Emerging Trends 07.27.20

Emerging Trends

China FIL: Reporting Requirements

Implementing China’s New Foreign Investment Law, Part One

Emerging Trends

Takeaways

07.27.20

The Foreign Investment Law (Article 34) provides that a foreign investment information reporting system shall be established under which foreign investors (Foreign investors) and foreign-invested enterprises (FIEs) are required to submit investment information to the competent commerce departments through the enterprise registration system and the enterprise credit information disclosure system. To implement these reporting provisions, the Ministry of Commerce (MOFCOM) and the State Administration for Market Regulation (SAMR) also issued new regulations that took effect on January 1, 2020 which establish the framework and provide guidance for the administration of reporting of FIEs establishments and changes.

Key elements:

- Foreign investors and their establishments in China are required to submit investment information to the competent commerce departments after their incorporations and during the operations of the China establishments. Among the four types of information reporting required during the operation of the foreign invested enterprises, the post-establishment initial information reporting system replaces the previous pre-establishment substantial review and approvals by the competent commerce government on foreign investments in the industries that are not in the Negative List.

- The concept of total investment and the requirements on the minimum ratio of registered capital vis-à-vis total investment (Borrowing Gap) continue to exist. The unique requirement on reporting total investment by FIEs is caused by the strict regulation on foreign loans to be borrowed by FIEs since the sum of the accumulated amount of medium and long-term (longer than one year) foreign loans and the balance of short-term (one year or less) foreign loans borrowed by an FIE must be within the balance between the total investment and its registered capital if it chooses such Borrowing Gap model.

- Foreign investors need to truthfully disclose, among others, the ultimate de facto controller(s) of the subsidiaries they establish in the PRC. The new regulations provide guidance as to the types of ultimate de facto controller(s) and circumstances under which ultimate de facto controller(s) should be identified.

For implementing the investment information reporting system under Article 34 of the Foreign Investment Law, on December 30, 2019, MOFCOM and SAMR jointly issued the Measures for Foreign Investment Information Reporting (Information Reporting Measures) which came into effect on January 1, 2020 and set forth the requirements and administration of the foreign investment information reporting system. MOFCOM, SAMR and the State Administration for Foreign Exchange (SAFE) have also issued several relevant circulars and notices with more detailed guidance on the information reporting system (collectively Reporting Notices). Among the Reporting Notices are the Notice Regarding Foreign Investor Information Reporting Related Matters (issued by MOFCOM on December 31, 2019), the Notice on Completing Annual Reporting "Multiple Reports in One" Reform-Related Work (issued by MOFCOM, SAMR and the State Administration of Foreign Exchange on December 16, 2019), and the Notice on Effective Work on Registration of Foreign Invested Enterprises for the Implementation of the Foreign Investment Law (issued by SAMR on December 31, 2019).

1. New Information Reporting System

The submission of relevant information by post-incorporation FIEs through an online system is not a new requirement. Such online systems have already been implemented since October 2016. Before January 1, 2020, the incorporation and changes of FIEs were required to be filed by FIEs through the online system to MOFCOM or its local counterpart for record. From January 1, 2020, the above record filing to MOFCOM is replaced by a new reporting system. Under the new reporting system, reporting will be done and consolidated through the SAMR registration system, which will share the information with MOFCOM and other government agencies, to avoid duplicative reporting to different government agencies. Submitting investment information report is not a precondition for the establishment of an FIE by foreign investors, nor is it a newly established procedure for administrative approval.

Under the new information reporting system, the following activities must be reported:

a. Foreign investors incorporating FIEs (Foreign Invested Enterprises) in China;

b. Foreign investors establishing representative offices in China;

c. Foreign investors acquiring stocks, shares, assets or other similar equity of a domestic Chinese company;

d. FIEs’ re-investment and establishment of subsidiaries in China; and

e. Foreign investors investing in new projects in China, individually or jointly with other investors (without forming a Chinese entity of acquiring another Chinese entity’s stock or ownership interests). The Reporting Measures and Reporting Notices do not provide a specific definition for “investing in new projects.” In general, it may refer to foreign involvement in certain highly regulated industries without establishing or acquiring an establishment in China, such as foreign investment and participation in exploration and exploitation of onshore and offshore oil in China and establishing branches of foreign banks in China.

