Webinar 06.21.22

China’s Legal Complexity: The Latest Developments and Impact on Associations in China

8:30AM - 10:00AM

Webinar

Alert

Alert

07.12.22

On June 24, 2022, the Standing Committee of the National People’s Congress of China (NPC) approved the proposed amendments to China’s Anti-Monopoly Law after a two-year review. This is the first amendment to the law since the promulgation of the Anti-Monopoly Law in 2008 (2008 AML). The amended law will become effective on August 1, 2022 (2022 AML).

The Anti-Monopoly Law, enacted in 2008, prohibits monopoly agreements, abuse of market dominance and anticompetitive abuse of government administrative powers, and requires filing and obtaining approval for any concentration of business beyond a certain threshold. The Anti-Monopoly Committee of the State Council of China (Anti-Monopoly Committee) is the key policy maker, under the supervision of which the State Administration for Market Regulation (SAMR) is entrusted as the key law enforcement agency nationwide.

Following the adoption of the 2022 AML, on June 27, SAMR published several drafts of implementing regulations and/or their amendments for public consultation. These draft implementation rules and amendments address the merger filing and review process and filing thresholds, abuse of dominance and monopolies, and intellectual property rights. With the 2022 AML and these updated implementation rules coming into effect soon, the Chinese government is set to strictly enforce the law to counter business activities that eliminate or restrict market competition. Multinational companies that are doing business in or related to China should carefully evaluate the law’s potential impacts on their business.

Fair Competition Policy

Promoting fair competition through regulation of policy making and government power exercise is a major theme of the 2022 AML. Article 5 incorporates a clause on the fair competition review mechanism, which requires review of any government regulations and policies from a fair competition policy perspective before the promulgation. The mechanism was first introduced in 2016 by State Council’s Opinions on Establishing a Fair Competition Review Mechanism.

Articles 40, 55 and 61 of the 2022 AML place emphasis on regulating government power abuse that distorts market competition, often referred to as an “administrative monopoly” in China. SAMR has the power to investigate government actions for their anticompetitive effects and demand corrections of the actions or policies.

Administrative monopoly cases often arise with local government protectionism. Local government agencies may introduce discriminative policies to support local businesses and restrict businesses based outside their administrative jurisdictions. These provisions in the 2022 AML echo SAMR’s recent enforcement actions. During the past five years, SAMR initiated 274 administrative monopoly investigations on governments at different levels. The new law adds more to SAMR’s toolkit for prohibiting administrative monopolies.

Focus on Digital, Internet and New Economy

Article 9 and Article 22 re-emphasize the recent enforcement trend on prohibiting abuse of market dominance and other anticompetitive activities through data, algorithm, technologies, advantages in capital, internet platform rules, etc.

Unilateral rules stipulated by the internet giants of China for their services and platforms have been repetitively challenged in the Chinese courtrooms and debated under media spotlights for the past several years. In a landmark case as early as 2010, Tencent sued Qihoo 360 for forcing its users to choose between Tencent and Qihoo. During the past two years, several internet giants have been investigated and fined for anti-monopoly violations. In February 2021, the Anti-Monopoly Committee issued its Guidelines for Internet Platform Economy Areas, setting out its analysis and views towards internet platform rules and actions by large internet giants. Like their counterparts in the EU and U.S., companies operating on the internet and other new economy industries in China may face more compliance risks due to their business models.

The 2022 AML also revises the merger control filing threshold to inhibit “killer acquisitions,” namely acquisitions of promising innovative startups by corporate giants to eliminate competition even though the filing thresholds are not met. See more details below.

Updates to Merger Control Filing

The 2022 AML grants SAMR the power to suspend a merger review if (1) the filing parties fail to provide information or materials as required so that the merger review cannot proceed; (2) certain new circumstances or new facts that materially impact the merger review occur and the merger review cannot proceed without examining the new circumstances or new facts; or (3) the proposed remedies require further assessment and the relevant business operators request a suspension of the review. This may help eliminate the need for filing parties of complex transactions to pull and re-file the case if the review extended beyond the 180-day time limit but might also increase uncertainty of the review timeline for noncomplex merger transactions.

In addition to existing merger control filings required for deals that reach the filing threshold, Article 26 of the 2022 AML grants SAMR the power to voluntarily require filing of a deal that does not reach the filing threshold if it has sufficient ground to believe the deal may eliminate or restrict market competition.

As a follow-up to the 2022 AML, on June 27, 2022, SAMR released its draft amendments to the Regulations on Undertakings Concentration Filing Thresholds for public comments.

The draft increases the filing threshold and includes a new threshold category (see (iii) below) to strengthen regulation over corporate giants’ acquisitions of small-and-medium-size companies or killer acquisitions.

Under the draft amendments, a merger, acquisition or other concentration of business undertakings must be filed with the SAMR for approval if:

(i) all undertakings’ annual global turnover exceeds RMB12 billion (approx. $1.8 billion), and at least two undertakings’ annual turnover in China exceeds RMB800 million (approx. $120 million); OR

(ii) all undertakings’ annual turnover in China exceeds RMB 4 billion (approx. $600 million), and at least two undertakings’ annual turnover in China exceeds RMB800 million (approx. $120 million); OR

(iii) one undertaking’s annual turnover in China exceeds RMB100 billion (approx. $14.9 billion), and the other undertaking(s)’s market valuation or market evaluation exceeds RMB800 million (approx. $120 million) and its revenue in China exceeds one-third of its global turnover.

