Alert 06.23.25

Alert

Senate Votes to Advance the Big, Beautiful Bill: The Latest on Renewable Energy Tax Credits

Alert

By Don Lonczak, Elina Teplinsky, David McCullough, M.C. Hammond, Baylee Beeman

Takeaways

06.30.25

On June 28, 2025, the Senate voted 51-49 to advance its version of the Big, Beautiful Bill (the “Bill” or “BBB”). As relates to renewable energy tax credits enacted by the Inflation Reduction Act of 2022 (IRA), the Senate’s version of the Bill differs in some significant respects from the version released by the Senate Finance Committee (SFC) on June 16, 2025, as summarized below. Our prior client alert discusses the differences in impact on renewable energy tax credits between the SFC version of the Bill and the version approved by the House of Representatives on May 22, 2025.

Early Expiration Dates/Phase-Outs. While the SFC Bill had proposed significant phase-outs of the clean electricity tax credits (IRC §§ 45Y and 48E) for wind and solar projects that start construction in 2026 and later years, the Senate Bill instead eliminates the ability to claim such credits for wind and solar projects that start construction after the date of enactment of the BBB and that are placed in service after December 31, 2027. For other projects looking to claim clean electricity tax credits, phase-out of the credits would begin for construction beginning after 2032, without regard to emission reduction targets provided by the IRA. The Senate Bill would end the clean hydrogen production credit (IRC § 45V) for projects starting construction after December 31, 2027, a two-year extension from the expiration date contemplated by the House and SFC versions of the BBB, but would have the clean fuel production credit (IRC § 45Z) expire after 2029, which is two years earlier than contemplated by the SFC Bill. With respect to the advanced manufacturing production credit (IRC § 45X), (i) the production and sale of wind components would not be eligible for the credit after December 31, 2027, and (ii) the credit for applicable critical minerals, which currently does not expire, would begin to phase out after 2030, except that a newly provided category of applicable critical minerals for metallurgical coal would expire at the end of 2029.

The following expiration dates would apply to the various tax credits currently available for clean vehicles and energy efficient homes and commercial buildings:

IRC § 25E (Previously Owned Clean Vehicle Credit) – 09/30/2025

IRC § 25E (Previously Owned Clean Vehicle Credit) – 09/30/2025

IRC § 30D (Clean Vehicle Credit) – 09/30/2025

IRC § 45W (Commercial Clean Vehicle Credit) – 09/30/2025

IRC § 30C (Alternative Fuel Vehicle Refueling Credit) – 06/30/2026

IRC § 25C (Energy Efficient Home Improvement Credit) – 12/31/2025

IRC § 25D (Residential Clean Energy Credit) – 12/31/2025

IRC § 45L (New Energy Efficient Home Credit) – 06/30/2026

IRC § 30D (Clean Vehicle Credit) – 09/30/2025

IRC § 45W (Commercial Clean Vehicle Credit) – 09/30/2025

IRC § 30C (Alternative Fuel Vehicle Refueling Credit) – 06/30/2026

IRC § 25C (Energy Efficient Home Improvement Credit) – 12/31/2025

IRC § 25D (Residential Clean Energy Credit) – 12/31/2025

IRC § 45L (New Energy Efficient Home Credit) – 06/30/2026

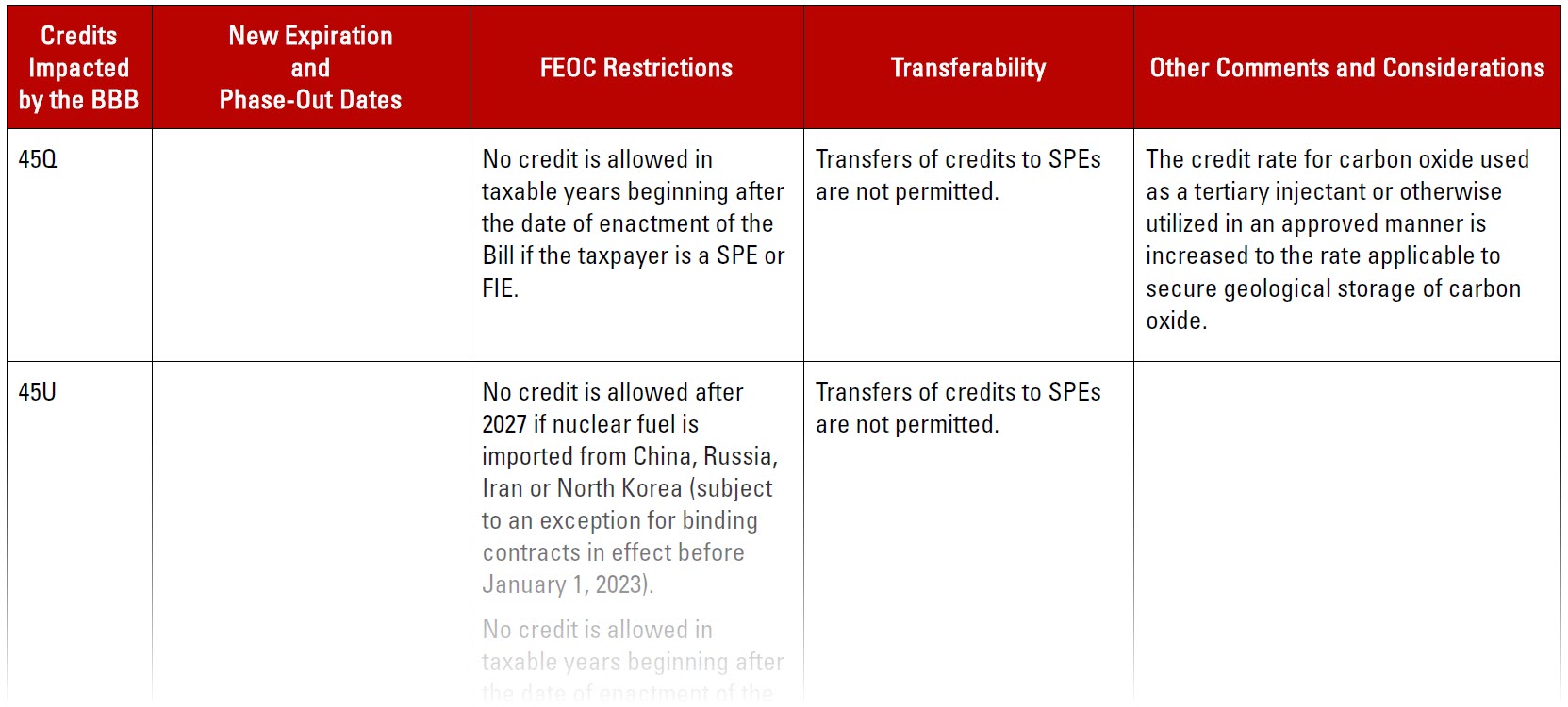

Cash Transfer Elections. Consistent with the SFC version, the Senate Bill generally follows current law with respect to the ability to sell renewable energy tax credits for cash consideration. A limitation would be imposed, however, under which credits cannot be transferred to “specified foreign entities” (SPEs).

FEOC Restrictions. The Senate Bill retains FEOC restrictions that largely are consistent with the House and SFC versions of the BBB. Under such restrictions, various renewable energy tax credits will not be available to SPEs and “foreign influenced entities” (FIEs and, together with SPEs, “prohibited foreign entities”). Furthermore, the clean electricity tax credits and advanced manufacturing production credits can be disallowed if the taxpayer receives “material assistance” from prohibited foreign entities. In this regard, the Senate Bill retains the approach provided in the SFC Bill under which a “material assistance cost ratio” would be calculated for credit eligible property, with tax credits being denied if the ratio falls below a threshold percentage that increases over time. The material assistance cost ratio generally would be calculated as (i) the total costs for the credit eligible property reduced by costs attributable to the mining, production or manufacturing by a prohibited foreign entity, (ii) divided by the total costs for the credit eligible property. An extended six-year statute of limitations is provided for deficiencies related to the material assistance determination.

Very generally, a SPE includes a foreign entity of concern or other entity or person with ties to Russia, China, Iran and North Korea. A FIE generally includes (i) an entity in which SPEs hold significant ownership interests or possess the ability to appoint directors or key executives or (ii) an entity that made certain sizable payments to SPEs during the previous taxable year. For purposes of these FEOC restrictions, “material assistance” would include the extraction, recycling, processing, manufacturing or assembly of a component, subcomponent or critical mineral in one of the designated foreign countries, or reliance on intellectual property, know-how or trade secrets originating from such countries.

New Provisions Favoring Advanced Nuclear. The Bill adds a special rule to expand the definition of “advanced nuclear facilities” in IRC § 45J(d)(2) to include facilities which have received a Construction Permit from the Nuclear Regulatory Commission, in addition to those granted a Combined Operating License. It also extends the 10% energy community bonus for purposes of IRC § 45Y to projects located in areas that have had at least 0.17% direct employment related to the advancement of nuclear energy, including employment in advanced nuclear facilities, nuclear R&D, the nuclear fuel cycle, or the manufacturing and assembly of components used in advanced nuclear facilities.

New Excise Tax. Additionally, an excise tax would be introduced by new IRC § 5000E that would be imposed on wind and solar projects that violate the material assistance cost ratio, which apparently would apply even though the projects would not qualify for clean electricity tax credits. The new tax is imposed on project equipment based on the degree to which a project exceeds material assistance cost ratios for materials sourced from prohibited foreign entities, up to 50% for wind projects and 30% for solar projects, and applies to wind and solar projects which either (i) begin construction after December 31, 2027, and before January 1, 2036, or (ii) begin construction after the date of enactment and before January 1, 2028, and are placed in service after December 31, 2027.

Other. The Senate Bill includes provisions that would deny five-year Modified Accelerated Cost Recovery System (MACRS) depreciation for facilities and energy storage technologies claiming the clean electricity tax credits under IRC §§ 45Y or 48E, and that would repeal the deduction for energy efficient commercial buildings under IRC § 179D for construction that starts after June 30, 2026.

A table summarizing these changes as relates to the key renewable energy tax credits is set forth below (click here to view the full table).