Alert 06.21.18

SEC Directed to Increase Rule 701 Disclosure Threshold to $10 Million

Increased Rule 701 threshold provides greater flexibility and reduces compliance costs for non-reporting companies.

Alert

Alert

10.25.18

On July 18, 2018, the Securities and Exchange Commission (SEC) published a concept release soliciting comment on ways to modernize and simplify Rule 701 under the Securities Act of 1933. In a letter dated September 21, 2018, Airbnb, Inc. responded to the concept release and proposed that a new exemption be created under Rule 701(c) that would apply specifically to grants by sharing economy companies to their participants. Airbnb refers to this exemption in its letter as the “Sharing Economy Award Exemption.” Uber Technologies, Inc. followed with a letter to the SEC on October 11, 2018, in which it similarly encouraged the SEC to expand Rule 701 and Form S-8 to cover the independent contractors that use its technology to deliver services.

Background

Rule 701 is the principal exemption from registration for offerings of securities under compensatory plans by non-SEC reporting domestic or foreign issuers to individual employees or other service providers in the United States. Rule 701 exempts from registration offers or sales of securities made to employees, independent contractors, advisors or de facto employees where such offers or sales are compensatory in nature and not for the purpose of raising capital for the issuer. SEC-reporting issuers, on the other hand, are not eligible to rely on Rule 701 and, instead, are required to file a registration statement on Form S-8 with the SEC unless another exemption from registration (such as Regulation D) is available.

One of the key questions raised by the SEC in its concept release is whether Rule 701 should be revised to exempt the offer or sale of securities to service providers who do not enter into traditional employment relationships with the issuer—those who participate in the so-called “gig economy.”

For a summary of Rule 701 and the SEC concept release, see our articles “SEC Directed to Increase Rule 701 Disclosure Threshold to $10 Million” and “A New Era in Compensatory Equity Offerings?”.

The Rise of the Gig Economy

According to the SEC concept release, these new types of workplace arrangements include short-term or freelance arrangements, where the individual—rather than the company—sets the work schedule. Typically, this involves the individual’s use of a company’s internet “platform” for a fee to provide peer-to-peer services such as lodging, ride-sharing, food delivery, household repairs, dog-sitting or tech support. An individual who provides services or goods through these platforms may have similar relationships with multiple internet platforms, through which the individual may engage in the same or different business activities.

Individuals participating in these arrangements may not be employees, consultants, advisors or de facto employees under Rule 701 and therefore may not be eligible to receive securities in compensatory arrangements under Rule 701. However, the SEC recognizes that companies may have the same compensatory and incentive motivations to offer equity compensation to these individuals.

In the case of Airbnb, the individuals engaged in non-traditional labor relationships are hosts who use its marketplace to offer accommodations and experiences. In the case of Uber, on the other hand, these individuals are drivers and delivery partners who, as independent contractors, provide services to users of Uber’s platform.

Employee vs. Independent Contractor

An individual is in a de facto employment relationship with the issuer—and, therefore, eligible to receive securities under Rule 701—if the individual provides services that traditionally are performed by an employee, with compensation paid for those services being the primary source of the individual’s earned income. Uber was extremely careful in its comment letter not to equate its relationship with its drivers and delivery partners to that of a de facto employment relationship. Presumably, this is because of the challenges it has faced in the U.S. in classifying such individuals as independent contractors for tax and other purposes.

However, Uber does argue in its comment letter that the requirement that compensation for a certain job be the worker’s primary source of income should be irrelevant in assessing whether the worker should be able to receive securities in a non-capital raising context. Instead, Uber argues that a substantial financial relationship, the availability of key financial information and the absence of capital raising as an objective should be a sufficient basis for allowing companies to issue securities as compensation to independent contractors in reliance on Rule 701 and pursuant to Form S-8.

