Emerging Trends 07.27.20

Emerging Trends

China FIL: Changes to Corporate Governance of Sino-Foreign Joint Ventures

Implementing China’s New Foreign Investment Law, Part Three

Emerging Trends

Takeaways

07.27.20

The Sino-foreign equity joint venture (EJV) is the prevailing form of corporate entity that foreign investors have adopted for their joint ventures with Chinese partners in the PRC. The EJV Law sets forth unique requirements on the various aspects of EJVs. After the PRC Company Law (Company Law) was amended for the third time on October 27, 2005 (further amendments followed in 2013 and 2018), differences arose between the EJV Law and the Company Law, in particular with respect to the corporate governance structure, decision-making authority and voting mechanism of an EJV.

Starting from January 1, 2020, when the new Foreign Investment Law came into effect, the EJV Law, together with the CJV Law, WFOE Law and their implementing rules were all abolished. As a result, EJVs are now required to comply with the Company Law, subject to a five-year transition period. Foreign investors who have existing EJVs in China should review their joint venture contracts (JVCs), articles of association (AOAs) and other corporate governance documents to identify necessary changes to comply with the Foreign Investment Law and Company Law. Foreign investors should also initiate discussions with their Chinese partners regarding such changes as soon as possible since the negotiations may take time.

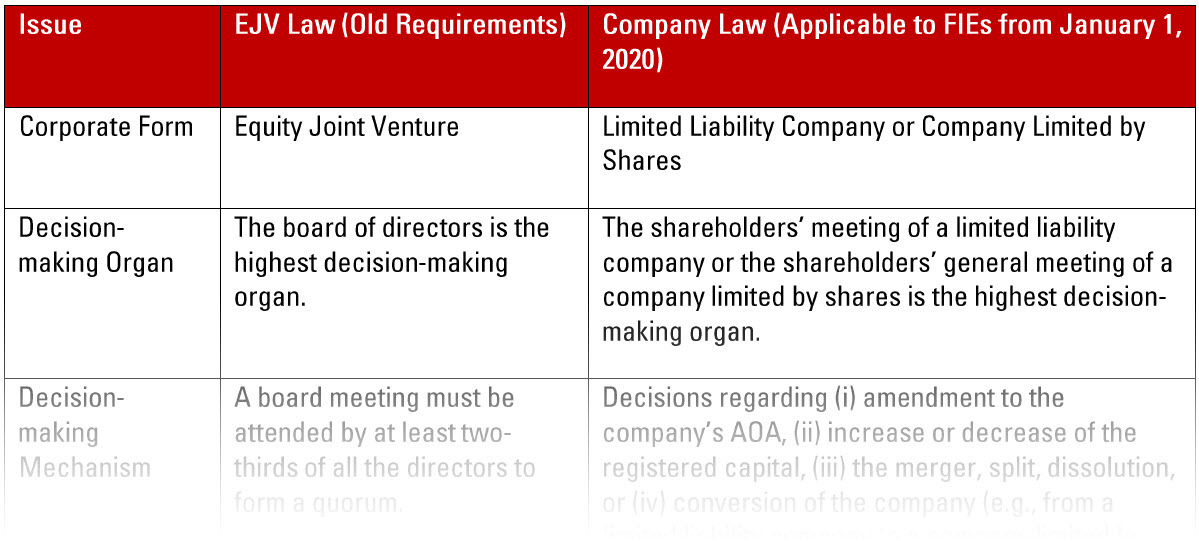

This alert introduces (i) the major differences on corporate governance requirements in EJV Law and Company Law, and (ii) several practical issues related to the design of voting mechanism and decision-making powers as a result of the application of Company Law to EJVs in replacement of the abolished EJV Law.

1. Brief Summary of Major Differences on Corporate Governance Requirements in EJV Law and Company Law

To the extent that any provisions in the JVC and AOA of existing EJVs are inconsistent with the requirements under the Company Law, they should be revised accordingly. Article 42 of the Foreign Investment Law provides for a five-year transition period for existing FIEs (including EJVs) to adjust their current organizational forms and other aspects to make necessary adjustments based on the Foreign Investment Law. Since corporate governance structure (particularly the decision-making mechanism) is typically a critical and sensitive topic during joint venture contract negotiations, we suggest that our clients do not wait until the last minute to take appropriate action. Section 2 below addresses several issues that foreign investors and their Chinese partners should be aware of in conducting such negotiations.

