Alert 04.25.25

Alert

Comparing Developments in U.S. and EU Strategies to Combat Forced Labor

Takeaways

05.01.25

In recent years, a multinational focus on preventing forced labor within supply chains has shaped due diligence requirements for companies worldwide. Recent changes to global policies and potential shifts in enforcement appetite are set to reshape these requirements once again.

The European Union (EU) Regulation on Prohibiting Products Made with Forced Labor, a comprehensive forced labor import ban unveiled in December 2024 (the “Import Ban” or “Regulation”), marks a significant milestone in these efforts, reflecting the evolution of international initiatives to promote ethical supply chains. While the Regulation aligns with similar measures in the United States, it differs in key respects in its approach, application and scope, and will not fully come into force until December 2027. Meanwhile, recent policy shifts under the Trump administration highlight ongoing uncertainty around the future of forced labor prevention as a pillar of U.S. trade strategy.

Multinational businesses navigating these complex regulatory landscapes must understand the distinctions between these frameworks and implement tailored, multifaceted compliance strategies.

U.S. Section 307 and the Uyghur Forced Labor Prevention Act (UFLPA)

The UFLPA builds upon Section 307 of the Tariff Act of 1930 (Section 307), which prohibits the importation of goods made with forced labor into the United States. For much of the 20th century, enforcement of Section 307 was limited under the “consumptive demand clause,” which allowed imports made with forced labor if domestic production could not meet consumer demand. In 2017, Congress removed this clause, paving the way for more dynamic use.

U.S. Customs and Border Protection (CBP) enforces Section 307 by issuing Withhold Release Orders (WROs) and Findings. CBP assesses public information and allegations of forced labor conditions, relying on, for example, the presence of International Labor Organization forced labor indicators in the foreign production process. It issues a WRO if it finds reasonable suspicion of forced labor, or a Finding if it has probable cause, which then results in a seizure of goods.

Signed into law on December 23, 2021, the UFLPA created a rebuttable presumption that goods produced in China’s Xinjiang Uyghur Autonomous Region (XUAR), or by certain identified entities with connections to Xinjiang, are made with forced labor. As a result of this presumption, goods produced in the XUAR or that incorporate components from the XUAR are automatically prohibited from entry into the United States, unless the importer can overcome the presumption through clear and convincing evidence that their supply chain does not involve the use of forced labor.

To date, no company has overcome the rebuttable presumption. The UFLPA sets a high bar, requiring U.S. Customs and Border Protection (CBP) to submit a report to Congress when it accepts such rebuttable evidence and allows the goods subject to the UFLPA to enter U.S. commerce. As a result, companies have focused instead on seeking to demonstrate that their supply chain does not contain any content originating from the XUAR. CBP has imposed rigorous standards, requiring that companies produce documentation allowing the tracing of the supply chain to all upper-tier suppliers, including for the raw materials from which each component was made.

CBP also maintains the “UFLPA Entity List,” which includes entities that are known to mine, produce or manufacture merchandise in Xinjiang with forced labor; work with the government of Xinjiang to recruit, transport, transfer, harbor, or received forced labor or members of persecuted ethnic groups; or source material from Xinjiang or the Xinjiang Production and Construction Corps for purposes of government labor schemes. Importantly, entities on this list are not restricted to those housed in the XUAR.

Because the UFLPA does not contain a de minimis exception, CBP may detain imports from anywhere in the world if they incorporate even a small component or raw material produced in the XUAR or by a supplier on the UFLPA Entity List. In fact, most detainments under the UFLPA have involved shipments from countries other than China.

UFLPA Enforcement

In Fiscal Year 2024, CBP detained 4,593 shipments valued at approximately $1.7 billion. These detentions targeted high-risk sectors, such as electronics, apparel, manufacturing and agriculture. CBP also significantly expanded the UFLPA Entity List, adding new companies linked to forced labor. Notably, these additions include entities located across China, extending beyond the XUAR and covering some of China’s largest state-owned enterprises (such as affiliates of the Baowu Group, the world’s largest steelmaker).