An independent contractor qualifies as an eligible offeree or purchaser under Rule 701 if the independent contractor provides bona fide services to the issuer of the securities or its parents, majority-owned subsidiaries or majority-owned subsidiaries of the issuer’s parent. Uber believes that, as its drivers and delivery partners use online platforms to deliver services, the requirement of bona fide services should not be a prerequisite for a person to receive securities as compensation under Rule 701 or Form S-8.

Sharing Economy Award Exemption

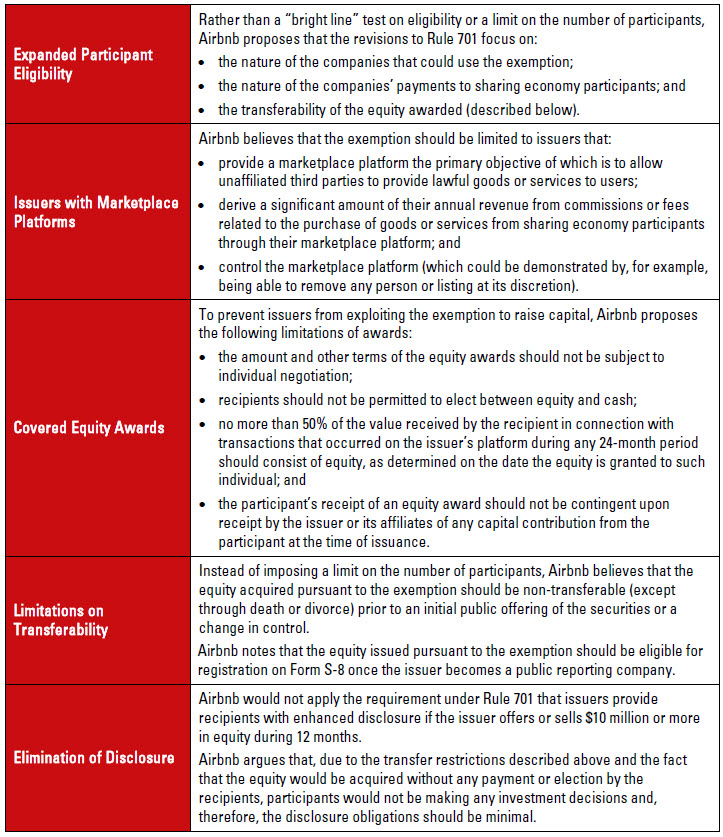

The Sharing Economy Award Exemption proposed by Airbnb in its comment letter would be a new sub-exemption under Rule 701(c). Awards granted under this sub-exemption would be more restricted than those currently available under Rule 701, and only those companies meeting certain additional criteria would qualify to grant such awards. As proposed by Airbnb, the key features of the Sharing Economy Award Exemption would be:

Avoiding Registration as a Public Company

Rule 12g5-1(b)(1) of the Securities Exchange Act of 1934 requires that companies register their equity securities under the Exchange Act after they have more than 2,000 “holders of record” or 500 “holders of record” who are not accredited investors. Rule 12g5-1(a)(8)(i)(B) contains a safe harbor permitting issuers to exclude individuals who received their shares pursuant to Rule 701(c) from the definition of “held of record” for the purposes of determining whether an issuer is required to register a class of equity securities.

In its comment letter, Airbnb argues that any participants who receive equity under the Sharing Economy Award Exemption should be excluded as holders of record for purposes of Rule 12g5-1(b)(1) of the Exchange Act. Airbnb notes that, if sharing economy participants are not excluded as holders of record, then few, if any, sharing economy companies (including Airbnb, which reports over five million listings) would find the proposed revisions to Rule 701 useful. (Because Uber proposes to rely on the existing Rule 701(c) provisions, it does not need to propose a new safe harbor under Rule 12g5-1.)

Discussion – Top issues for the SEC

Is there an investment decision? As the SEC evaluates Airbnb’s and Uber’s proposals, one issue that it will need to consider is whether a sharing economy participant does in fact make an investment decision in connection with an equity award, either at the time of grant or subsequently. In its comment letter, Airbnb argues that the limitations on the type of equity that may be awarded under the Sharing Economy Award Exemption should prevent the transaction from involving an investment decision by the recipient and, therefore, that minimal or no disclosure needs to be given to recipients.

