Alert 03.07.25

Alert

USTR Section 301 Shipbuilding Reprised

Takeaways

05.09.25

On April 17, 2025, the Office of the U.S. Trade Representative (USTR) published a Notice of Action and Proposed Action in its Section 301 investigation finalizing aspects of USTR’s responsive measures to China’s targeting for dominance of the maritime and shipbuilding industries. The Notice narrows the fees and service restrictions USTR proposed in March, as discussed in our previous article. Fees on Chinese-owned and operated vessels will start to take effect within 180 days, with incremental increases over three years. Meanwhile, in response to substantial comments, USTR delayed and limited the scope of its service restrictions on exports, starting with a requirement that one percent of all exports by vessel of liquified natural gas (LNG) be on U.S.-flagged and U.S.-operated vessels effective April 2028, and on U.S.-built, U.S.-flagged and U.S.-operated vessels starting in 2029.

The Notice also proposes new tariffs on Chinese origin ship-to-shore (STS) cranes and cranes and parts containing Chinese components. Interested parties may submit comments in response to these proposed measures before May 19.

The measures in the Notice, if implemented, will have significant impact on international commerce and the maritime industry, including how exporters and importers and the vessel owners, operators, charterers and investors that service them structure their global shipping operations and contractual and financing arrangements.

Background

As described in our previous alert, on February 21, USTR promulgated a series of proposals in connection with its investigation under Section 301 of the Trade Adjustment Act of 1974. USTR had launched its investigation in April 2024 following a petition from labor unions alleging that unfair and anticompetitive practices by the People’s Republic of China (China or PRC) in these sectors harmed U.S. commerce and stifled the development of U.S. shipbuilding. In response, USTR proposed measures seeking to resuscitate U.S. shipbuilding while discouraging the use of Chinese-built vessels and Chinese operators at U.S. ports. These included fees at a rate of up to $1 million per vessel on Chinese maritime transport operators and up to $1.5 million on operators with fleets comprising Chinese-built vessels. USTR also recommended restricting access to U.S. port infrastructure for Chinese logistics firms (such as LOGINK) and banning their software from U.S. terminals.

During the comment period, USTR received significant feedback from both domestic manufacturing groups and unions generally supporting the measures, and traders and companies reliant on U.S. imports cautioning that port fees risked increasing costs for U.S. businesses and consumers and disrupting maritime trade. Commenters noted the particular burden of fees that would apply to non-Chinese operators, including allied trading partners, as a result of the commission of a vessel from a Chinese shipyard or inclusion of a Chinese-built vessel in their fleet even when such vessels would not dock at U.S. ports.

Commenters also observed that the broad requirement for U.S. exporters to use U.S.-flagged and built vessels would face substantial economic and practical obstacles. U.S. flagged, operated and built vessels tend to be significantly more expensive to charter than foreign flag vessels, and the U.S. commercial fleet lacks capacity to transport certain goods altogether. One commenter observed for example that there are no U.S.-built vessels and only one U.S.-flagged LNG vessel.

As described below, while USTR moved forward with much of its proposal, it modified its proposed fees and service restrictions in significant respects.

First Phase: Chinese Vessel Fees

The Notice provides three categories of port fees, two focused on Chinese vessel owners or operators and a new fee on foreign-built car carrier vessels. No fees will be assessed for the first 180 days, or until mid-October 2025, with incremental increases to follow over several years.

For each fee, if a vessel makes multiple U.S. entries before transiting to a foreign destination, it shall be assessed per rotation or string of U.S. port calls. The fees and requirements outlined below are not cumulative—a vessel will be subject to either: (a) one of the three fees noted above; or (b) a requirement under Annex IV. Fees can be assessed up to five times per year per operator.

1. Annex I: Phased fee on Chinese vessel operators and vessel owners

CBP will collect a fee based on the net tonnage on Chinese-owned or operated vessels. USTR initially proposed fees on Chinese vessel operators, but in response to comments, USTR concluded that “[i]mposing a fee on a vessel owner may more directly influence purchasing decisions and exact more financial pressure on Chinese shipbuilders, thus providing an even more significant source of leverage to encourage China to eliminate the investigated practices.” As a result, the final action added a fee paid by operators based on Chinese ownership of the vessel, regardless of the nationality of the operator.