In July 2024, the Forced Labor Enforcement Task Force (FLETF) released updated guidance identifying aluminum, PVC and seafood as new high-priority sectors for UFLPA enforcement. This marked the first significant update to the priority sectors since 2022, highlighting the shifting nature of forced labor risks within global supply chains.

The UFLPA also continues to draw considerable attention from the House of Representatives Select Committee on the Chinese Communist Party (CCP), which has emphasized enforcement and compliance challenges as part of broader efforts to counter CCP influence. To date, the Trump administration has not made additions to the UFLPA Entity List. However, enforcement of the UFLPA continues under the Trump administration, with almost 3,500 shipments detained in January, February and March of this year.

The Trump administration has also taken some measures that arguably cut against vigorous enforcement of forced labor prevention in trade. On March 26, 2025, the Trump administration ordered the cancellation of funding for grants administered by the Department of Labor’s Bureau of International Labor Affairs (ILAB). Former government officials and trade experts have argued that these cuts will impair CBP’s investigations of forced labor allegations under U.S. trade law, including the enforcement of Section 307, as CBP and Commerce have historically collaborated closely with ILAB on the enforcement of U.S. laws targeting forced labor abroad. Combined with the recent removal of a WRO on Central Romana Corporation, a Dominican sugar producer, these developments could signal reduced prioritization of Section 307 enforcement.

At the same time, policies combatting forced labor have typically enjoyed bipartisan backing, including from Secretary of State (then-Senator) Rubio, an original author of the UFLPA.

The EU Forced Labor Import Ban

Key Provisions and Implementation

Adopted in December 2024, the EU Import Ban prohibits the placing, availability and export of goods made with forced labor into the EU market. Unlike the UFLPA’s regional focus, this regulation applies universally, addressing forced labor in all geographic locations and industries. Importantly, the regulation also prohibits the sale of goods already in the EU market that are found to be linked to forced labor, adding a layer of enforcement beyond the point of entry. In addition, products located overseas and sold online will also be covered if the offer for sale is targeted at consumers in the EU.

Enforcement Timeline and Process

The prohibitions in the Regulation will become applicable three years after the adoption of the Regulation (December 2027) to allow member states and operators sufficient time to prepare for compliance with the new rules. Enforcement will rely on a risk-based approach, with national authorities identifying high-risk products and initiating investigations. Businesses are expected to conduct due diligence and adjust supply chains accordingly within the ramp-up period to ensure compliance. In addition, businesses will need to continue to comply with applicable supply chain due diligence regulations under the law of relevant EU member states.

Complementary EU Initiatives

With the adoption of the Import Ban, the EU becomes one of the first major markets to maintain both a tailored forced labor import prohibition and a human rights due diligence reporting requirement. The EU’s Corporate Sustainability Due Diligence Directive (CSDDD), which was adopted last year, complements the import ban by imposing detailed supply chain due diligence obligations on companies to address human rights and environmental concerns. EU member states, such as France and Germany, are in the process of amending or introducing new domestic regulations to transpose the requirements of the CSDDD into their national laws.

In response to concerns about regulatory complexity, in February 2025, the EU introduced the Omnibus Package, a proposed legislative package aimed at simplifying the CSDDD and other environmental and social transparency EU regulations.

Key thresholds and requirements under the CSDDD, as amended by the Omnibus Package, include:

- Applicability. The directive applies to EU companies with over 500 employees and €150 million in net turnover, as well as smaller companies (250 employees and €40 million in turnover) in high-risk sectors like textiles, agriculture and minerals. It also covers non-EU companies meeting these thresholds for EU operations.

- Due Diligence Obligations. Companies must identify, mitigate and prevent adverse human rights and environmental impacts across their operations, subsidiaries and value chains. This includes risks related to forced labor. If adopted, proposed amendments under the Omnibus Package would limit due diligence obligations to direct counterparties unless the company has plausible information suggesting an adverse impact further down the supply chain (such as credible media reports or sustainability risk assessments from service providers).

- Stakeholder Engagement. Companies are required to consult affected stakeholders, such as workers or local communities, to address human rights concerns effectively.