2. Types of Reporting and Reporting Parties

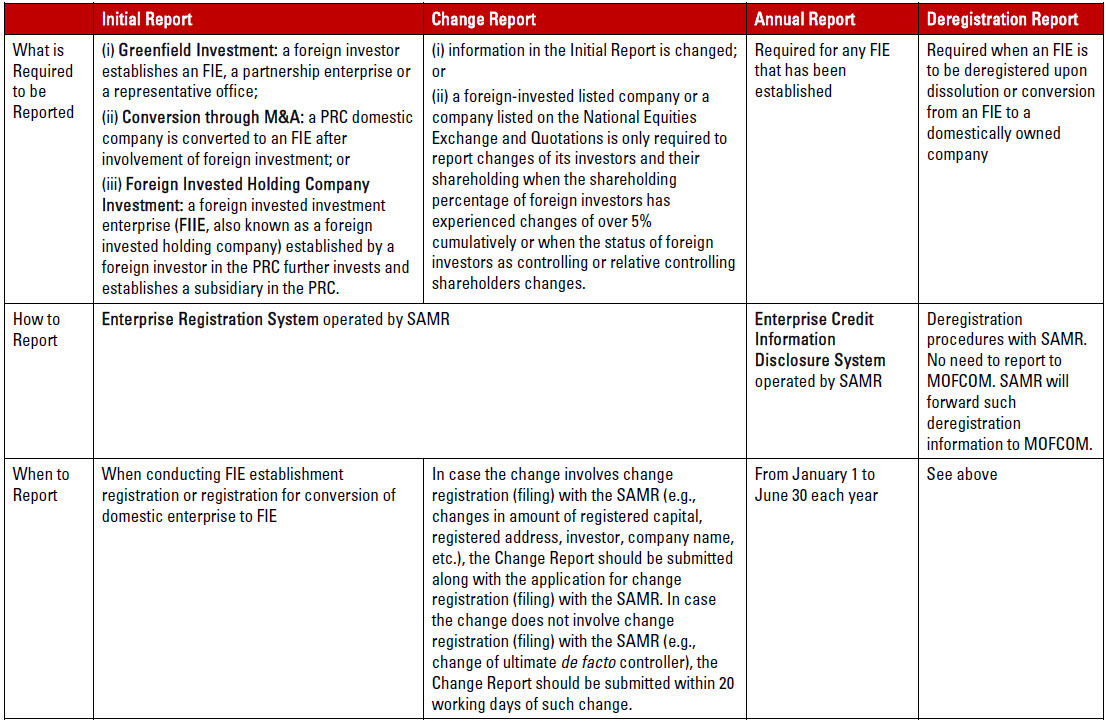

Under the Information Reporting Measures, upon incorporation and during the term and operation of an FIE, it is required to undertake the following four types of reporting: (1) Initial Report, (2) Change Report, (3) Annual Report, and (4) Deregistration Report. The table below lists the key requirements on each type of reporting.

3. Total Investment Concept Unique to FIEs

The Foreign Investment Law expressly provides that foreign investment will be treated equally with its domestic counterpart unless any laws and administrative regulations provide otherwise. However, the term “total investment” has been and is still a concept unique to FIEs during the implementation of the new Foreign Investment Law. Foreign investors should still determine the total investment of the FIE upon its establishment registration, while the registration of a domestic company never requires the reporting of the total investment.

In the sample Initial Report and Change Report forms for the investment information reporting system issued by MOFCOM, the information regarding the “total investment” of the FIE is still required to be provided to MOFCOM. In practice, the amount of “total investment” of an FIE is also required by the local counterparts of MOFCOM.

In China, all companies, regardless of whether they are foreign invested or purely domestic, are required to determine and set forth in the articles of association and register with the company registration authorities their respective registered capital. The registered capital is the fund all the shareholders contribute or subscribe to contribute to the company when they apply with the company registration authority for the incorporation of the company.

The total investment is the total amount of funds required to establish the enterprise, namely, (i) the sum total of registered capital (capital fund subscribed and to be contributed by shareholders) plus (ii) the amount of any additional funds (including domestic and foreign loans) required for the enterprise’s production or business scale. This unique requirement on reporting total investment by FIEs is caused by the strict regulation of foreign loans to be borrowed by FIEs since the sum of the accumulated amount of medium and long-term (longer than one year) foreign loans and the balance of short-term (one year or less) foreign loans borrowed by an FIE must be within the balance between the total investment of the FIE and its registered capital (see further discussion in a separate article in this series, Part Two: Accepting Foreign Loans).