If a vessel makes multiple U.S. entries before transiting to a foreign destination, this fee is assessed per rotation or string of U.S. port calls. The fee will be set at $0 for the first 180 days, will then be set at $50/NT, and will increase incrementally over the next three years, as set out in Annex I to the Notice.

Annex I provides definitions for “vessel owner,” “vessel operator” and “vessel owner of China.” The definitions of vessel owner and operator are tied to the name identified on the Vessel Entrance or clearance Statement under CBP Form 1300. (See Notice, Annex I, subsection (c) and (d).) Meanwhile, USTR provided a broad definition of a vessel owner of China that would include not only PRC, Hong Kong, or Macau citizens or entities but also entities with part Chinese ownership or other indicia of PRC government control. (See Notice, Annex I, subsection (e) for a complete list.) Due diligence should be conducted on any vessel used to ship goods to the United States and whether the ownership structure of the vessel triggers the corresponding fees.

2. Annex II: Phased fee on Chinese-built vessels

USTR imposed a fee on operators of Chinese-built ships based on the higher of (i) a fee based on the net tonnage of the vessel, or (ii) a per-container fee. Effective October 14, 2025, the fee will be set at $18 per ton for the arriving vessel or $120 for each container discharged, with the fees increasing incrementally over the next three years. Again, this fee does not stack on top of fees for Chinese-owned or operated vessels; if the vessel qualifies as Chinese-built, the Annex II schedule will apply.

USTR carved out significant excepts for certain Chinese-built vessels that will not be subject to the fee. These include: certain vessels enrolled in certain U.S. Maritime Administration programs (e.g., the Maritime Security Program and Tanker Security Program); vessels arriving empty or in ballast; vessels below certain size or capacity thresholds; vessels engaged in short sea shipping (i.e., voyages of less than 2,000 nautical miles from certain U.S. ports); certain U.S.-owned companies’ vessels; and certain specialized export vessels. A vessel operator is eligible for a fee remission for up to three years if it orders and takes delivery of a U.S.-built vessel of equivalent size. Note that these exceptions do not apply to Annex I fees on Chinese-owned and operated vessels.

Consistent with the emphasis on supporting U.S. shipbuilding in the proposed actions, the Notice provides that a vessel operator is eligible for a fee remission for up to three years if it orders and takes delivery of a U.S.-built vessel of equivalent size.

3. Annex III: Fees on foreign-built car carrier vessels

Effective October 14, 2025, a fee in the amount of $150 per Car Equivalent Unit (CEU) capacity of the entering non-U.S.-built vessel, effective as of October 14, 2025. Consistent with the broader industrial policy initiative to create a robust American shipbuilding sector, USTR hopes this fee will incentivize U.S.-built car carrier vessels.

An operator could receive a fee remission for up to three years if it orders and takes delivery of a U.S.-built vessel of equivalent or greater capacity. A vessel operator will be eligible for a fee remission for three years if it orders and takes delivery of a U.S.-built vessel of at least equivalent size.

Second Phase: LNG Service Restrictions

USTR’s original proposal would have required a set percentage of all U.S. exports to sail on U.S.-flagged and built vessels, incrementally increasing from 2026 onwards. Commenters stressed that USTR should consider alternatives in light of significant capacity constraints counseled, including: a delay in implementation; exemptions for specific products; exemptions for non-Chinese operators with Chinese ships already on order; and an exemption for ships built by U.S. allies. Several comments noted possible harm to regional trade and requested that that the proposals be limited to trans-oceanic vessels. Other commenters raised significant concerns about how the service restriction would be implemented and enforced.

In response, USTR limited the scope of the proposed restrictions to U.S. LNG exports, with restrictions on maritime transport of LNG to begin on April 17, 2028, and gradually increasing over 22 years. (See Annex IV.) This follows proposed Congressional legislation to incentivize the U.S. production of LNG vessels, as noted in our prior piece.

