Alert 01.24.22

FTC Announces Largest-Ever HSR Threshold Increase for 2022 Transactions

Size-of-transaction threshold under Hart-Scott-Rodino Act will increase to $101 million in Federal Trade Commission’s largest threshold increase ever.

Alert

Alert

01.09.23

The Merger Filing Fee Modernization Act (MFFM Act), included in the year-end omnibus spending bill that President Biden signed into law on December 29, 2022, updates the fee structure for filings submitted pursuant to the Hart-Scott-Rodino Antitrust Improvements Act (HSR Act) for the first time since 2001.1 Under the HSR Act, parties to certain mergers and acquisitions are required to report transactions valued in excess of the lowest filing threshold, currently $101 million, to the Federal Trade Commission (FTC) and Department of Justice (DOJ) and wait a proscribed period of time before closing.

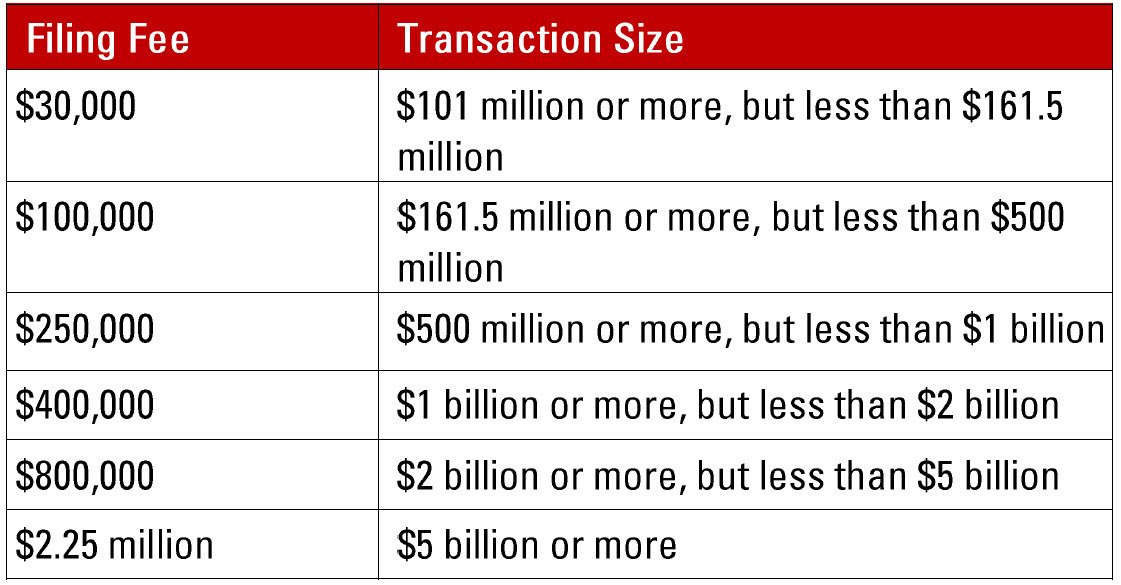

Pursuant to the MFFM, the initial fee structure for HSR Act filings will be as follows:

The new filing fees will result in an increase of at least $120,000 for reportable transactions valued at $500 million or more, a decrease of $15,000 for those valued less than $161.5 million, and a decrease of $25,000 for those with a value of at least $202 million but less than $500 million.

Prior to the passage of the MFFM Act, the filing fees remained constant each year, even though the transaction value thresholds either increased or decreased based on yearly changes to the Gross National Product. Going forward, the filing fees will be updated on a yearly basis, but the statute only allows for fee increases. The fees will be increased by an amount equal to the percentage increase, if any, in the Consumer Price Index for the year then ended over the level for the fiscal year ending September 30, 2022.

The new fees are expected to go into effect in 2023. In the meantime, parties should continue to submit payments under the prior filing fee structure until the FTC’s Premerger Notification Office posts guidance regarding the effective date for the new filing fees.

The change in the filing fee structure is expected to infuse an additional $1.4 billion in funding over the next five years for the antitrust agencies to implement the Biden administration’s aggressive antitrust agenda and allow the agencies to investigate transactions that might not otherwise have received a prolonged investigation. See Client Briefing: Biden’s Blueprint for Aggressive Antitrust Enforcement.

Once the new fees go into effect, parties contemplating high-value transactions will have a few additional things to consider when negotiating transaction agreements and deciding when to submit their HSR filings. Per the HSR Act regulations (16 C.F.R. 803.9(a)), buyers are responsible for paying the filing fee and often default to paying the entire fee. The transacting parties, however, are permitted to negotiate a different payment structure, and this might become more commonplace for high-value transactions, with buyers looking to offload some of the financial risk. In addition, parties are permitted to submit HSR filings based on an executed letter of intent, which is often beneficial when parties are looking to sign and close. Without deal certainty, however, parties might be less willing to risk paying substantially higher fees prior to execution of a definitive agreement, and filing on a letter of intent might only be reserved for lower-valued deals.

Also included within the MFFM Act is a requirement for parties submitting HSR Act filings to disclose any subsidies received from economic and strategic adversaries of the United States, referred to as “foreign entities of concern,” including entities owned or controlled by China, Iran, North Korea, and Russia, as well as entities on the Specially Designated Nationals and Blocked Persons List, which is maintained by the Department of the Treasury. This reporting requirement will not go into effect until the FTC, with the concurrence of the DOJ, promulgates a rule requiring this disclosure.

Pillsbury recently published an FTC alert on worker non-competes.

1. Current HSR filing fees are as follows: (1) $45,000 – transactions valued >$101 million but <$202 million; (2) $125,000 – transactions valued ≥$202 million but <$1,009.8 million; and (3) $280,000 – transactions valued ≥$1,009.8 million.