2. Several Noteworthy Issues

2.1 Can Shareholders Delegate Decision-making Power to the Board?

Before the implementation of the Foreign Investment Law and under the abolished EJV Law, the highest decision-making organ of an EJV was the board of directors (Board). The following matters were subject to unanimous approval by all directors attending the board meeting or in the case of a written resolution in lieu of a meeting, the approval and signatures by all the directors:

(i) amendment to the AOA of the EJV,

(ii) suspension or dissolution of the EJV,

(iii) increase or decrease of the registered capital of the EJV, and

(iv) merger or split of the EJV.

Now that the Foreign Investment Law has taken effect, the Company Law applies to EJV’s corporate governance whereby the shareholders’ meeting is now the highest decision-making organ of an EJV. Under the Company Law, the above listed matters as well as the conversion of the corporate form of an EJV (e.g., from a limited liability company to a company limited by shares) must be approved by shareholder(s) representing at least two-thirds (2/3) of the “voting rights.” Under the Company Law, shareholders shall exercise “voting rights” in proportion to their capital contribution, unless otherwise stipulated in the articles of association of the company. This means that if the AOA of an EJV does not provide otherwise, a shareholder who holds two-third (2/3) of the equity interest in a limited liability EJV may make unilateral decisions on the above important matters that previously required unanimous approval of all the board directors representing all the shareholders.

The issue here is how an existing EJV should design the voting mechanism in its AOA amendments to not only comply with the Company Law for corporate government (as referred to by the Foreign Investment Law) but also maintain its existing voting and decision-making mechanism.

Based on our experience and survey, many existing EJVs are choosing a more conservative approach to try to keep the voting rights of each shareholder the same as in the previous arrangement designed in accordance with the EJV Law, under which approach the above-mentioned important matters (which previously required unanimous approval by the Board) will be required under the amended AOA to be approved by all shareholders to be effective. This approach is especially important for minority shareholders who have less than 1/3 of the voting rights.

At the same time, since many EJVs may still want their appointed boards of directors to take the lead on decision-making, or at least initiate proposals for important matters, one practical solution is for the shareholders of an EJV to delegate certain powers to the Board for making proposals to the shareholders or making final decisions on certain matters to the extent permitted by the Company Law.

The Company Law does not expressly prohibit the shareholders’ meeting from delegating powers to the Board. However, in practice, court decisions indicate that the following two types of matters may not be delegated from the shareholder level to the Board for the Board to make final decisions:

(1) If the matter needs to be registered with the relevant company registration authority where the company registration authority requires a shareholders’ resolution in accordance with the Company Law as part of the application documents, a shareholder resolution is required and a board resolution is not sufficient. Based on the Company Law, the following matters must be approved by the shareholders:

a. Any change to the following information that is required to be included in the AOA of a company, thus resulting in an amendment to the AOA:

i. name and address of the company

ii. business scope of the company

iii. registered capital of the company

iv. names of the shareholders

v. form, amount, and schedule of capital contributions by the shareholders

vi. organization of the company and the methods of formation, authorities, and rules of procedure thereof

vii. legal representative of the company

b. split, merger, dissolution or change of corporate form of the company

(2) If the matter concerns the right to dividends to the shareholders, that matter cannot be delegated to be decided by the board.

However, in practice, the shareholders meeting can consider using the AOA to delegate to the Board the power to initiate the discussions and propose solutions (in the form of a board resolution) related to the above matters for the final verification and confirmation in the shareholders’ meeting.

For matters other than the above matters that must be approved by shareholders’ meeting, the shareholders’ meeting of an EJV may consider delegating to the Board for final decision making.

2.2 Must Voting right be Proportionate to the Subscribed or Actual Paid-in Capital Contribution Percentage?

Article 42 of the Company Law provides that the shareholders of a company shall exercise their voting rights at shareholders’ meetings in proportion to their respective capital contribution percentages, unless otherwise specified in the company’s AOA.

As a practical matter, it is likely that foreign investors and their Chinese partners may want to keep their voting rights in proportion to their respective capital contribution percentages since this approach is fair and straightforward. While the Company Law is silent in this regard, the prevailing view is that “capital contribution” under this Article 42 refers to subscribed capital of the shareholders rather than actual paid-in capital.

However, the parties are allowed to establish alternative voting mechanisms to the extent not contrary to the Company Law. For example, the shareholders can specify that their voting rights should be in proportion to their respective paid-in capital contribution percentages (rather than subscribed capital).

