Alert 09.27.22

DHS to Boost State and Local Cybersecurity Programs with $1 Billion in Grant Funding

The grant program will be authorized and appropriated through the Infrastructure Investment and Jobs Act.

Alert

Alert

11.16.22

November 15, 2022, marked the one-year anniversary of President Biden signing the Infrastructure Investment and Jobs Act (IIJA) into law. The historic $1.2 trillion dollar investment into infrastructure marked a major bipartisan accomplishment for the 117th Congress and may ultimately represent one of the most impactful accomplishments of the Biden administration. The IIJA, which is also sometimes referred to as the Bipartisan Infrastructure Law (BIL), made investments into roads, bridges, electric vehicles, broadband, hydrogen hubs, cybersecurity, water infrastructure and grid resilience, among other areas of infrastructure.

The law directed funding to various sectors over a five-year period. Funding was allocated through a variety of mechanisms including “formula funding,” where states receive designated awards based on population or other criteria, and competitive grants. Competitive grants—which are administered by federal agencies—are typically announced through Notices of Funding Opportunities (NOFOs) with awards being made to “winning” applicants. Roughly 60 percent of the IIJA funding is to be distributed through formula funding with the remaining 40 percent allocated through competitive grants along with loans and other federal support programs.

Unlike other historic federal funding programs, eligible recipients of IIJA funds—whether distributed by formula or through competitive grants—are typically public entities (i.e., states, counties, local government agencies, and tribal governments) rather than private companies, requiring significant coordination between the federal, state, and local governments. However, the massive influx of new federal dollars into both “shovel ready” and longer-term projects has—and will continue—to create opportunities for suppliers, vendors, contractors, public-private partners, and other private sector stakeholders.

Given the scale of the IIJA, the implementation of the new programs and additional funding streams was expected to be a heavy lift for the federal agencies charged with carrying out the requirements of the law.

Those agencies have been able to distribute most funds on schedule—notably, formula funding for transportation projects and funding for water infrastructure were quickly disbursed. This report will analyze the implementation process of the IIJA over the past year and highlight some of the upcoming funding opportunities.

I. Progress Report

Key Notices of Funding Opportunity Released Thus Far

Total Funds Allocated to States as of July 6, 2022

II. Implementation Progress

Over the past year, the White House and various federal agencies have announced plans, initiatives, stakeholder “roundtables,” and a host of other measures aimed at ensuring the successful implementation of IIJA programs and funds. For example, in January 2022, the White House released A Guidebook to the Bipartisan Infrastructure Law for State, Local, Tribal, and Territorial Governments, and Other Parties, a comprehensive playbook outlining each IIJA program, eligible recipients, funding status, and timing for NOFOs and other disbursements. Then, in April 2022, the White House released a Rural Infrastructure Playbook, specifically designed to aid smaller and rural communities in identifying funding programs and taking advantage of cost share waivers.

The White House has similarly announced action plans aimed at solving specific “red tape” issues or streamlining a certain funding set. In May 2022, the administration announced a “Permitting Action Plan” to accelerate federal permitting and environmental reviews that are necessary for certain new building projects. At the end of 2021, a month after enactment, the administration announced a “Lead Pipe and Paint Action Plan” to leverage federal funds along with other government tools to replace lead pipes and remediate lead paint across the country. Most recently, in October 2022, the White House hosted an “Accelerating Infrastructure Summit” and announced new efforts and an Action Plan to accelerate infrastructure projects.

After enactment, agencies overseeing new programs issued batches of requests for information, seeking input from potential recipients and other stakeholders to shape program guidance in ways that fulfill the objectives of the IIJA while also accounting for the realities of supply chain, technological advances, and project management complexities.

At a high level, agency leaders are working directly with state leaders to make big funding announcements and highlight IIJA successes. At the same time, implementation at the state and local level has proven challenging, especially in the implementation of new funding streams.

