Budget 2023 provides much anticipated details of the ITC, first announced as part of the 2022 Fall Economic Statement (FES). The FES, which we discussed in our previous client alert, included major investment incentives for clean energy and hydrogen to help Canada meet its clean energy goals and to ensure Canadian companies remain globally competitive against the backdrop of strong support mechanisms in other nations, particularly the United States’ Inflation Reduction Act (IRA).

Tax Credit Structure

The ITC will be available to projects which produce hydrogen irrespective of whether those projects also produce CO2 (so long as the CO2 is captured and stored or used) or produce and sell excess electricity. Eligible projects initially include facilities producing hydrogen via electrolysis or natural gas with carbon capture, utilization and storage (CCUS), but other forms of production will be evaluated by the government going forward. Credits will be refundable and become claimable when the eligible equipment becomes available for use.

The ITC will apply to the cost of purchasing and installing equipment required to produce hydrogen from electrolysis or natural gas plus CCUS. Note, though, that equipment that is already eligible for Canada’s CCUS ITC is not eligible for the clean hydrogen ITC. Further, in some cases, the clean hydrogen ITC may apply to equipment that produces heat and/or power from natural gas or hydrogen or dual-use power or heat production equipment. However, broader project costs, such as feasibility studies, front-end engineering design studies and operating expenses are ineligible for the ITC.

In addition, the ITC will extend a 15% tax credit to equipment used to convert hydrogen into ammonia for transportation fuel, so long as the ammonia production is associated with the production of clean hydrogen.

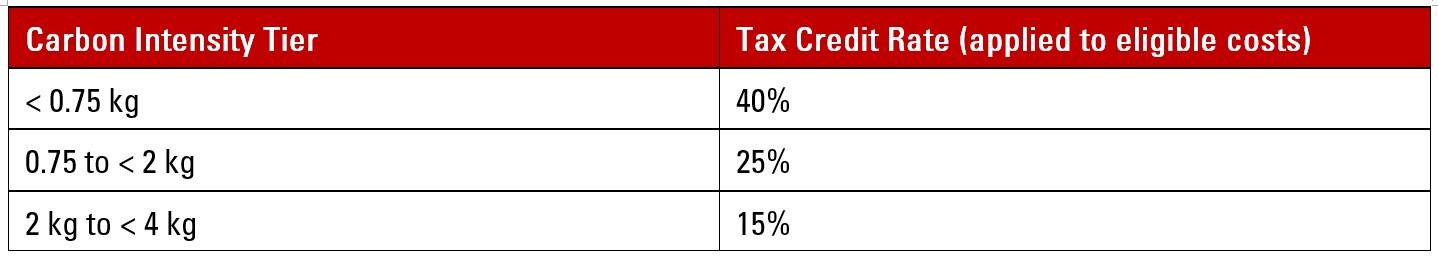

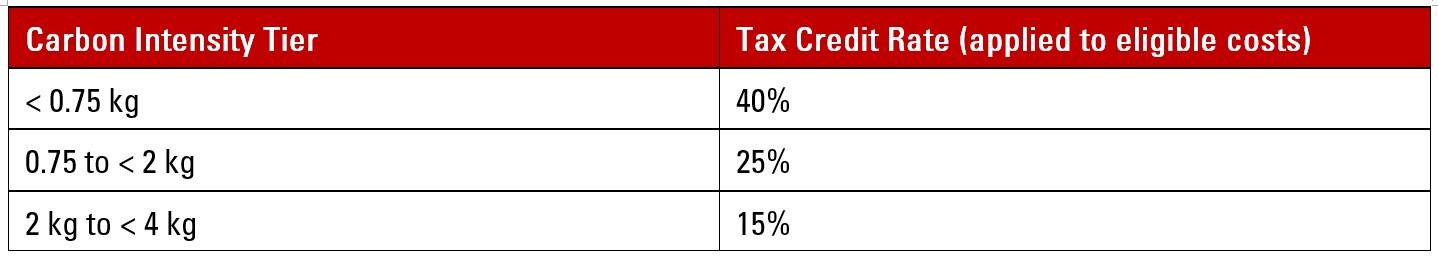

The ITC will be determined using the following tiered structure based on life cycle carbon intensity (measured as kg of CO2e per kg of hydrogen (H2) produced), assuming labor conditions are met:

Total life cycle CO2 intensity will be assessed based on the government’s Fuel Life Cycle Assessment (LCA) Model that is maintained by Environment and Climate Change Canada. Emissions will be calculated “cradle-to-gate,” meaning calculations consider upstream emissions through the point where the hydrogen exits the facility gate and therefore omit consideration of any downstream emissions.

For projects using grid-electricity, the source of the power must be included in the calculation. However, specific details—such as rules on the time frame for matching, rules to promote additionality principles or whether power must be purchased from a Canadian generator to be eligible—have not yet been provided.

The credit is expected to cost $4.5 billion over five years, starting in 2023 – 2024, and an additional $6.6 billion CAD from 2028 – 2029 to 2034 – 2035. The credit would apply to property that is acquired and becomes available for use on or after January 1, 2024, and would no longer be in effect after 2034, subject to a phase-out starting in 2032.

Comparing the Canadian Investment Tax Credit and American Inflation Reduction Act Tax Structures

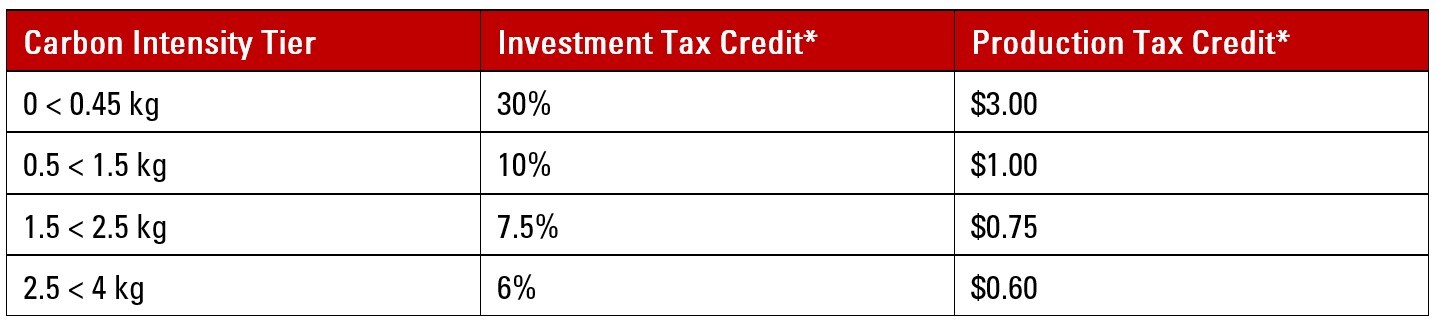

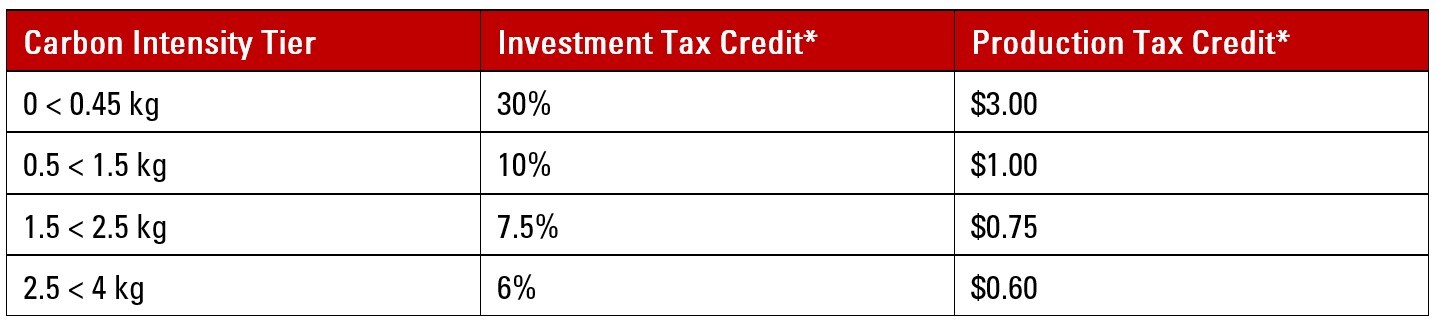

The Canadian ITC allows eligible producers to obtain tax credit equal to a specified percentage of their capital expenses (an investment tax credit). To contrast, the U.S. IRA subsidizes the production of hydrogen by allowing producers to obtain either a credit equal to a specific percentage of their capital expenses (an investment tax credit) or a tax credit equal to the specified dollar value per kilogram of hydrogen produced (a production tax credit). The IRA tax credit is determined using the following tiered structure based on life cycle carbon intensity (measured as kg of CO2e per kg of hydrogen (H2) produced):

* Note that the above ITC and PTC amounts are dependent on the facility qualifying for the 5X multiplier. This applies to facilities that have maximum net output of less than 1MW, facilities that started construction by January 29, 2023, or facilities that meet the IRA’s prevailing wage and apprenticeship requirements.

Furthermore, as discussed above, the proposed Canadian ITC is only available to producers using electrolysis or natural gas plus CCUS to produce hydrogen, whereas the U.S. IRA is process-neutral towards obtaining tax credits. Under the IRA, producers may use various technologies to become eligible for the tax credit. Nonetheless, both the Canadian ITC and U.S. IRA condition receiving credits only if emission intensities towards H2 production is lower than the 4 kg of CO2 cap.

