Alert 06.21.18

SEC Directed to Increase Rule 701 Disclosure Threshold to $10 Million

Increased Rule 701 threshold provides greater flexibility and reduces compliance costs for non-reporting companies.

Alert

Alert

07.23.18

This alert also was published in WoltersKluwer’s Insights: The Corporate & Securities Law Advisor, Vol. 32, No. 9 (September 2018).

On July 18, 2018, the Securities and Exchange Commission (SEC) unanimously voted in favor of two actions relating to compensatory securities offerings and sales. First, the SEC voted to approve the amendment to Rule 701(e) under the Securities Act of 1933 (Securities Act) to increase the disclosure threshold from $5 million to $10 million with subsequent increases every five years to account for inflation. Second, the SEC voted to issue a 36-page concept release soliciting comment on various ways of modernizing and simplifying Rule 701 and Form S-8.

Background

Under the Securities Act, an offer and sale of compensatory securities by a domestic or foreign issuer to service providers in the U.S. must be registered with the SEC or be eligible for an exemption from the federal registration requirements. The most common exemption from registration for securities issued under compensation plans is Rule 701. Non-SEC reporting issuers may rely on the Rule 701 exemption, whereas SEC-reporting issuers are not eligible to rely on it and, instead, should file a registration statement on Form S-8 with the SEC if another exemption from registration (such as Regulation D) is not available. Depending on the facts and circumstances and provided certain requirements are satisfied, issuers may rely on the “no sale” theory.

Surprise! No SEC Rulemaking

Under Rule 701(e), an issuer is required to provide recipients of compensatory securities enhanced disclosure when the total sales of such securities exceed $5 million (now $10 million) within any 12-month period (either on a rolling or on an annual basis). Such disclosure includes a summary of the equity plan’s material terms, risk factors and financial statements of the issuer and must be provided a reasonable period of time before the date of sale to all recipients of the securities in the 12-month period. For a detailed overview of Rule 701 (including the enhanced disclosure requirements under Rule 701(e)), see SEC Directed to Increase Rule 701 Disclosure Threshold to $10 Million.

We initially anticipated that the change to Rule 701(e) to increase the disclosure threshold from $5 million to $10 million would be subject to the SEC’s lengthy rulemaking process, including the release of proposed rules and a comment period. However, there will be no rulemaking process and, instead, the amendment will become effective immediately upon the final rule’s publication in the Federal Register. In its release adopting the final rule, the SEC explained that, as “the amendment implements a statutory mandate and involves no exercise of agency discretion, [it] believe[s] there are no reasonable alternatives to the amendment” and, therefore, no notice and public comment are necessary. This is because the Economic Growth, Regulatory Relief, and Consumer Protection Act directs the SEC to adopt an amendment to Rule 701(e) to increase the disclosure threshold from $5 million to $10 million.

So, Now What?

The elimination of the comment period means that the SEC did not issue any guidance (transition or otherwise) on the practical implications of the amendment to Rule 701(e).

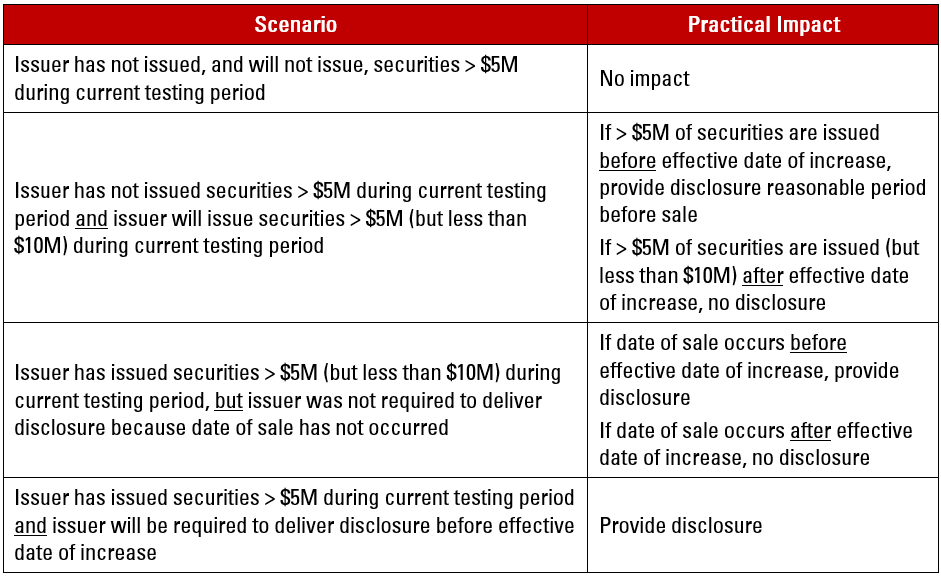

However, the SEC’s release provides that, if the effective date of the final rule (which is the date on which the final rule is published in the Federal Register) occurs during an issuer’s ongoing 12-month testing period, the issuer may rely on the increased $10 million disclosure threshold immediately. As a practical matter, this means the following for the current testing period for issuers who rely on Rule 701:

It’s About Time

The SEC acknowledges in the concept release that, since Rule 701 was last amended in 1999, forms of equity compensation have evolved (including an increase in the use of restricted stock units) and new types of contractual relationships between companies and individuals involving alternative work arrangements have emerged in the so-called “gig economy.” This is particularly true for emerging growth companies with high numbers of temporary or freelance workers. Accordingly, as part of the amendment to Rule 701(e), the SEC believes that it is appropriate to revisit its regulatory regime for compensatory securities transactions.

This process kicked off in September 2017 when the SEC’s Advisory Committee on Small and Emerging Companies issued recommendations to the SEC to amend Rule 701, including increasing the $5 million disclosure threshold to $10 million. However, the SEC’s concept release goes further than the September 2017 recommendations and requests feedback on the following items impacting Rule 701 and Form S-8, among others:

Rule 701(e) and Restricted Stock Units

Perhaps one of the most critical questions raised in the concept release is when Rule 701(e) disclosure should be required for restricted stock units (RSUs).

On October 19, 2016, the SEC published C&DI 271.24 in which it stated that, in the case where an issuer is relying on Rule 701 to exempt the offer and sale of an RSU, the date of sale for purposes of the disclosure requirement under Rule 701(e) is the date on which the RSU is granted. This C&DI surprised many legal practitioners because, prior to the C&DI, it was thought to be a well-established principle that the grant of RSUs for no consideration was not a “sale” requiring an exemption under Rule 701. This C&DI has created confusion among legal practitioners and should be clarified by the SEC.

The SEC staff has indicated in informal discussions that there are clearly situations, such as the issuance of RSUs to all of the existing employees of a certain category, where the staff would agree that no sale is involved in the grant, but that the staff believes that in situations where RSUs are being granted, for example, to an individual employee, perhaps as part of an inducement grant, it is more difficult to conclude that no sale is involved. We are hopeful that the staff will issue further guidance in this area, but it has not been provided as part of the current rulemaking.

Watch This Space

It will take time before the SEC proposes additional changes (if any) to Rule 701 and/or Form S-8. As such, other than implementing the increase in the Rule 701(e) disclosure threshold from $5 million to $10 million, issuers of compensatory equity securities should not make any changes to their compliance practices for such securities. We will continue to monitor developments in this area and provide updates as necessary.