Press Release

Pillsbury Releases Climatetech Investment Trends Report

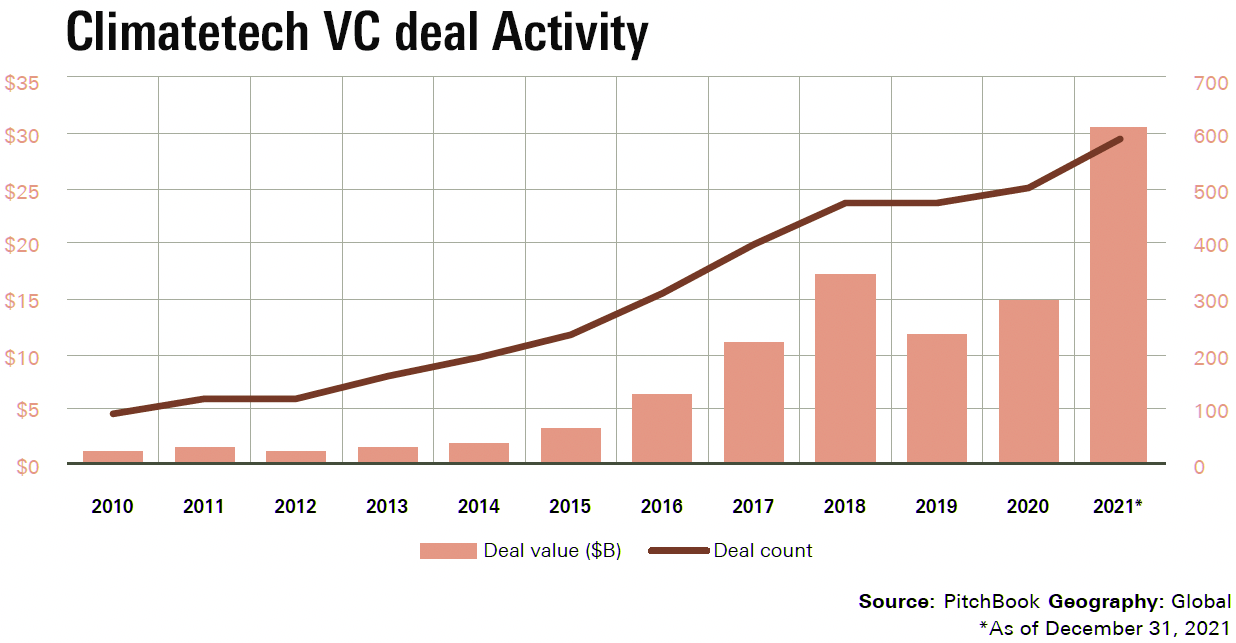

New PitchBook data shows record surge of liquidity in 2021, with transactions in climatetech sector up 100 percent and financings more than doubling

Press Release

Press Contacts: Erik Cummins, Matt Hyams, Taina Rosa, Olivia Meyer

03.04.22

Pillsbury has published the first installment of a new three-part climatetech research series based on PitchBook’s proprietary Venture Monitor methodology, also featuring exclusive commentary from three of the firm’s leading energy transition lawyers. “Climatetech: Investment Trends, Market Analysis & Authoritative Commentary” analyzes investment and exit trends within this burgeoning field.

Pillsbury partners Christina Pearson, Elina Teplinsky and Jorge Medina feature in the report as part of an extensive Q&A where they provide comprehensive insight on innovation, impact, tax incentives and more.

“I am seeing U.S.-based strategic investors investing in foreign climatetech startups, and foreign investors investing in U.S.-based climatetech entrepreneurs,” said Christina Pearson, a Corporate partner who regularly represents companies and investors in the climatetech space. “Climate change is a global issue, and knowing that these technologies are being pursued globally is exciting.”

In 2021, venture investment in climatetech exceeded expectations, surging past $30 billion over nearly 600 transactions. According to the report, the growth represented a year-over-year increase of more than 100 percent in deal value and close to 18 percent in deal count. Nontraditional and corporate players participated in major proportions of climatetech deals in terms of both value and count, signifying a broadening base of investors active within the sector.

“We are starting to see more pragmatic solutions to decarbonization, like balancing the increase of renewables in the energy mix with clean baseload energy, such as small modular reactors,” said Elina Teplinsky, Pillsbury’s Energy Industry Group deputy leader. “There is also recognition that we need large-scale production of clean hydrogen to decarbonize hard-to-abate sectors like transport, industry and buildings; that had led to significant investment into hydrogen-related technologies and projects.”

Key findings in the report’s trend data demonstrate three primary themes driving the growth of the climatetech investment market:

- The increasing diversification of the types of investment firms active in climatetech, with nontraditional investors (such as hedge funds and sovereign wealth funds) joining traditional venture firms already active in the industry.

- The expanding array of successful climatetech subsegments experiencing success thanks to slow but steady technical advances throughout the 2010s.

- Support for climatetech innovation leading to the accelerated deployment of related technologies by public financial institutions, asset managers, governments, consumers and others.

Jorge Medina, the co-leader of Pillsbury’s Renewable Energy practice, added: “What is most exciting to me is how these advancing technologies—and the diminishing costs associated with them—create so much more opportunity to scale. We saw this happen with solar … now we are starting to see [it] in other areas at a quicker pace, such as in the e-mobility and electric vehicle market.”

Pillsbury works in close coordination with clients around the world and across industries as they evolve and adapt to the climate needs of the moment. Our client base includes companies representing virtually every aspect of the global energy spectrum, from long-established Fortune 50 energy and transportation corporations driving cutting-edge research into cleaner and sustainable energy solutions, to cleantech innovators pushing the boundaries of what can be achieved to reduce carbon impacts and adapt to a changing climate. For more information and insights about the energy transition, click here.