III. Big Winners

IV. Challenges

To be considered “produced in the US” for the purpose of the IIJA, goods must contain greater than 55% domestic product. These requirements, however, have been challenging for grantees to comply with due to sourcing difficulties. As such, both the DOT and EPA have had to issue waivers from Buy American restrictions over the past year. Nevertheless, those wishing to take advantage of funding available over the next several years should be aware of Buy American content requirements.

V. Next Steps

Over the next several months, additional agencies will announce Notice of Funding Opportunities to receive funding allocated from programs under the IIJA in FY 2022 and FY 2023. Entities eligible to receive funding under these programs should plan to submit applications for funding. Industries that have capabilities that align with the infrastructure aims of these projects should monitor for opportunities to partner with eligible entities to assist in executing their projects.

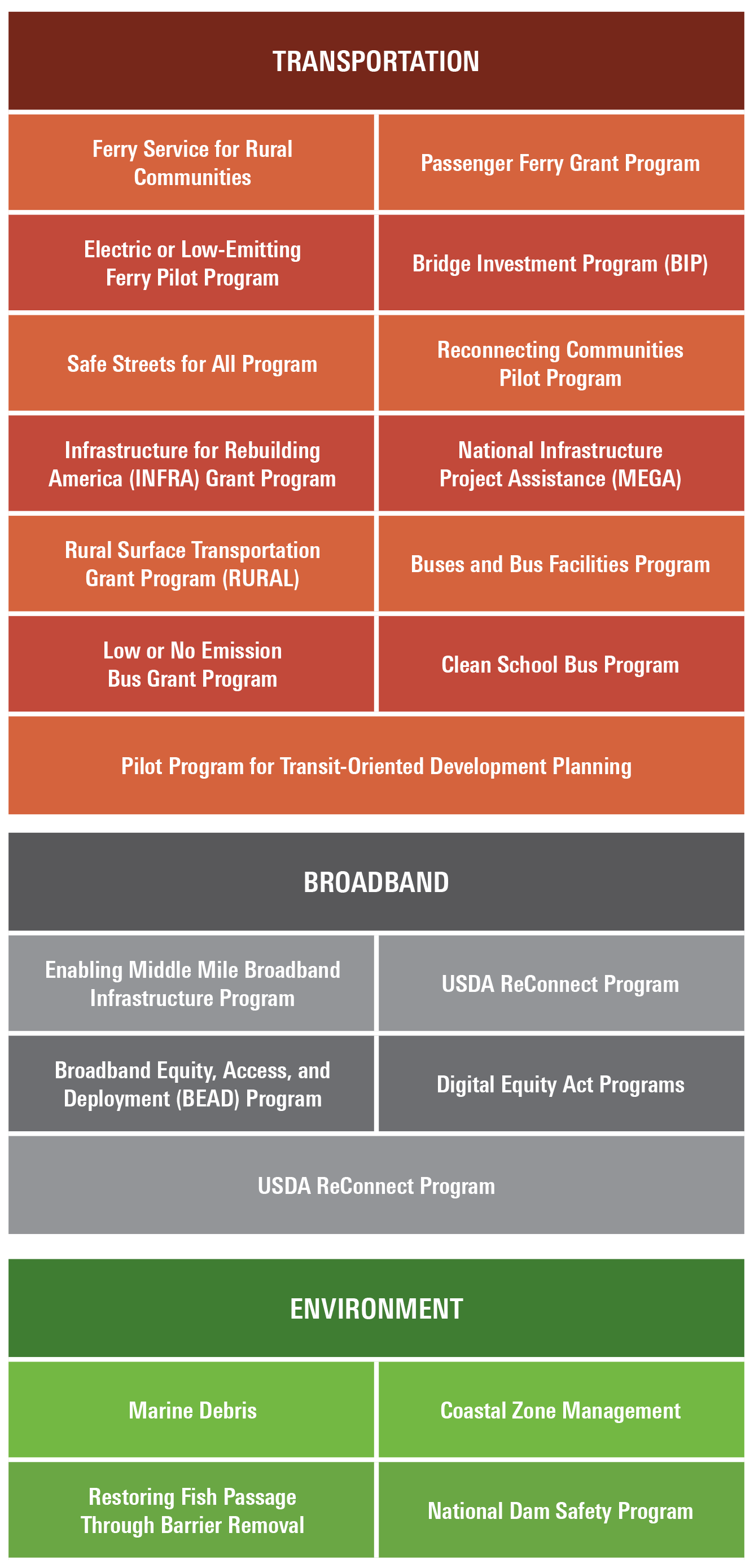

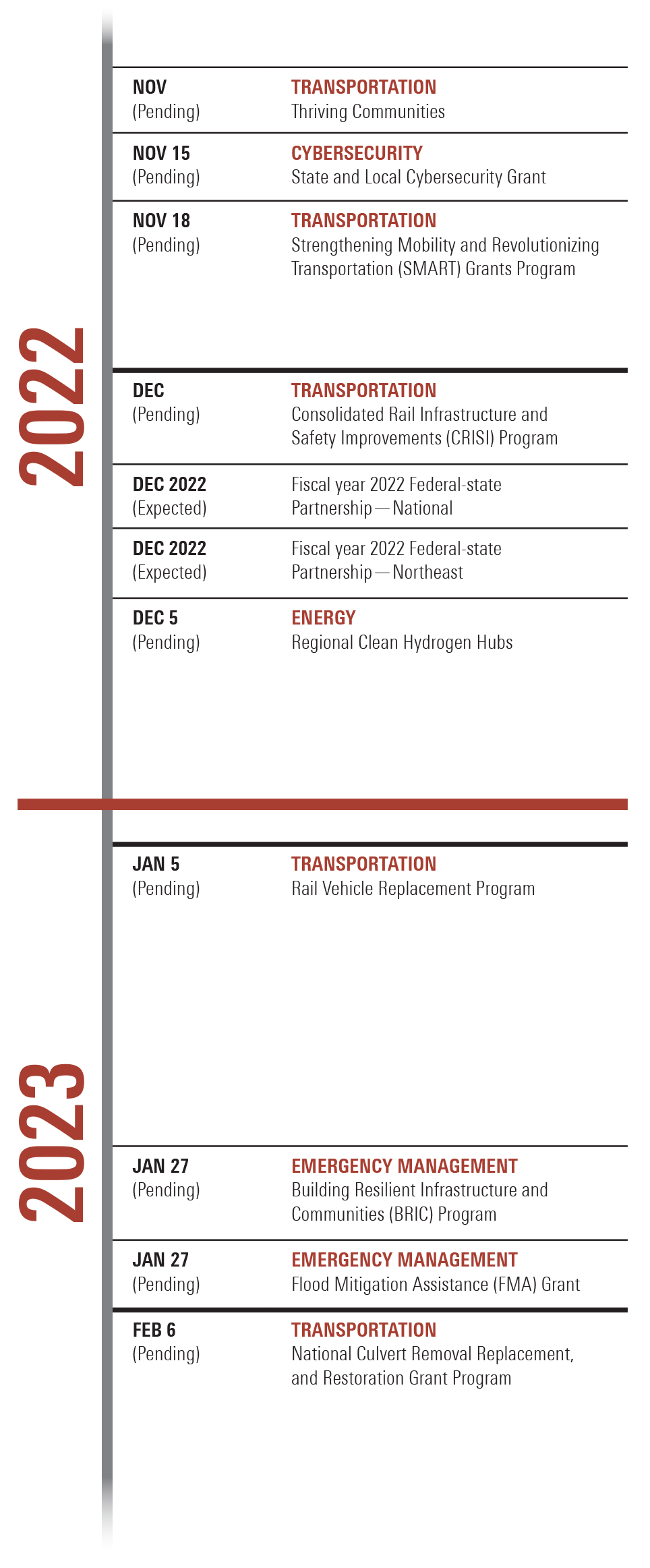

NOFOs that are currently pending include:

In addition to pending NOFOs, there is still a substantial amount of money available through appropriations made in the IIJA. These funds will be expended over the next several years, with many programs accepting grant applications for programs again in FY 2023, FY 2024, and so on. Entities interested in receiving funding should continue to monitor for NOFOs while industry partners should begin assessing what sort of partnership opportunities may best fit their products. Pillsbury’s Government Law & Strategies team is ready to assist you with monitoring and targeting IIJA funding opportunities over the coming year.

