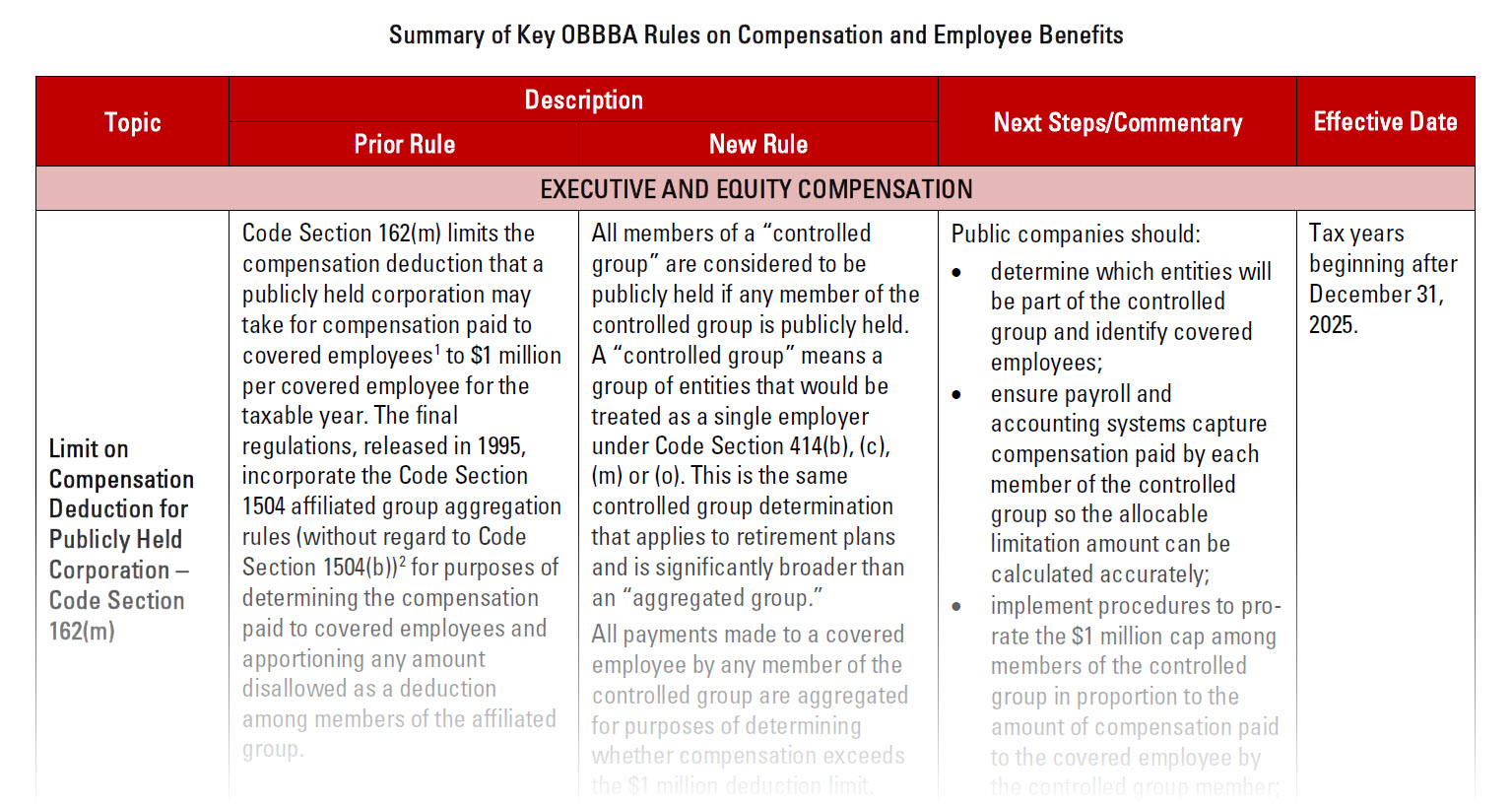

The One Big Beautiful Bill Act (OBBBA), enacted on July 4, 2025, may have made headlines for its political theatre, but included in the OBBBA are changes that will significantly reshape the compensation and employee benefits landscape. While many of these changes only become effective in 2026, proactive employers should begin planning now to address these changes, communicating these changes to employees and modifying plan documents and pay practices to accommodate these changes. Failure to adequately address these changes could lead to missed tax savings for employers and hamper employers’ efforts to recruit and retain key talent.