4. Disclosure of Ultimate de facto Controller(s)

When submitting the Initial Report, Change Report and Annual Report, a foreign investor or FIE is required to provide information with respect to the actual controlling person, also called as the “ultimate de facto controller(s)” of the FIE. The sample Initial Report and Change Report form published by MOFCOM lists the following types of ultimate de facto controllers:

- Overseas listed company

- Overseas individual

- Foreign government entities (including government fund)

- International organization

- PRC listed company

- PRC individual

- PRC state-owned/collective enterprise

- Other

An ultimate de facto controller should be identified if he/she/it:

(1) owns, directly or indirectly, more than 50% of the equity interest, shares, assets, voting rights or other similar rights in the FIE; or

(2) owns, directly or indirectly, no more than 50% of the equity interest, shares, assets, voting rights or other similar rights in the FIE, but

a. is, directly or indirectly, entitled to appoint more than half of the members of the board of directors or similar decision-making authority of the FIE; or

b. is able to ensure that its nominees will obtain more than half of the seats of the board of directors or similar decision-making authority of the FIE; or

c. has the voting rights which are sufficient to impose material influence on the decisions of the shareholder meeting, board of directors or other decision-making authority of the FIE; or

(3) is able to decide, through contract(s), trust or otherwise, on the operation, finance, human resource, technologies, etc. of the FIE.

Any ultimate controlling entity and/or individuals that meet one of the above three criteria should be identified in the Initial Report, Change Report and Annual Report. Therefore, an FIE may have one or more ultimate de facto controllers for the purpose of the information reporting under the Foreign Investment Law.

The requirement for disclosing the ultimate de facto controller is not brand new, since it has been implemented since October 2016. The main legislative purposes of the requirement for disclosure of the ultimate de facto controller(s) of the FIEs are to prevent foreign investors from hiding the identity of the actual ultimate investor or evading any specific requirements or limitations on the ultimate de facto controllers of FIEs engaged in certain industries strictly regulated by the Chinese governments. This disclosure requirement also has certain effects on current investments by foreign investors in China.

Since the foreign investor of an FIE is required to disclose the ultimate actual controlling person behind the special purpose vehicles (SPVs) they use, the use of SPVs in an ownership structure may no longer be effective to achieve the SPVs goals.

The disclosure of ultimate de facto controller may impose cumbersome burdens on companies that have complex corporate structures. An FIE with complex corporate structures may have limited clarity as to who are the ultimate beneficial owners, such as an FIE invested by various private equity funds, venture capital funds, angel funds, family trusts or limited partnerships. We suggest that companies with complex controlling structures consult with legal counsel for assistance when making such disclosures.

The disclosure of ultimate de facto controller may also affect the variable interest entity (VIE) structure that many foreign investors adopt in investing in industries restricted or prohibited from foreign investment by the Chinese government. Prior to the Foreign Investment Law, foreign investors used the VIE structure to access Chinese industries that were restricted under the Negative List by signing a set of contractual agreements with domestic companies with licenses for operation in the restricted industries to control the actual management and operations of the business. VIE structure investors may no longer hide the identities of the actual controlling investors.

5. Conclusions

FIEs are subject to different reporting obligations going forward, which will involve submission of information into two systems (Enterprise Registration System and Enterprise Credit Information Disclosure System) administered by SAMR, with information to be shared between SAMR and MOFCOM. The timing, format and content of information to be submitted differ from what FIEs have been required to submit to MOFCOM and SAMR historically.

The Foreign Investment Law (Article 37) stipulates the penalties of noncompliance by FIEs and foreign investors of the reporting obligations. The Chinese commerce department in charge will order the foreign investors or the FIEs to make corrections within a time limit if they fail to report the required investment information. If they fail to correct within the time limit, a fine between RMB 100,000 (approximately US$14,000) and RMB 500,000 (approximately US$70,000) will be imposed. Therefore, foreign Investors and FIEs should get familiar with the circumstances when these reports should be made and what to submit under each type of the reports, and submit the reports truthfully and in a timely manner.