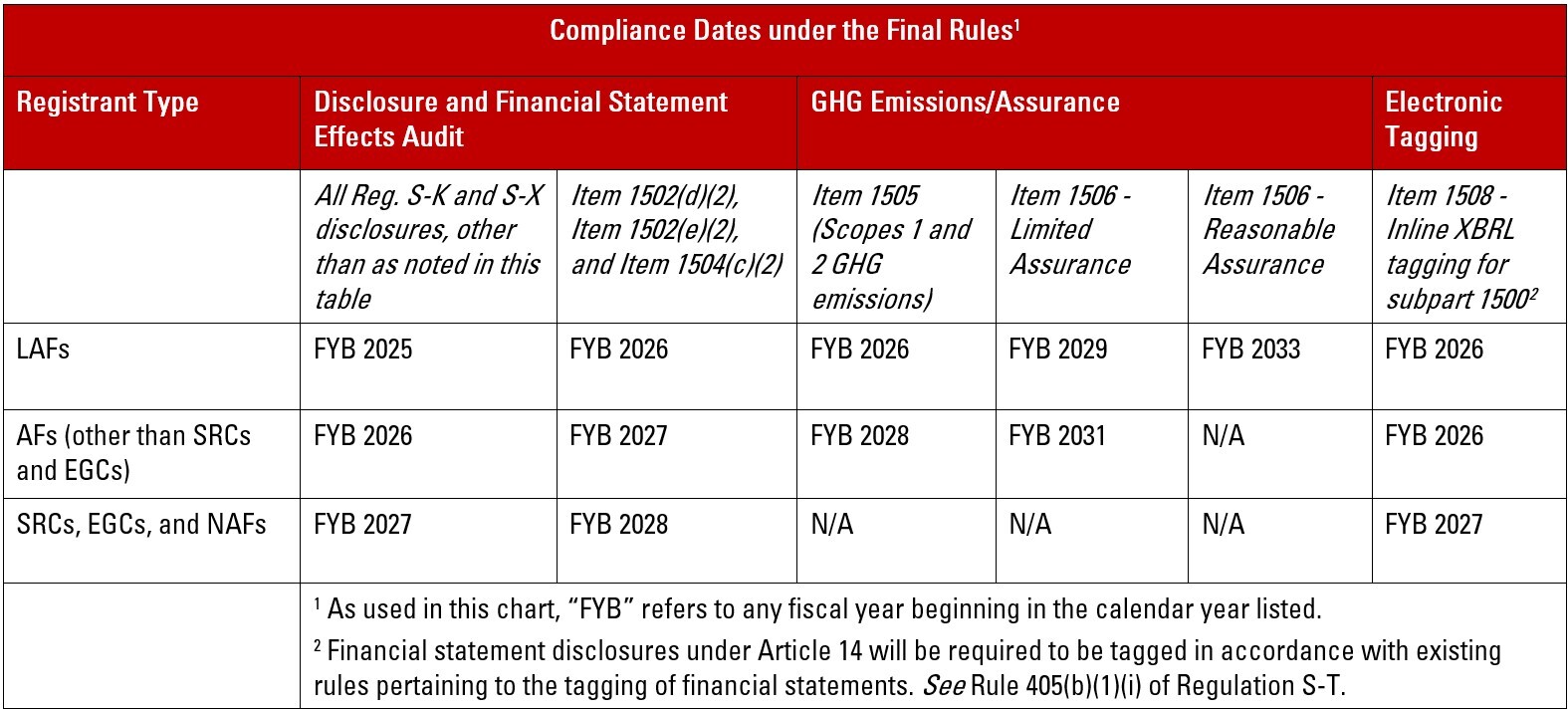

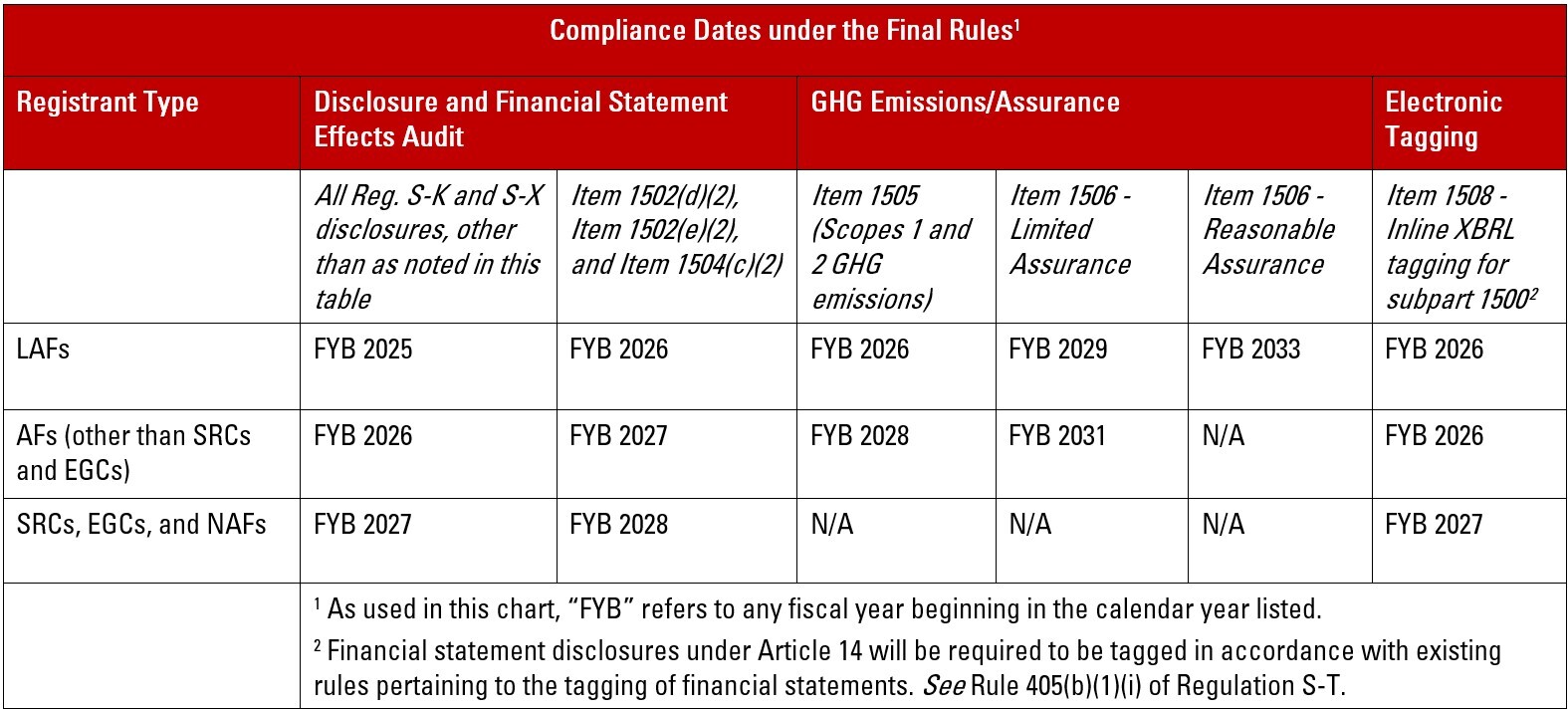

Timing for Compliance

The Final Rules dictate compliance dates depending on the filer’s status and content of the disclosure. The following table from the SEC Fact Sheet summarizes the compliance dates for annual reports and registration statements under the Final Rules.

Other Jurisdictional Considerations and Legal Challenges

California climate-related disclosure laws also contain disclosure mandates related to GHG emissions and climate-related risks for companies doing business in California who meet annual revenue thresholds. These laws are currently subject to pending legal challenges. Although the Final Rules do not expressly preempt any state law, it is possible that future legal proceedings may consider whether the rules as applied will qualify as implied preemption. In addition, notwithstanding the overlapping nature of these regulatory frameworks, it remains unclear whether compliance with one will result in, or be deemed to constitute compliance with, the other. Moreover, companies with operations outside of the United States may also have to comply with any applicable climate-related disclosure mandates for the jurisdictions in which they conduct business.

The Final Rules are subject to pending and potential legal challenges by various states and industry groups, among others, as well as possible Congressional action. For example, a coalition of 10 states filed a petition for review challenging the Final Rules on the grounds that the SEC exceeded its statutory authority. Additional states, fracking companies and oil and gas groups have also filed their own petitions for review on similar grounds. Congressional Republicans stated that they have prepared text in anticipation of the Commission’s adoption of the Final Rules to submit the regulation to the Congressional Review Act, which would allow a majority vote in Congress to dismantle the agency regulations.

Recommendations

Although many companies have been voluntarily disclosing some level of climate-related risks outside of the mandatory SEC filings, the adoption of a formal framework within the SEC reporting system will significantly expand registrant’s reporting requirements.

Notwithstanding the pending legal challenges, companies are strongly encouraged to consider and implement strategies and processes to position themselves to be able to comply with the Final Rules by the applicable deadlines. Registrants should expect the implementation of new assessment, compliance and reporting procedures to require significant time and expense.

Companies are encouraged to create a detailed action plan now, including steps to:

- Evaluate which climate-related disclosures will be required, for example identifying which, if any, climate-related risks may have material impacts, whether disclosure of Scope 1 and/or 2 emissions is required and which line items in the audited financial statements will be impacted by the disclosure requirements;

- Assess registrant’s current data and reporting capabilities, for example, identifying gaps in system processes related to data, reporting and controls;

- Establish clear roles and responsibilities of the board of directors and management, for example the role of the audit and/or disclosure committee and whether current members have the necessary expertise; and

- Monitor future developments and guidance to further elaborate on and adapt an action plan to ensure timely compliance.