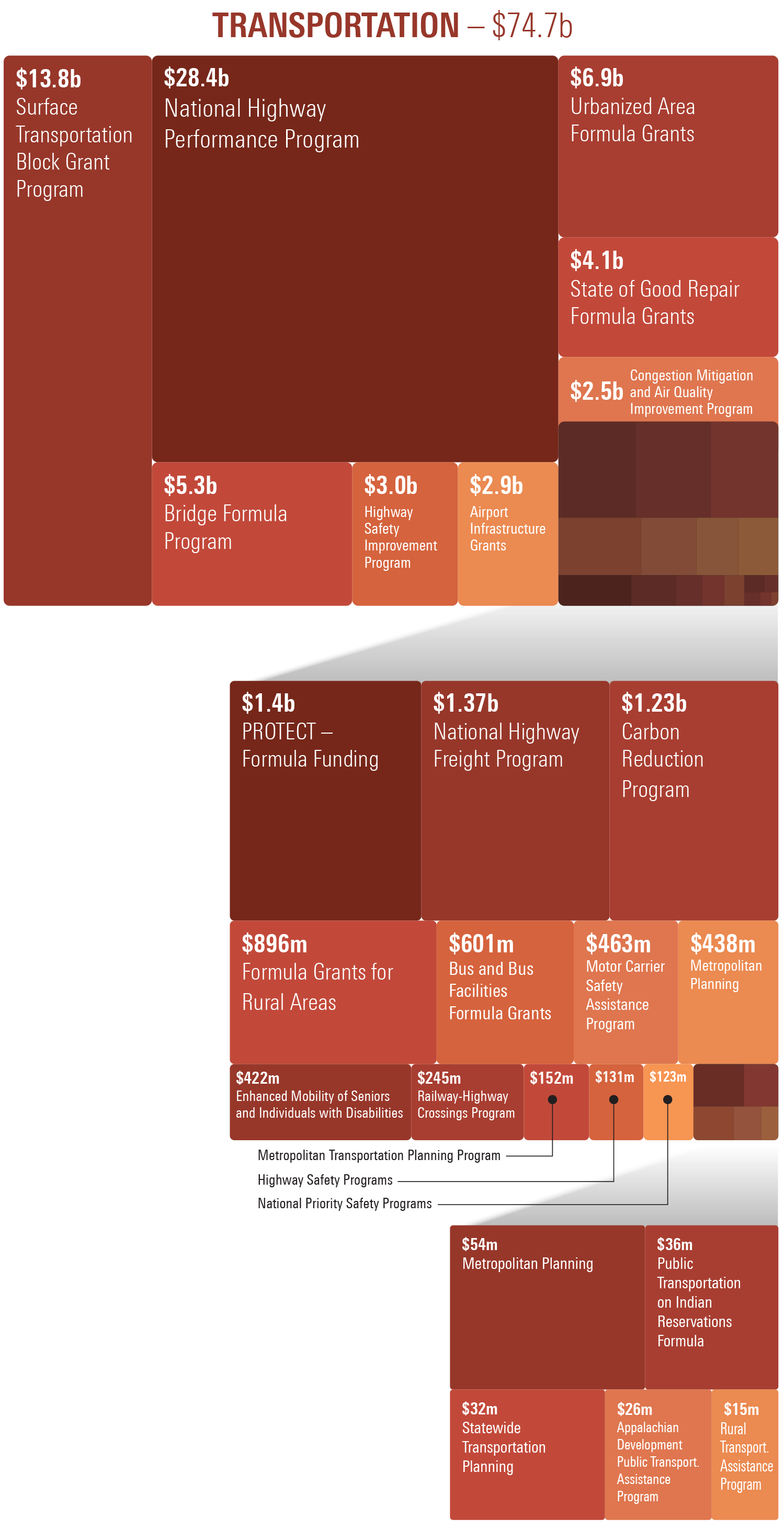

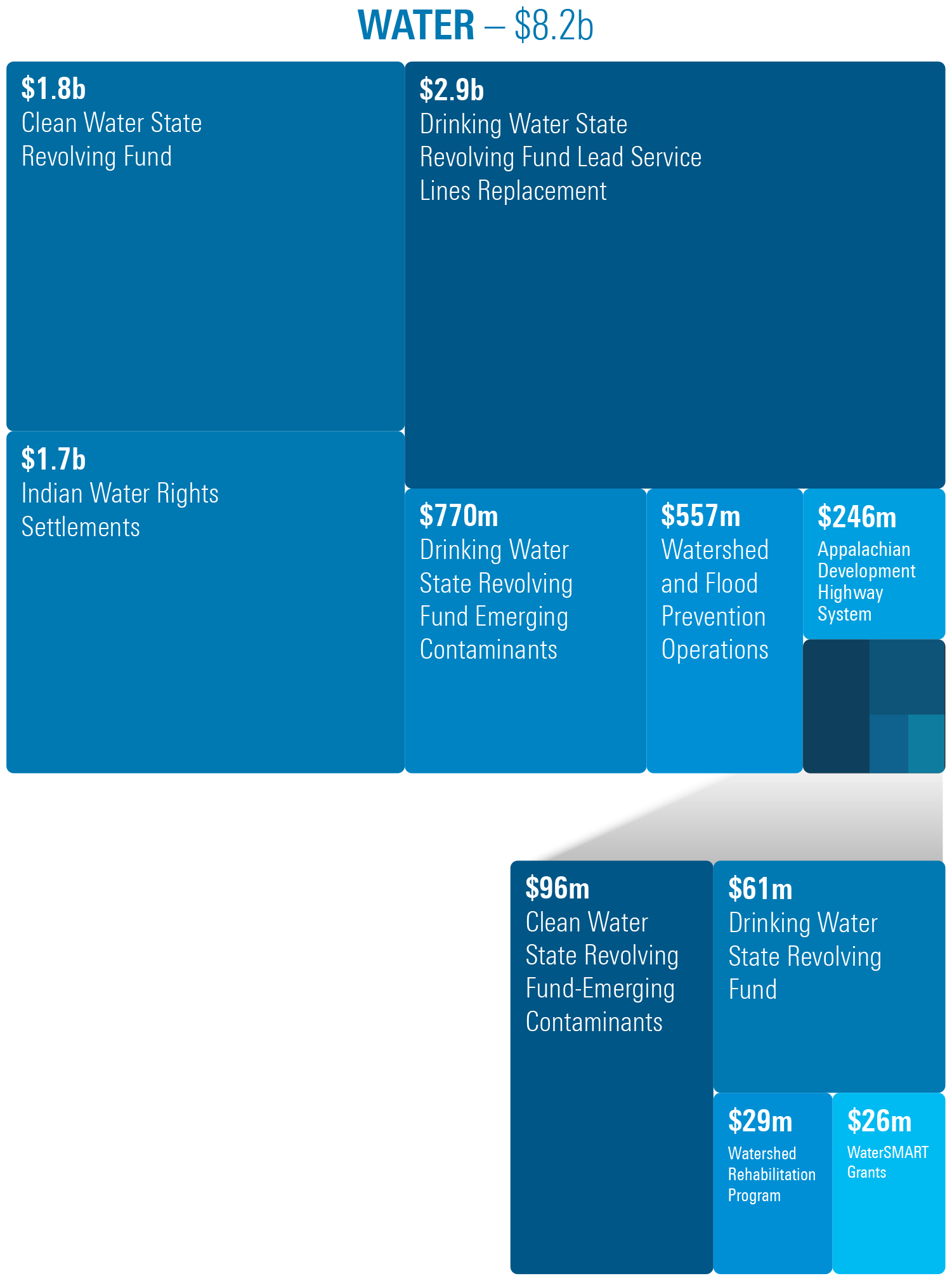