Unlike the IRA, the Canadian ITC does not offer “bonus” credits based on a facility satisfying certain conditions of hydrogen production (e.g., location in an energy community or meeting domestic content standards). Both frameworks do, though, require producers to meet prevailing wage requirements to maximize credits.

Wage and Apprenticeship Requirements

Canada’s proposed ITC will require projects to meet certain wage and apprenticeship requirements in order to receive the maximum credits, similar to the U.S. IRA. If a business does not meet these requirements, the credit rate for each carbon-intensity tier will be reduced by 10%.

To meet these requirements, businesses must ensure all covered workers are paid a total compensation package that equates to the prevailing wage. The prevailing wage is based on union compensation—including total benefits and pension contributions—from the most recent, widely applicable multi-employer collective bargaining agreement, or corresponding project labor agreements, in the jurisdiction within which the relevant project-laborer is employed. In addition, a business must demonstrate that 10% of its total tradesperson hours for work on eligible project elements in a relevant tax year are performed by registered apprentices. These requirements would apply to work that is performed on or after October 1, 2023.

By contrast, while the IRA also contains a prevailing wage requirement, the prevailing wage is defined by reference to the U.S. Department of Labor’s published prevailing rates for relevant work in a particular locality rather than the regional union agreement. In addition, the IRA’s wage and apprenticeship requirements began on January 29, 2023, approximately eight months ahead of when the proposed Canadian ITC wage and apprenticeship requirements would become effective.

Next Steps

Presently, a date is not scheduled for Parliament to vote on Budget 2023. Although Trudeau’s Liberal Party is short of a majority in Parliament, the party is supported by the New Democratic Party, ensuring that the Prime Minister possesses the votes for Budget 2023 to pass.

Pillsbury has provided legal support on energy matters for several branches of the Canadian government, Canadian energy producers, suppliers, laboratories and constructors, and is a member of the Canadian Nuclear Association. Our team stands ready to support in-bound and out-bound investment in this vibrant and dynamic energy market.