Article 37 provides a new Undertaking Concentration Categorization and Classification Review System to speed up the review process. More details of how this system works will be provided in the implementation rules. Currently, SAMR categorizes merger control filings into ordinary cases and simplified cases. Simplified cases are given an expedited review process. It is also possible for SAMR to delegate certain merger control filing reviews to its branches.

Safe Harbor for Vertical Monopoly Agreement

The 2008 AML prohibits business undertakings from reaching vertical monopoly agreements, i.e., agreements between business undertakings with supply relationship to fix resale price, set minimum resale price or other activities specified by the regulator.

The 2022 AML provides a new Safe Harbor clause that exempts these vertical monopoly agreements if the business undertakings’ market shares in the relevant markets don’t exceed the threshold(s) specified by the Anti-Monopoly enforcer. The Safe Harbor clause is a well-established mechanism in other jurisdictions but was not included in the initial 2008 law. In 2019, the Anti-Monopoly Committee of the State Council introduced the Safe Harbor clauses in its Anti-monopoly Guidelines for Intellectual Property-related Areas (Article 13) and Anti-monopoly Guidelines for the Automotive Industry (Article 4). It is expected that new regulations will be introduced shortly to implement the newly incorporated Safe Harbor clause.

Furthermore, under the 2008 law, vertical monopoly agreements are considered as per se illegal, while under the 2022 AML these agreements will be exempted if the business undertakings are able to prove that the agreements have no anticompetitive effects.

Hub-and-Spoke Conspiracy

Article 19 of the 2022 AML makes it clear that it is a violation of law for a business undertaking to organize others to reach a monopoly agreement. The hub organizer will be subject to the same penalties for reaching the monopoly agreement. Under the 2008 law, only trade associations were specifically prohibited from promoting entering into a monopoly agreement.

Public Interest Actions

Article 60 of the 2022 AML adds a new paragraph authorizing procuratorates to bring public interest actions where the monopoly violations harm public social interest. Public interest actions are commonly introduced under Chinese law in areas where individuals receive significant adverse impact but cannot bring effective litigations to protect their interests. The procuratorates are responsible for bringing public interest actions before the courts. Prosecutors have been active in environmental pollution, juvenile protection, personal information protection and other areas.

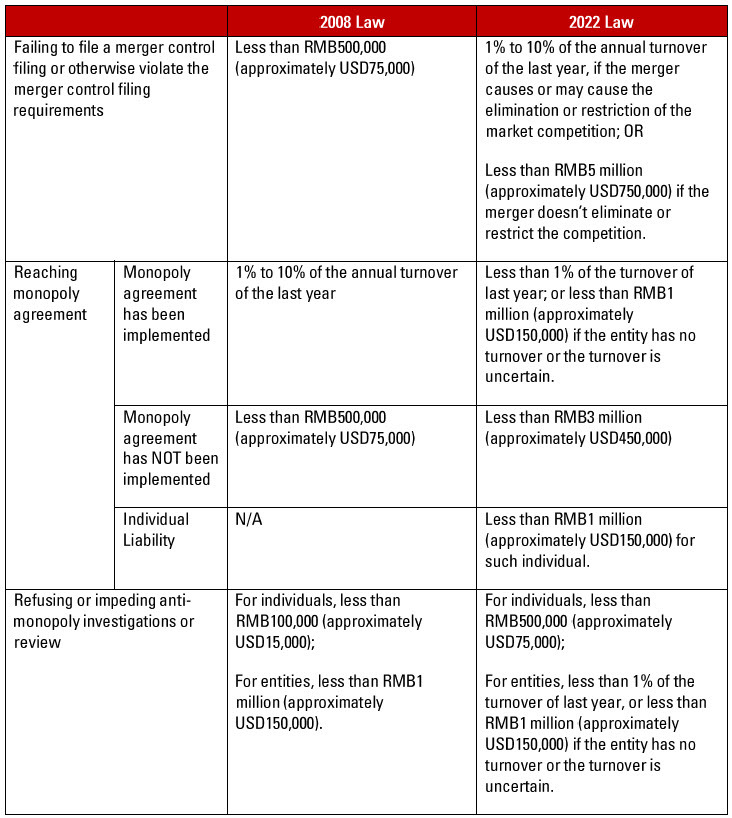

Increased Penalties

The 2022 AML increases the penalties for violation of the law. The 2008 law has led to several significant fines on cartel and market dominance abuse violations during the past years, while it has also been criticized for its low penalty for failing to file a merger control filing. The current fine for failing to clear the pre-merger control filing is RMB500,000. The low penalty has been cited as a reason for the potential reluctance to file and gun-jumping during the past years.

Furthermore, based on Article 63 of the 2022 AML, if the anti-monopoly violation is extremely severe, causes a severe influence or causes a severe consequence, the law enforcement authority may impose a fine of twice to five times of the amount specified in 2022 AML.

Observations

Following the new law, on June 29, 2022, SAMR released the proposed draft amendments to six sets of its regulations for public comments. Business leaders should keep an eye on these updates and consider how they would change the business landscape.

Merger control clearance in China has been a key milestone for large cross-border strategic mergers, acquisitions and investments. Venture capital and private equity investors were less concerned. With the increased fine for gun-jumping, investors must pay more attention to the merger control clearance process.

As with EU and U.S. regulators, Chinese regulators place their focus increasingly on the online and digital world, where many companies adopt innovative measures to seek business growth. Companies should closely review their new business models before bringing them to the market.