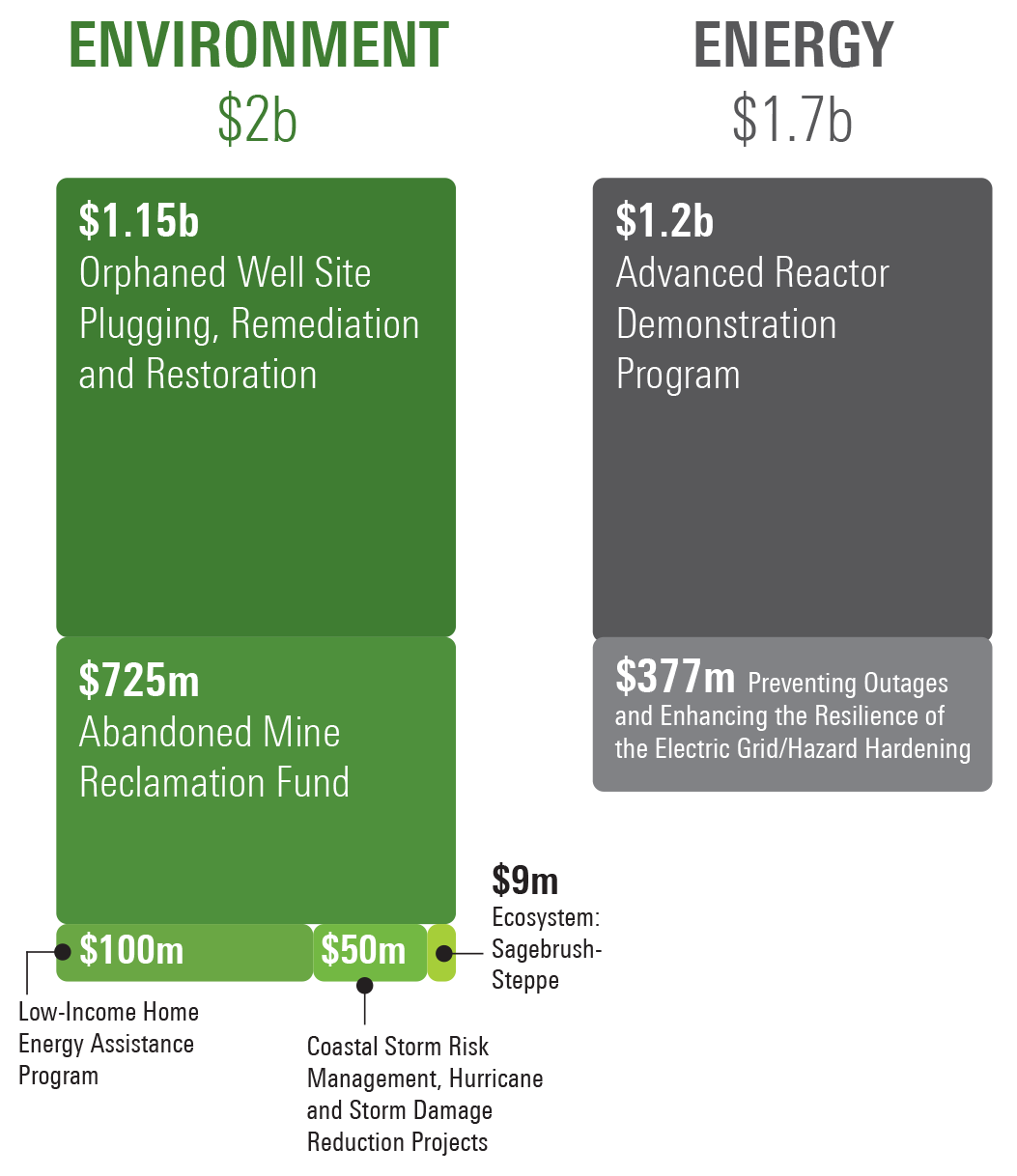

Below are estimates of funds that remain available in a few programming areas:

Transportation

Broadband

Water

Energy and Environment