- Reporting and Accountability. Firms must publicly disclose their due diligence efforts and progress, subject to scrutiny by national authorities and potential penalties for non-compliance.

While the Omnibus Package attempts to relax the burden of certain compliance obligations, in sum, the CSDDD creates a framework that aligns with the EU’s forced labor ban, reinforcing the expectation that businesses adopt proactive and comprehensive ethical sourcing practices. Due to the EU’s outsized influence in crafting global regulatory frameworks, other jurisdictions may apply the CSDDD as a model in their own efforts to combat forced labor.

How They Compare

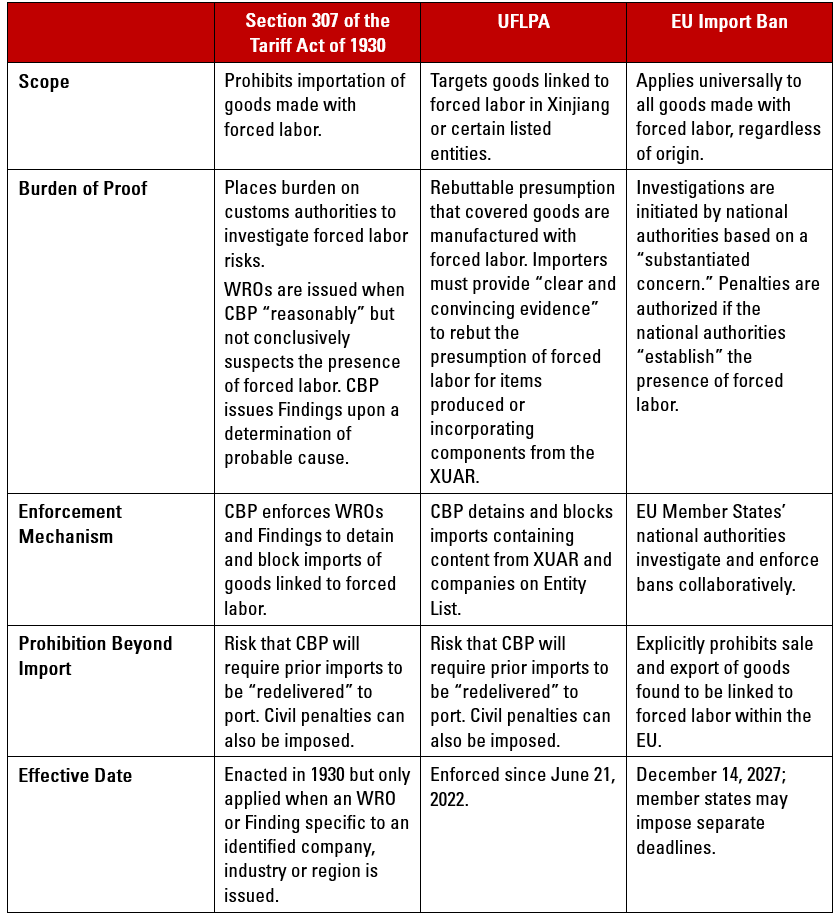

The chart below highlights key differences and similarities between U.S. and EU laws addressing forced labor in global supply chains. Understanding these distinctions is essential for businesses operating internationally, as compliance requires a proactive approach to identifying and mitigating risks across supply chains to meet evolving regulatory expectations.

Additional Measures Worldwide

Measures to identify and mitigate forced labor in supply chains continue to promulgate worldwide. Canada, Mexico, Australia, Japan and the UK are among those increasing efforts to address forced labor through legislative, enforcement measures and government guidance. For example, the UK Parliament’s Joint Committee on Human Rights recently launched a new inquiry into forced labor in UK supply chains and is contemplating legislative amendments to the UK Modern Slavery Act to increase effectiveness and enforcement. These initiatives, including modern slavery laws and enhanced due diligence requirements, reflect a growing global commitment to ethical sourcing and accountability. As these laws take hold, businesses must proactively assess their supply chains, enhance due diligence processes, and prepare to comply with shifting international standards aimed at eradicating forced labor from global commerce.