The Rule 701 exemption is based not on a conclusion that compensatory awards do not involve offerings of securities and investment decisions by participants, but on a regulatory judgment that, notwithstanding the existence of an investment decision, compensatory awards should require less regulation, and less disclosure, than capital-raising offerings. It is quite possible that broad-based grants to participants in a platform such as Airbnb and Uber may not involve an investment decision, but that will be a judgment based on the specific terms of the compensatory plan.

What disclosure should be required? Airbnb argues that the disclosure required by Rule 701(e) for issuers providing more than $10 million in equity compensation in any 12-month period (which would include financial statements prepared on at least a quarterly basis for companies engaging in continuous compensatory offers) would be burdensome to small companies and could act as a deterrent to use of the Sharing Economy Award Exemption. There is certainly room within Rule 701 for a revised standard of disclosure, more directly tied to the characteristics of the offerees and the interests being granted, than that currently provided by Rule 701(e). The SEC’s invitation for comments has given Airbnb the opportunity to propose a revised standard.

Provision of bona fide services. Uber’s letter notes that Rule 701 requires that the individual who will receive securities as compensation provide bona fide services to the issuer, its parents, its majority-owned subsidiaries or majority-owned subsidiaries of the issuer’s parent. Uber argues that the “bona fide services” requirement should not be a prerequisite for a person to receive securities as compensation pursuant to Rule 701 or Form S-8. As Uber notes, a key part of its business model is that the service providers, such as those who use the Uber platform to provide services, are independent contractors who use its technology to deliver services, not employees of Uber. Uber’s argument is one of the central reasons why Rule 701 should be adapted to the “gig economy.” Uber would not argue that its drivers are offering bona fide services to Uber, but the drivers are certainly offering bona fide services to users of Uber’s platform. Recognizing that would be an important step in the SEC’s recognition of the gig economy, and drafting a new regulatory standard should be a priority for rulemaking.

The “primary source” requirement. Uber argues that the question of whether compensation for a certain job is the worker’s primary source of income should be irrelevant in assessing whether the worker should be able to receive securities under a compensatory plan. This argument is clearly correct, particularly in the context of an entrepreneurial economy in which individuals earn income by providing services under a variety of different platforms. The text of Rule 701 does not contain a “primary source” requirement; the concept emerged in the 1999 SEC release that amended the definition of “consultants and advisors” permitted as offerees under Rule 701 (SEC Rel. 33-7645 (February 25, 1999)), and that took the dramatic step of withdrawing a number of SEC staff letters that had approved the treatment of independent agents, franchisees and salespersons as “consultants or advisors” for purposes of Rule 701. The release drew a firm line limiting the use of Rule 701 for offers to non-employees to “de facto employees,” meaning a non-employee “providing services that traditionally are performed by an employee, with compensation paid for those services being the primary source of a person’s income.”

Recognition of the fact that the gig economy structure has permeated the economy, however, should mean that it is time to reconsider Rel. 33-7645, and to permit participants in a sharing economy platform to receive compensatory grants under Rule 701 even if the compensation they receive from the platform is not their primary income source. Revision of this standard also should be a priority of the SEC’s rulemaking process.

Amendments mirrored in Form S-8. Uber correctly points out that any amendments to Rule 701 should be mirrored in Form S-8. The SEC staff letters that had expanded the definition of “consultants and advisors” under Rule 701 had created an uncomfortable tension between the disparate treatments of that phrase under Rule 701 and Form S-8, which were reconciled in 1999 by a rollback of the staff letters under Rule 701, in SEC Rel. 33-7645. Administrative consistency requires that revisions to eligibility to participate in compensatory plans under Rule 701 should be mirrored in Form S-8.

We will continue to monitor developments in this area.