2.3 Should Profit-Sharing Rights be Proportionate to the Actual Paid-in Capital Contribution Percentage? Can Shareholders Set Forth Profit-Sharing Arrangements Not in Proportion to Equity Ratio?

According to Article 34 of the Company Law, the default position is that the dividends shall be distributed to shareholders in proportion to their respective actual paid-in capital. However, the shareholders are allowed to agree otherwise.

The Company Law (as referred to by the Foreign Investment Law to be applicable to the FIEs and EJVs’ profit sharing and other corporate governance matters) only provides for one class of equity for limited liability companies, and therefore the concepts of “common equity (shares)” and “preferred equity (shares)” do not exist under current PRC law and practice for limited liability EJVs. However, the AOA of a company may still provide for “preferential rights” for shareholders.

In terms of voting right, for example, the AOA may provide that a shareholder who owns a minority percentage of the equity interest (e.g. 30%) possesses veto rights on certain matters including those that must be approved by shareholder(s) representing at least two-thirds (2/3) of the voting rights.

In practice, in terms of profit sharing right, for example, a shareholder may also be provided under the AOA of an EJV with the right to enjoy a larger share of the dividends (e.g. 70%) as compared to its shareholding percentage (30%).

Based on our consultations with the company registration authorities in some of the major cities in China, the officials at the company registration authorities normally will not interfere with or challenge voting rights and profit-sharing arrangements that are not in proportion to the shareholders’ equity ratio of an EJV, as long as the shareholders reach mutual agreement on such arrangement.

However, the flexibilities for voting rights and profit sharing rights discussed above may not be feasible for EJVs that are engaged in businesses listed in the Negative List of industries for foreign investment. This is because that the joint venture contracts and AOAs of the EJVs in such industries (within the Negative List) will still be subject to substantial review and regulatory approval by the Ministry of Commerce or its counterparts (as well as other governmental authorities if applicable) before the process of company registration with the company registration authorities. During such substantial review and approval, the approval authorities may challenge the arrangement of flexible voting rights and profit sharing rights that are not in proportion to the equity ratio, in particular for EJVs in which the Chinese shareholders are required to take controlling majority shareholding.

2.4 How About Equity Transfer to Third Parties?

Under the EJV Law, unanimous consent of all other shareholders was required if a shareholder wants to transfer its equity interest in the EJV to a third party. The other shareholders had the right of first refusal to purchase the equity interest to be transferred to the third party. The terms and conditions of the proposed transfer to the third party could not be more preferential than those of the proposed transfer to the other shareholders.

The Company Law provides for more flexible conditions on equity transfer to third parties. Based on Article 71, consent of more than half of the other shareholders is required if a shareholder wants to transfer its equity interest to a third party unless otherwise provided by the AOA. The term “half” as used in this article refers to the number of shareholders rather than the capital contribution percentage of the shareholders. For example, if an EJV has five shareholders and one shareholder wants to transfer all of its equity interest to a third party, consent from at least three of the other four shareholders is required absent any provisions to the contrary in the AOA. The shareholder that wants to transfer shall notify the other shareholders in writing for their consent. Failure to reply by any of the other shareholders within 30 days upon receipt of the written notice shall be deemed as consent to the transfer. Where at least half of the other shareholders do not consent to the transfer, such non-consenting shareholders shall purchase the equity interest to be transferred. Failure to purchase the equity interest shall be deemed as consent to the transfer.

3. Conclusions

Although there is a five-year transition period for EJVs to change their corporate governance structure, we suggest that foreign invested enterprises (including EJVs) in China should start to discuss among their shareholders how to convert to the appropriate corporate governance arrangement, and they should update their articles of association and any shareholder contracts to comply with the PRC Company Law as referred to by the Foreign Investment Law. Joint ventures may face more challenges than wholly foreign owned enterprises, since the required adjustments will involve revisions to the joint venture contracts and possible renegotiations on corporate governance issues. Foreign investors in joint ventures should have a plan for how to approach their JV partners about the adjustments required, in particular, if the foreign investors also have other proposed updates to the joint venture contracts from a commercial perspective.

Please note that there is no five-year transition period for new investments by foreign investors. Greenfield investments after January 1, 2020 as well as M&A transactions not already completed before December 31, 2019 are required to comply with the post-FIL requirements. Document templates will need to be established. We suggest foreign investors consult with experienced legal counsel to start the process of documents preparation/updates and negotiation with Chinese partners.