Under USTR’s final action, an operator or its non-compliant LNG vessel may be licensed to operate for up to three years as if the requirement is met, if that operator orders and takes delivery of a U.S.-built LNG vessel of equivalent or greater capacity within that time period. USTR indicated that it will provide further notice and technical information regarding the U.S.-flagged and built LNG vessel requirement after consultation with the interagency, including the U.S. Department of Energy (DOE), which is responsible for authorizing U.S. exports of natural gas.

New Proposed Tariffs on Cranes

As directed by the Executive Order entitled Restoring Maritime Dominance (the EO), USTR has proposed additional duties on STS cranes and certain parts from China. China currently accounts for approximately 80% of all STS crane production, led by Shanghai Zhenhua Heavy Industries Company Limited (ZPMC), a state-owned enterprise with significant ties to the Chinese Communist Party and the PRC military. As USTR explained, upon reviewing findings from its Section 301 report, over-reliance on Chinese production of STS cranes and other maritime components “may create opportunities for China to manipulate the supply of critical components or materials essential to U.S. maritime infrastructure.”

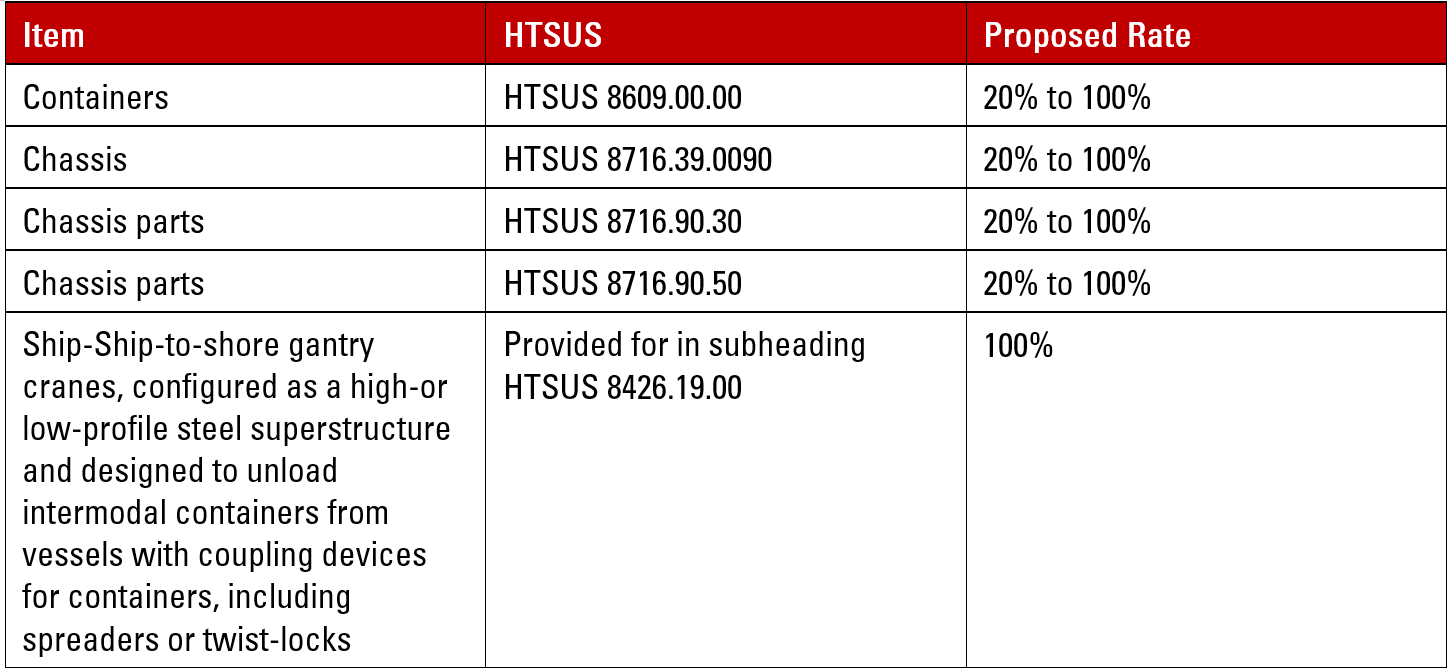

Specifically, USTR’s proposed action would impose duties on the following products of Chinese origin:

Moreover, the proposed duties would apply whenever one or more of a set of components, assembly or sub-assembly of such STS cranes contained products of Chinese origin. As a result, a final assembled STS crane with a different country of origin—due to a substantial transformation or otherwise—could still be dutiable under UTSR’s proposal based on its Chinese components. This creates both opportunity and risk for the roughly 20% of the non-Chinese market, concentrated in Finland, South Korea and other countries, depending on the extent to which they rely on Chinese parts in their supply chain.

USTR is requesting comments regarding the following in connection with the proposed actions:

- The specific products to be subject to increased duties, including whether the tariff subheadings and product descriptions listed above should be retained or removed, or whether tariff subheadings not currently on the list should be added.

- The level of the increase, if any, in the rate of duty.

- Whether the increased duties should take effect in 180 days, or over a phase-in period of six to 24 months.

USTR also requests that commenters specifically address whether the action would be practicable or effective to obtain the elimination of China’s acts, policies and practices. Comments are due on May 19, and a hearing will also be held that day.

Per the EO, USTR is directed to engage with allies and partners with respect to their potential imposition of the proposed tariff measures. These discussions could be part of the ongoing trade negotiations during the 90-day pause of the reciprocal tariffs.

What’s Next?

USTR’s Notice of Action leaves several important questions for future resolution. These may culminate in customs instructions or additional Federal Register notices from CBP over the 180-day implementation period, or later Customs rulings and litigation. As a few illustrative examples:

- The proposed tariffs on cranes would apply not only based on Chinese-origin final imports but also Chinese components of STS cranes of other origin. This departure from the WTO/WCO country of origin and substantial transformation framework follows other recent measures emphasizing the national content of subparts or components of finished products, such as heightened Section 232 duties on any products containing aluminum ingots smelt and cast in Russia and duty reductions in the reciprocal tariffs for the U.S. content of foreign imports. Substantial questions remain outstanding as to how Chinese-origin components of completed STS cranes and chassis would be identified and declared given the complex supply chains for the advanced manufacturing articles. These issues may be explored during the comment period in advance of the finalization of the action.

- The exceptions in Annex II apply only to Annex II fees applicable to vessel operators of Chinese-built vessels (regardless of the operator or owner). However, those exceptions have potentially broad applicability. For example, with respect to the exception in subsection (vi), USTR did not define the phrase “chemical substances in bulk liquid forms,” which could apply to a wide range of products (such as most refined products).

- Questions remain as to how the service restrictions on transport of LNG in Annex IV will be enforced. Annex IV requires a certain percentage of LNG intended for export by vessel to be on a U.S.-built vessel, starting in April 2028. The only penalty contemplated in the Notice of Action for failure to abide by the percentage requirement is the suspension of LNG export licenses. (See Annex IV, subsection (j).) Such licenses are granted by both the U.S. Department of Energy (DOE) to parties who want to enter into natural gas transactions with foreign sellers or buyers and by the Federal Energy Regulatory Commission (FERC) for LNG export terminals. It is not clear whether exporters would lose their DOE license or export terminals would lose their FERC license, or both? Additionally, how will the federal government determine which companies have violated the service restrictions based on the fleet activity of different vessel operators? For example, will the company associated with the last LNG shipment in the preceding annual period be responsible for transport on a U.S. vessel?

We anticipate that USTR and CBP will publish further guidance clarifying many of these important commercial questions. Interested parties can also seek to engage with the appropriate government agencies (or through counsel on a non-names basis) in the meantime to obtain more information. Pillsbury attorneys continue to closely monitor updates to the Section 301 shipbuilding action and are prepared to advise and assist, including in the submission of public comments.